What is crowdfunding?

Crowdfunding offers a platform for start-ups and budding entrepreneurs to raise funds. Business ventures are, as the name suggests, funded by a crowd of people over the internet. A well-known example of a crowdfunding platform would be American-based Kickstarter, which focuses largely on creative projects. A number of companies crowdfunded on Kickstarter have eventually become extremely successful, such as the Oculus VR (the company which specialises in virtual reality and produces virtual reality headsets for video gaming) which crowdfunded $2.4 million on Kickstarter during their initial foray.

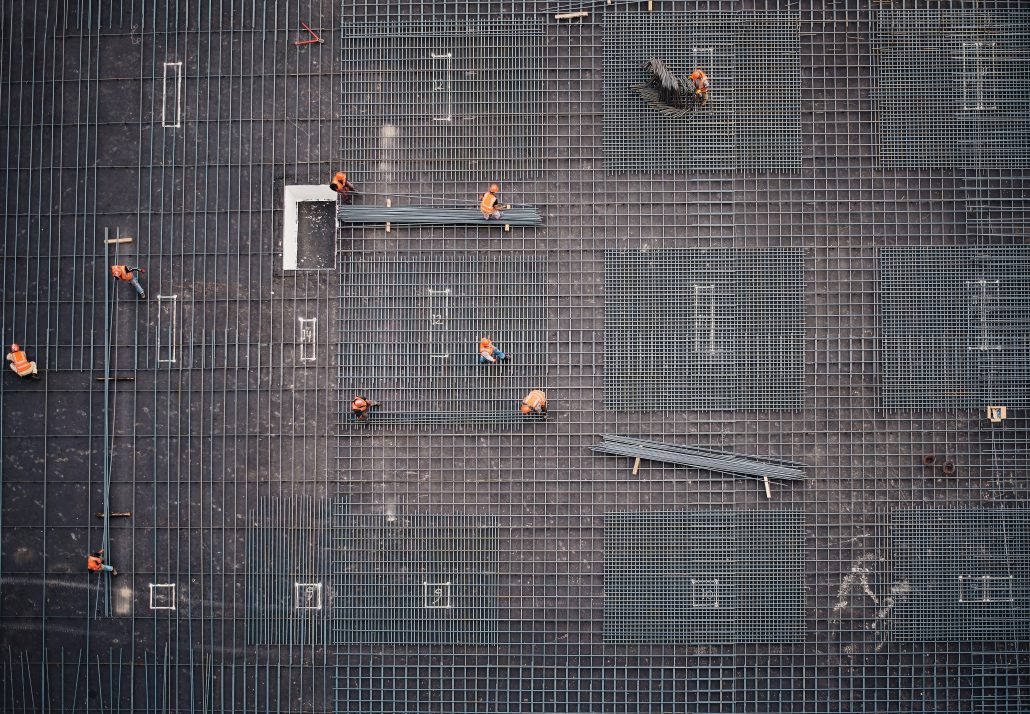

In the real estate context, developers can list their development projects on crowdfunding platforms to obtain the initial capital they require. The advantages of real estate crowdfunding include flexibility of choice, where investors can browse through various development projects on such platforms, and participated in those that they are interested in. Also, it gives retail investors access to real estate projects that would previously only be available to high net worth individuals because the minimum investment on such platforms tend to be low.

An example of a crowdfunding platform in Singapore is CoAssets, which is currently listed on the Australian Stock Exchange (ASX).

However, before deciding to invest in a crowdfunded real estate venture, here are a few things to take note of:

-

Caveat Emptor

Crowdfunding is now regulated by the Monetary Authority of Singapore (MAS), and platforms facilitating crowdfunding require a Capital Markets Services (CMS) Licence. This should give investors peace of mind, as MAS regulations will protect them from fraudulent investments and shady businesses.

However, regulation by MAS does not translate into guaranteed returns, and these platforms generally leave investors to do their own due diligence before investing in a project. This is referred to as caveat emptor, or “buyers beware”.

It is clearly stated on most platforms and websites that it does not provide any advice on the profitability or viability of projects listed on the platform, and it is up to investors to seek professional advice should they require it. There is still a possibility that crowdfunded companies end up unprofitable or go bust.

Investors have to do their homework before deciding to commit to an investment. They are fully exposed to real estate development risks, so they need to ensure that the investment matches what they want and their risk appetite. In essence, although crowdfunding platforms provide a convenient channel for investment, investors still need to have strong fundamental real estate knowledge to make good investment decisions.

-

What if the crowdfunding platform fails?

Investors in crowdfunding face the risk of the crowdfunding platform failing. If a crowdfunding platform closes down, it will be extremely detrimental to investors, and they can possibly lose the money they have invested through the platform. Before making an investment, finding out what rights and recourse investors have in such a scenario is therefore very important.

Additionally, investors should ensure that the platform is of good quality. Crowdfunding platforms should have a CMS Licence number, and investors can double-check this by referring to the Financial Institutions Directory found on MAS’s website. An important thing to note would be that crowdfunding platforms which have adopted certain business models (such as using cryptocurrency in crowdfunding) are not regulated by MAS. Although this does not necessarily mean that these platforms are bad, investors investing in an unregulated platform are not afforded protection under the MAS regulatory framework. In that case, investors should familiarise themselves with the platform, and choose which to invest in wisely.

-

Real estate crowdfunding VS real estate securities

Real estate crowdfunding is just one of the many ways to invest in the real estate market. A more conventional investment vehicle would be the Real Estate Investment Trust (REIT). The suitability of either REITs or crowdfunding investments will depend on the investment profile of investors.

REITs are much more liquid as compared to crowdfunding investments. A liquid asset means that it is more easily converted into cash and is important for investors who need cash quickly. REITs are tradeable over the stock exchange, so if an investor urgently needs cash on hand, they can simply sell off their REIT units. For crowdfunding, however, an investor’s funds will likely be tied up in the investment until the property is divested.

Traditional REITs generally have established track records and can offer high yields. On the other hand, crowdfunding investments commonly involve start-ups, which are untested in the real estate market. This means that there is an additional layer of risk because the chances of a start-up company failing in their ventures could be higher than an established REIT company. At the same time, crowdfunded companies have much higher upside potential as compared to established REITs and can offer potentially higher returns.

In crowdfunding, investors can choose what they like from a catalogue of investments listed on a platform. REITs generally own a portfolio of properties, so investing in a REIT is equivalent to investing in the assortment of properties. Investors are therefore more involved in a crowdfunding investment and have a greater degree of control over which exact property they want to invest in. Whereas for REITs, investors are more passive and leave the selection of properties to the REIT.

Basically, investors should consider all types of investment vehicles before deciding on which to park their money in. Real estate crowdfunding is more suitable for investors that want a greater sense of ownership over their investment, do not need cash in the immediate future and have higher risk tolerance. REITs are more suitable for investors that prefer to have a less hands-on approach to property investment, require cash quickly and seek high dividend yields over riskier capital gain profits.

Conclusion

Crowdfunding is very much a product of the age of the internet and moving forward, it will likely further evolve once Blockchain technology is fully incorporated into crowdfunding. While crowdfunding comes with its own set of disadvantages, it is a viable investment avenue and provides good opportunities for diversification.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!