How many of us have regrets in life? Take your time to think. I guess pretty much everyone has one or two regrets in their life regardless of whether it’s due to education, relationships, career or family. It could be as simple as not choosing the right subject of interest to pursue in university or not telling your loved ones how much you mean to them until it’s too late.

Apply this to wealth planning.

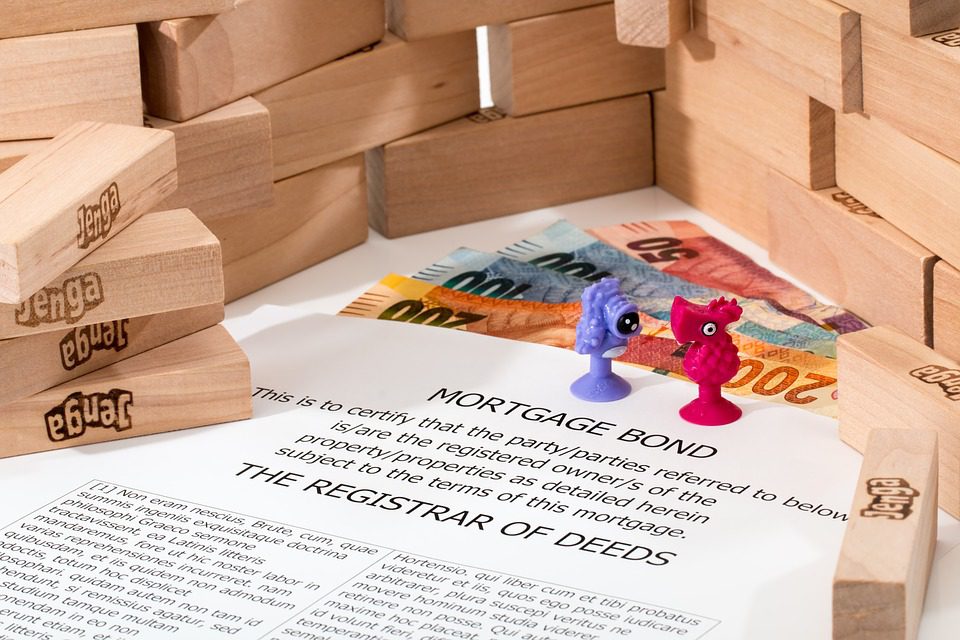

One key point would be to mitigate any risks that could wipe out our hard-earned savings or destroy the lives of families. Generally, buying a house in Singapore is the biggest investment for a typical Singaporean but it is also the greatest liability to the owner in times of need; hence, it brings us to the importance of owning mortgage insurance.

In Singapore, there are two types of mortgage insurance, commonly known as Home Protection Scheme (HPS) or Mortgage Reduced Term Assurance (MRTA). HPS is primarily for HDB owners while MRTA is for all other properties. Both act as mortgage-reducing insurance that protects loved ones against losing their home in the event of death, terminal illness or total permanent disability. Below is a comparison table between the two of them.

Comparison Table

| Factor | Home Protection Scheme (HPS) | Mortgage Reducing Term Assurance (MRTA) |

| Method of payment | Premium can be paid by CPF OA.

|

Premiums can only be paid by cash. |

| Payment Frequency | Premium paid yearly. | Premium could be paid Monthly, Quarterly, Semi-Annual and Annually.

|

| Coverage Commencement | Effective upon legal home ownership. | Effective upon approval of home loan.

|

| Riders | No riders are allowed. | Extra riders like Critical illness and Premium waiver are allowed.

|

| Types of Ownership | Single Ownership. | Can be applied as a Single or Joint owner.

|

| Beneficiary of Claims | If there is successful claim, the sum assured will be paid to HDB instead of the owner of the house. | If there is successful claim, the sum assured will be paid to the beneficiary of the policy.

|

| Applicability of properties | Applicable to HDB(except EC/HUDC flats). | Applicable to all housing types.

|

| Is it transferrable? | Non-transferable upon sale of property. A new application will be needed upon new purchase of new housing based on the customer age and health status. | The remaining insurance coverage is transferrable to the mortgage loan of the new property. Any mismatch of the coverage to the new loan amount will be top up by additional premium amount.

|

As shown in the table above, MRTA has its competitive advantages when compared to HPS. Some examples include in the event of claim, commencement of coverage, addition of riders onto the policy and transfer of policy coverage.

Having said that, customers must ensure that the MRTA is within their affordability to prevent over stretching on their cash flow, if not HPS would be a better alternative as payment is made using CPF OA.

Is MRTA necessary?

Here comes the question. Is it necessary to purchase mortgage insurance?

Below are four main reasons for having mortgage insurance.

1. Life is unpredictable

As mentioned above, a house is probably the biggest financial commitment on will ever made.It is an imperative part of any financial plan to ensure it is protected in the event of unfortunate events.

Critical illnesses or disabilities could happen to anyone and subsequently hinder one from working and make their home repayment. According to a report released by the National Registry of Diseases Office (http://www.straitstimes.com/singapore/health/more-people-getting-cancer-since-2010 ), there were 13,241 reported cases in 2014, and at the same time, one in four men and one in five women are at risk of getting cancer by the time they turn 75 years old.

This is where mortgage insurance comes in. Having a mortgage insurance would give you peace of mind that the repayment of the housing loan will still be taken care of by the insurance company even when you are at your lowest point in life, without needing your family members to shoulder the liability for you.

2. Property is illiquid

When faced with circumstances such as the sole bread winner’s death or sickness, families with no mortgage insurance would have to shoulder the repayment of housing loan. Many people think that they can just sell of the property at market value easily, but that’s usually not the case.

Advertising, conducting viewings, and waiting for the buyer to secure a housing loan would easily take months before the sale of the property is completed.Thus, in the event of premature death, having mortgage insurance will ensure the remaining loan gets paid up, so that your loved ones can remain status quo. They would get to continue staying in the same house, and carrying on with their lives without having to worry about the repayment of loan.

Since private properties generally cost more than HDBs, your loved ones will have to fork out more to repay the outstanding loan in the event of terminal illness, disability, and death. Therefore, private property owners should consider buying mortgage insurance to give a holistic financial coverage.

The last thing anyone would want is to be forced to sell off their property below market value due to their inability to service the loan due to such unforeseen circumstances.

3. Affordable premium

As compared to life insurance, mortgage insurance is generally very affordable. As low as $100 per month, you could be insured up to $1,000,000, depending on your age and health. Effectively, this means that by catering for the premium at about $3 per day, you could buy yourself a safety net for your whole family.

Many property owners would insist on the fact that it’s a waste of money, since mortgage insurance is of no cash value. However, when things happen and circumstances are beyond our control, we can only look back and regret not setting aside the small amount of cash to secure a safer future. Instead, we have to look forward and brood over the past.

It doesn’t matter what your age is – the fact is that people of all ages will face death. Rather, the question is when?

We can only be prepared. You would not want to unnecessarily aggravate your family’s grief over your death because of the absence of mortgage insurance.

Let’s not have regrets. Protect your life with mortgage insurance, starting from today.

Alternatives to MRTA

Instead of Mortgage Reducing Term Assurance, term insurance could also be considered. It costs relatively the same as MRTA, but it provides a level guaranteed payout till age 99 instead of a reducing sum like MRTA. Term insurance is suitable when property owners are considering taking up another property, loan and covering other financial liabilities while leaving a legacy.

Using CompareFirst (http://www.comparefirst.sg/ ), assuming a 30-year old, Non-Smoking male, whose coverage amounts to $1,000,000 (45-year coverage), I have ranked according to lowest premium to highest for your own comparison.

| Insurance Company | Plan Name | Premium (Yearly) |

| Tokio Marine Life Insurance Singapore Ltd | TM Term (Level & Convertible) | $1,681 |

| Zurich Life Singapore | Z Protect | $1,877 |

| Aviva | MyProtectorLevelPlus | $2,058 |

| HSBC Insurance Singapore Pte Ltd | Value Term | $2,064 |

| Prudential Assurance Company Singapore Pte Ltd | PRUTerm Vantage | $2,114 |

| Great Eastern Life | Prestige Protector Gold | $2,220 |

| NTUC Income Insurance Co-operative Limited | iTerm | $2,461 |

| Etiqa Insurance Pte Ltd | ePremier essential with TPD | $2,800 |

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!