Have you ever considered how you could tap into the equity your property provides? Aside from the existing loans in the market, equity loans are a great way for you to get funds for your child’s tertiary education or for home improvements. Synonymous with “cash out refinancing” and “term loan”, equity loans can be incredibly helpful for you to access the value appreciation of your property. But is it suitable and accessible for you? This article gives you a rundown of equity loans – the pros and cons, and everything in between.

What is an equity loan?

To unlock additional equity from the property for investment purposes, equity loans provide you with a line of credit that is based on the difference between what your house could sell for and your outstanding loans. Be it your business expansion plans or legacy planning, this can provide additional liquidity by using the equity of your property as collateral.

This is particularly helpful if the value of your property has risen significantly since you purchased it as it allows for a greater margin of loan quantum.

Who can get an equity loan?

While enticing, only private property owners with properties that have obtained Temporary Occupation Permit (TOP) are eligible for home equity loans. Unfortunately, this is not an option for HDB homeowners. As for owners of Executive Condominiums, they are eligible after fulfilling the Minimum Occupancy Period (MOP) of 5 years.

Additionally, you have to take your equity loan from the same bank as your current bank loan if you still have outstanding bank loan for your mortgage. It is also notable that only cash is allowed for the repayment of monthly installments.

Following Mortgage Equity Withdrawal Loan Rules set by Monetary Authority of Singapore (MAS), the loan tenure is between your age and 75, but capped at 35 years. The borrowers must also be 35 or younger.

Although MAS states that there is no limit on the Total Debt Servicing Ratio (TDSR) if the loan quantum is 50% or less of that property’s current market valuation, banks usually still apply TDSR or their own ratios to determine loan eligibility.

How much can I borrow?

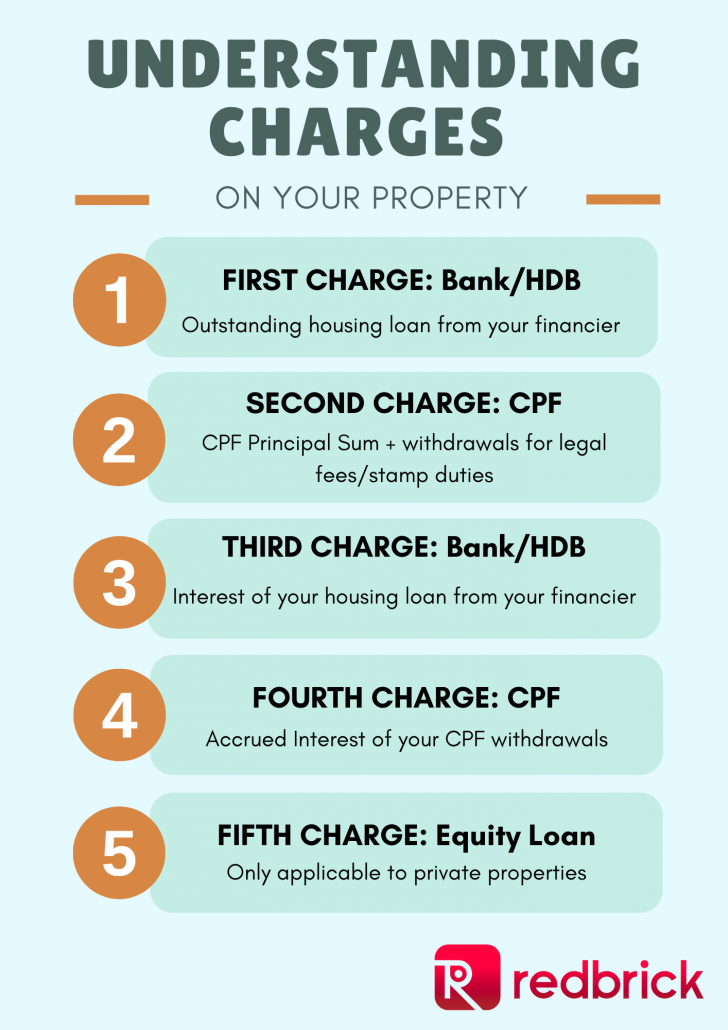

Before we jump into the loan quantum you could borrow using an equity loan, it is paramount that we first understand the concept of charges.

Since you are likely to have used your property as collateral for multiple uses, each lender has a charge on your property. This means that in the event you are unable to repay them, their charge would indicate the order of them getting the monies from the auction of your property.

Since equity loan is the 5th charge on your property, which means that they can only claim from your sale of property after the bank has received your outstanding housing loan and CPF is paid the principal sum and accrued interest. As such, the bank faces a higher risk in lending you the equity loan as compared to a regular housing loan.

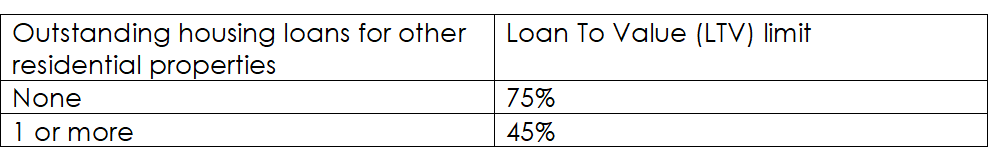

Therefore, banks would be willing to loan you a lower amount and would base it on the amount after repaying the other prioritized charges. If the only outstanding housing loan you have is on the property you are taking the equity loan on, the assumed amount is at 75% of the market valuation of your property.

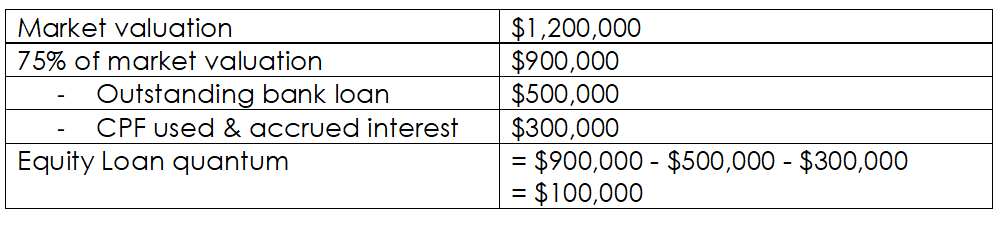

For instance, Mr. Tan bought a condominium valued at $1.2million with an outstanding mortgage of $500,000 as well as used $300,000 of CPF and accrued interest.

Mr. Tan would be able to borrow up to $100,000 as an equity loan.

How can I benefit from an Equity Term Loan?

(1) Accessing cash from built-up equity:

– Unlocking wealth for various purposes: If your home’s value has risen, you’ve essentially accumulated equity, which can be tapped into through an equity term loan. This cash can be used for investments, renovations, debt consolidation, education, or other financial goals.

– Financial flexibility: Having access to this extra cash can provide breathing room in case of emergencies or unexpected expenses.

(2) Leveraging low interest rates:

– Potentially lower rates than other loans: Equity term loans often come with lower interest rates compared to personal loans or credit card debt. This can make them a cost-effective way to borrow if you manage the loan responsibly.

However, it’s important to consider the downsides as well:

– Increased debt: Taking on any additional debt adds to your financial obligations, so ensure you can comfortably manage the repayments.

– Risk of foreclosure: Defaults on the loan can lead to foreclosure, so responsible borrowing practices are crucial.

Summary

Whether or not an equity term loan is right for you depends on your individual financial situation and goals. Consider factors like your current debt levels, income, risk tolerance, and planned use of the loan proceeds.

You may wish to consult with one of our mortgage advisors if you are eligible for an equity loan but unsure of whether it is the best option for you.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!