In 2013, the Housing Development Board (HDB) of Singapore introduced a new type of flat called 3-generation (3Gen) flats. These flats, though launched 7 years ago, still remain a mystery to some people.

The aim of launching these flats is to cater to multi-generational families living together or intend to live together. Then National Development Minister Khaw Boon Wan said in a statement that, as a “social objective”, the Singapore Government wants extended families to live together and provide an intimate support network.

Ever since its inception, HDB has offered approximately 1,700 3Gen flats across 31 Build-to-Order (BTO) projects. A compiled list of BTO projects that offer 3Gen flats is shown in the table below.

Still not sure as to what 3Gen flats are? Fret not, we have compiled a list of what you need to know about 3Gen flats here:

3Gen Flats – size, layout, prices

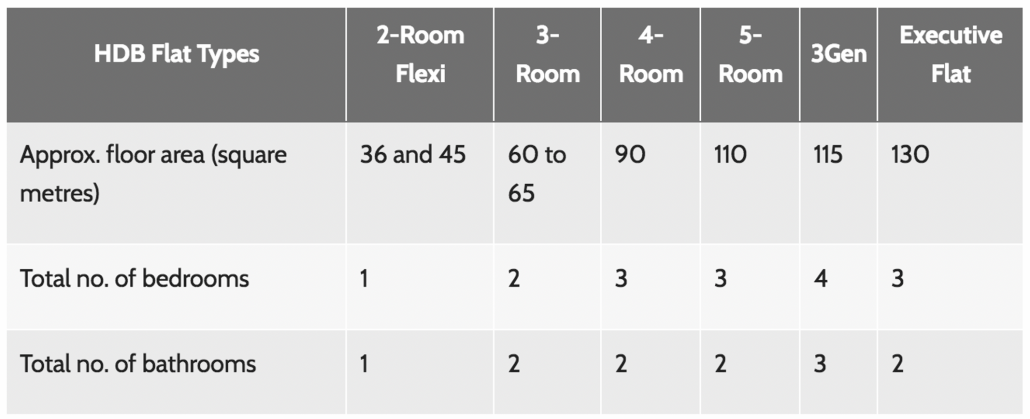

With reference to the table below (which illustrates the different flat types currently offered by HDB, their approximate floor areas and the total number of bedrooms and bathrooms available), as 3Gen flats are meant to house extended families, these flats are typically larger than 5-room flats – 110 square meters vs. 115 square metres.

Other general features of a 3Gen flat:

Though the layout of 3Gen flats may differ between projects, the picture above depicts the layout of a typical 3Gen flat.

One important point to note, as these flats encourage multi-generational living, one may make the assumption that these flats are similar to dual-key apartments. Unfortunately, instead of a separate studio unit (like those of dual-key apartments), the extra space of 3Gen flats comes in the form of a separate ensuite room. Though dual-key apartments and 3Gen flats serve the same purpose, they are two separate housing terms.

Eligibility Conditions

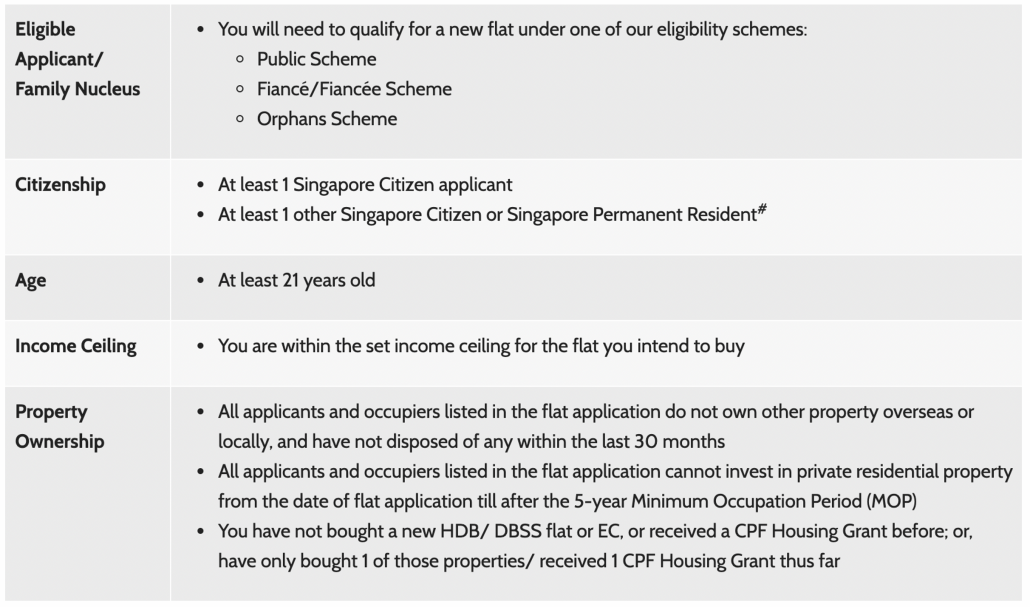

Similar to other flat types, to be eligible for 3Gen flats, you have to fulfil the basic eligibility conditions before you can submit an application for a flat. These conditions are listed in the table below.

However, since 3Gen flats specifically cater to multi-generational families, there are additional eligibility conditions that have to be fulfilled. Unlike the eligible family nucleus for 3-room/4-room and 5-room flats, the eligible family nucleus for a 3Gen flat is as follows:

Where at least one of the parents/married child(ren) is a Singapore citizen or Singapore Permanent Resident.

Since joint application is required for 3Gen flats, your parents’ average monthly income will also be counted in the monthly household income assessed by HDB. Not to worry, the income ceiling for 3Gen flats is extended – from SGD12,000 to SGD18,000.

Post-Purchase Conditions

Though you may fulfil the eligibility conditions, these are several post-purchase conditions you should be aware of before you submit an application:

| Condition | Description |

| Disposal of existing flat | You and your family members registered under the flat will have to dispose of any existing flat within 6 months of possession of the new flat. |

| Minimum Occupation Period (MOP) | The new flat has to be occupied for 5 years before it can be sold in the open market. Occupiers who are essential in forming the eligible family nucleus in the flat application must continue being listed in the application and reside in the flat during the 5-year MOP. These essential occupiers are not allowed to make a separate application, or be listed as occupiers in another application to purchase an HDB flat or another Executive Condominium within the MOP. |

| Renting of whole flat | You are allowed to rent out your whole flat after the 5-year MOP upon approval from HDB. No prior approval is required if you wish to rent out bedrooms in your flat within the MOP. However, it is required of you to register the renting out of bedrooms with HDB within 7 days before you do so. If you own a 3Gen flat, you are not allowed to rent out any bedrooms within the MOP. |

| Resale levy | The resale levy is intended to reduce the housing subsidy on the flat buyers’ second subsidised flat. Furthermore, it also ensures a fairer allocation of housing subsidies among flat buyers. You are liable to pay a resale levy if you intend to buy a second subsidised flat or assume ownership of another subsidised flat from HDB after selling your first subsidised flat. For more details on amount of resale levy payable, mode of payment for resale levies and when to pay resale levies, visit HDB’s website here. |

| Ownership/interest in property | You are permitted to investing in private residential property after fulfilling the 5-year MOP. Nevertheless, you must still continue living in the flat after purchasing the private property. |

| Further conditions for purchase of 3Gen flats | Unlike other flat types, 3Gen flats can only be resold in the open market to eligible multi-generation families. |

3Gen flats are undoubtedly attractive due to its benefits – extra space, cost savings (shared utility costs, lower childcare fees), etc. However, one should be mindful of the specific eligibility and resale conditions of 3Gen flats before submitting an application.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!