What are the important things you must take note when evaluating your loan eligibility? If you have bought a property and applied for a mortgage loan before, you probably have struggled to understand the eligibility criteria. Or perhaps you have panicked about securing a loan to finance your new apartment after signing the Option To Purchase (OTP). The window to exercise your OTP is only 2 weeks for private properties and 3 weeks for HDB properties.

If you have been wondering the ins and outs of how loans are granted by banks, this article will explain more on loan eligibility and the amount of loan granted.

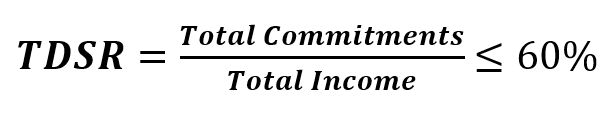

1. Total Debt Servicing Ratio (TDSR)

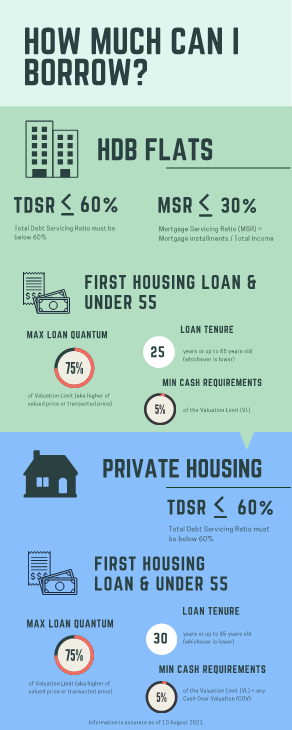

As regulated by MAS, any credit facility purchasing or refinancing of property must have a Total Debt Servicing Ratio (TDSR) of 60% or lower. This means it is applicable to all property loans in Singapore, regardless of HDB or private property. The state’s motivation for such a regulation is to ensure Singaporeans do not overleverage and investors do not start flipping houses. At the end of the day, the severe consequences of the 2008 housing bubble in the US may not be one Singapore’s small economy can withstand.

Total Commitments refer to all of the debt added together. This includes personal loans, tuition loans, and car loans. Additionally, credit cards are also considered commitments and are calculated based on minimum payment – which refers to the lower of 3% of the outstanding bill or $50.

On the other hand, Total Income involves more complicated calculations. It can be difficult for banks to ascertain your income with 13th month bonuses and volatile investments.

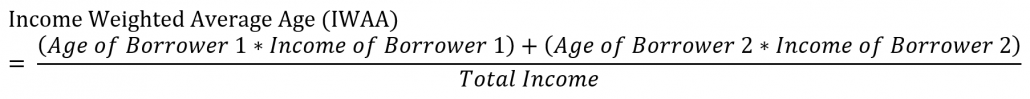

If you are employed, 100% of your base salary would be recognized and only 70% of your bonus pay would be recognized. This is because bonuses could vary across years. How do banks determine your bonus then? Well, this is where your tax bill or Notice Of Assessment (NOA) comes in. If there is more than 1 borrower, your Income Weighted Average Age (IWAA) may be taken into account.

Whereas for a self-employed individual, only 70% of your latest income tax statement would be recognized.

Sample Calculation

Ryan had a monthly salary of $5,000 and paid NOA of $200,000 in 2020. He has a car loan of $1,000 monthly.

Annual salary = 12 x $5,000 = $60,000

Bonus = $200,000 – $60,000 = $140,000

Since only 70% of the bonus is recognized, we have to discount for that

$140,000 * 70% = $98,000

Monthly income recognized = ($98,000/12) + $5,000 = $13,166

$13,166 * 60% = $7,899.60

Since Ryan already has a $1,000 car loan, his monthly mortgage installments cannot exceed $6,899.60.

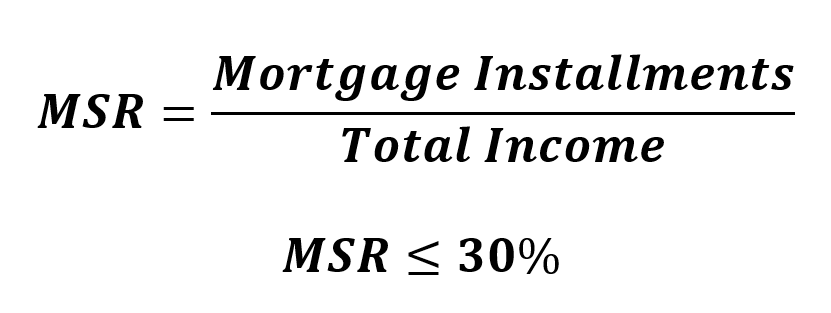

2. Mortgage Servicing Ratio (MSR)

If you are purchasing an HDB flat or Executive Condominium (EC,) TDSR is not the only ratio to take into consideration. Introduced in 2013, Mortgage Servicing Ratio (MSR) refers to mortgage liabilities being 30% or less than the income of the borrower. This applies to all loans for HDB flats purchased after 12 January 2013 and EC units purchased after 10 December 2013. Note that as long as the properties are for owner occupation, the MSR is not applicable to HDB and EC units for refinancing.

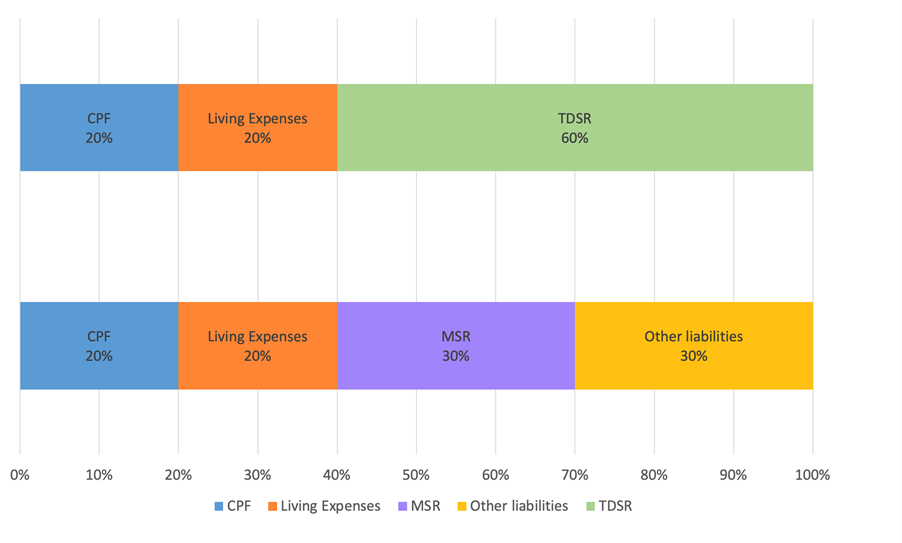

Although it seems like a greater hassle, MAS set the threshold of MSR to be 30% is based on the assumption that CPF and living expenses would take up a total of 20% of the individual’s income. The remaining 60% would be used for loan liabilities – specifically 30% for mortgages and 30% for other liabilities.

To secure a bank loan for HDB or EC, you will need to fulfill MSR and TDSR. While it may not be an issue for those with minimal loans, the issue arises when your other liabilities such as equity loan and personal loans exceed 30%. The loan available to you would be a smaller quantum.

3. Loan Tenure (Depends on your age)

In the past, when there are 2 or more borrowers, the age of the younger borrower is taken as the age. For instance, if a son aged 25 and a father aged 60 are joint borrowers, the bank takes the son’s age into consideration. This means that the loan tenure can be up to 30 years. However, this resulted in many borrowers struggling to repay the loan. When the father retires, the income of the son might be unable to sustain the mortgage installments.

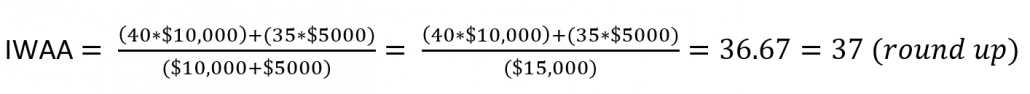

Thus, Income Weighted Average Age (IWAA) was introduced to scale the age towards the person with higher income.

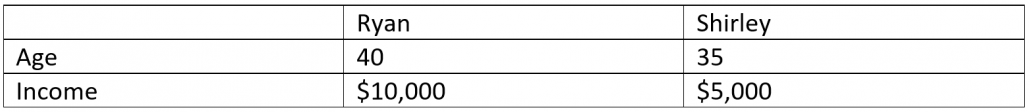

For instance, Ryan and Shirley are co-borrowers to their new apartment

Since the loan tenure is the lower of 30 years or up to age 65, the maximum loan tenure for Ryan and Shirley would be 28 years.

4. LTV Ratios (Based on the number of housing loans & age)

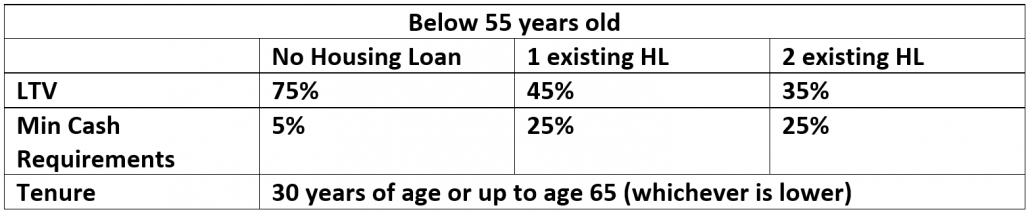

Aside from the loan tenure, the Loan-To-Value (LTV) ratios also determine the loan amount. Generally, borrowers below age 55 with good credit history and no loans would be able to secure an LTV of up to 75%. For 1 million properties, that would mean a $750,000 mortgage. As for the remainder, the minimum 5% cash requirement means borrowers must pay $50,000 down payment with cash while the rest can be paid by CPF.

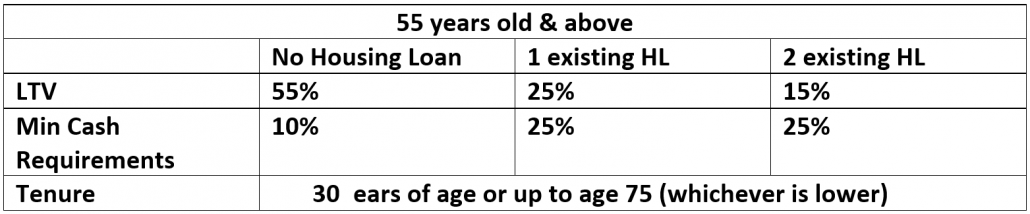

In contrast, borrowers aged 55 and above would have a different LTV ratio since they have a shorter runway to repay their installments and are likely to have more cash stashed away for the down payment.

5. In Summary

If you are buying a private property, make sure that your TDSR does not exceed 60%. If it does, consider adding another borrower to meet the requirements.

It might sound like there are far too many hoops to jump through – but let’s break it down step by step.

Firstly, consider whether you and your fellow borrower can meet the loan requirements. If you are purchasing a private property, ensure that your TDSR does not exceed 60%. As for HDBs, in addition to TDSR, MSR has to be below 30%.

Secondly, ensure that the loan quantum is sufficient to cover your property purchase. Aside from considering your cash on hand, also take your monthly installments into account. You might want to do specific calculations to forecast how much of your CPF contributions can pay for your mortgage installments.

For HDB purchasers looking for additional loan quantum, HDB Concessionary Loan offers LTV of 90% instead of 75% that is offered by private banks. However, there is a more stringent eligibility for this loan as compared to private loans.

Alternatively, for private property purchasers who are looking to get a loan of $750,000 but are only eligible for a $600,000 loan, you may want to speak with our mortgage advisors to give case-specific advice to improve your loan limits.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!