HDB flat owners, rejoice! According to the Inland Revenue Authority of Singapore (IRAS), your property tax next year will be lowered. Owners of all private property will either see a decrease as well, or no changes made to their taxes.

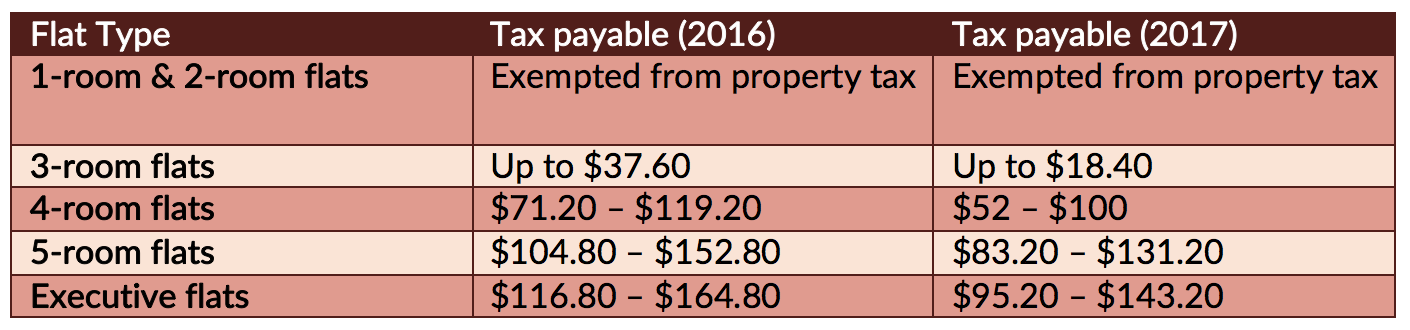

Property owners will receive their tax bills by the end of 2016, and payment has to be made by 31 January 2017. The payable property tax for each HDB flat type are as follows:

IRAS urges property owners to opt for payment via GIRO where they can enjoy up to 12 months’ interest-free instalments, or opt for a one-time deduction.

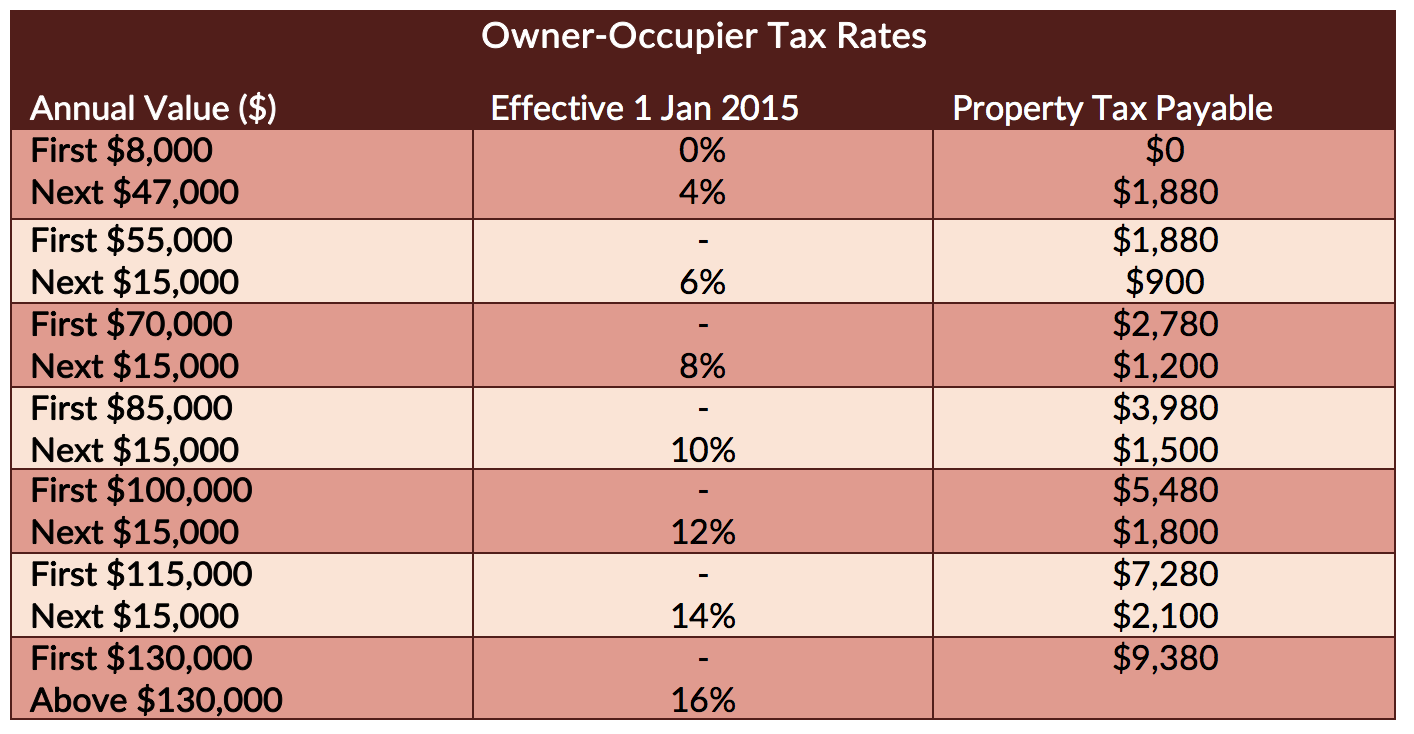

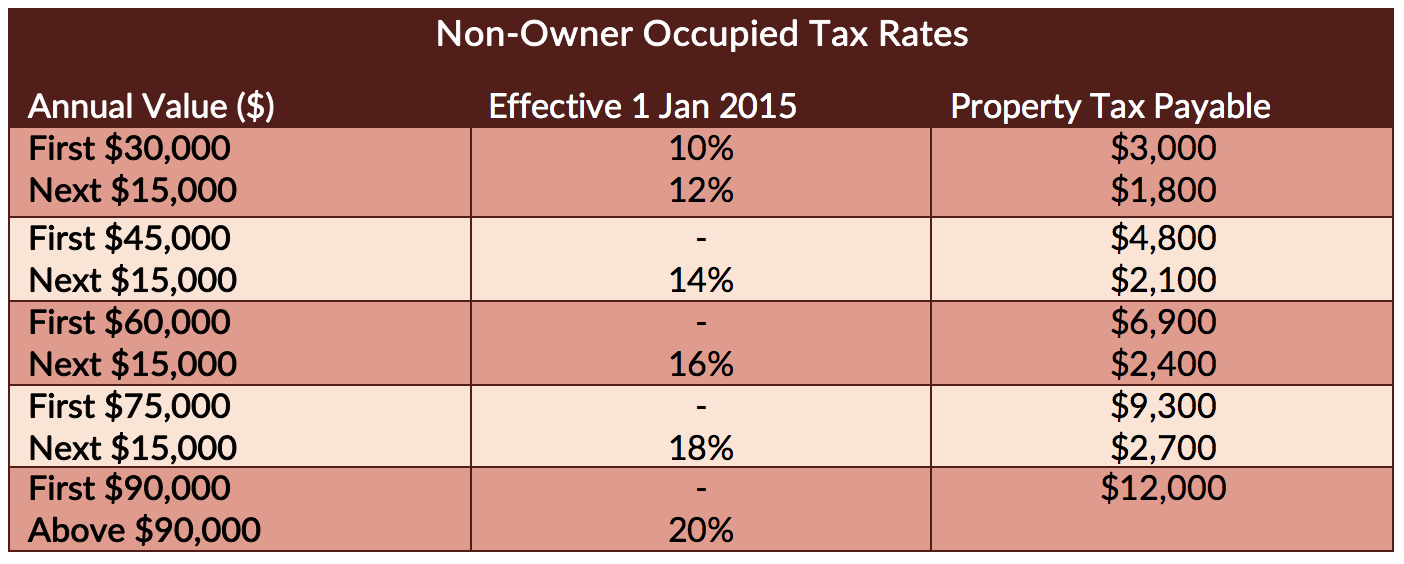

Property tax rates differ between owner occupied and non-owner occupied residential properties, and these rates are applied on a progressive scale based on the annual value of the property. Non-residential properties are taxed at 10% of the annual value. Annual value of a building, according to IRAS, is the “estimated gross annual rent of the property if it were to be rented out”.

For residential property tax rates on both owner-occupied and non-owner occupied residential properties, refer to the table below:

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!