This week’s iteration of “Redbrick conversations with” covers Mr. Alvin Chow, the CEO of Dr Wealth. He shares with us his motivations for teaching personal finance, how the business has grown to what it is today, and perspectives on how we define success.

Q: Can you tell us more about yourself and how you got to where you are today?

Alvin: I spent my first 6 working years in the Air Force. During which, I realized that due to the younger retirement age of 45 for regulars in the force, I had to build my skills in other sectors for a second career. During this period, I found my interest in personal finance and investing, and through my own experience, this only grew stronger. After leaving the Air Force at 31, I met a few like-minded friends who also enjoyed investing and we decided to start a company to teach and share what we knew from our own learning.

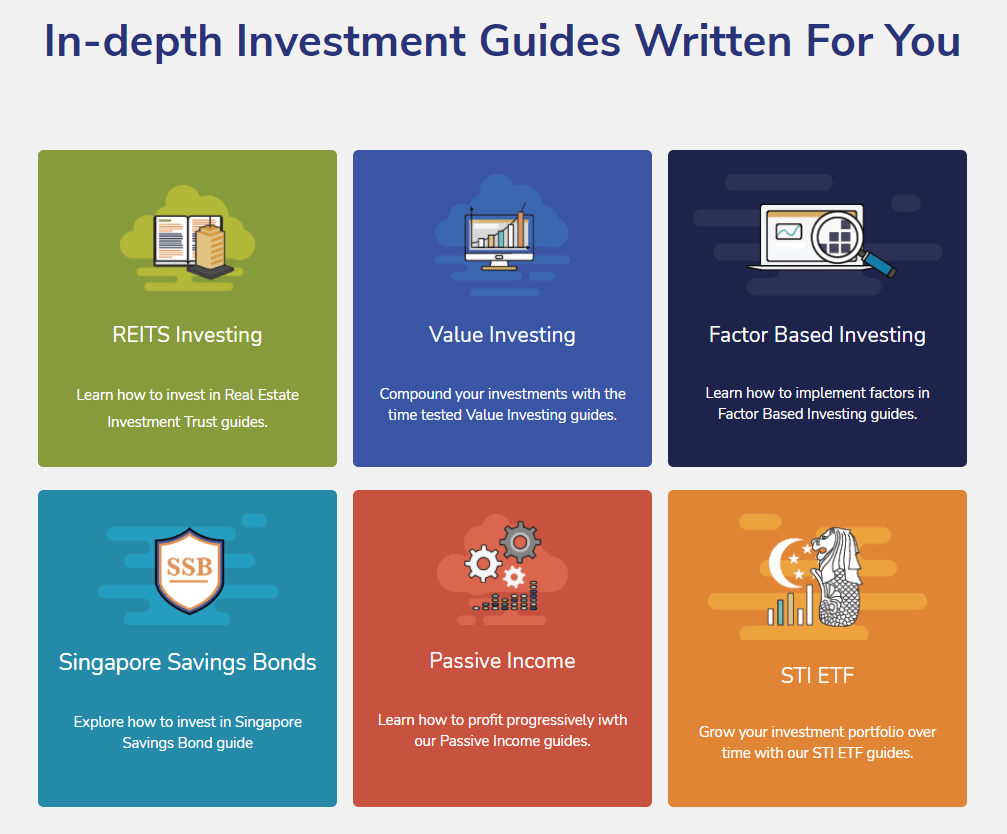

Unlike other professional fields like Engineering and Medicine, personal finance applies to everyone, and can be learnt if one puts in the effort to understand it. This is especially important since a lot of large life decisions like purchasing a home or insurance involves large sums of money. I personally enjoy learning more about finance so I can make good decisions.

The company began with 4 friends, and we were all engaged as shareholders and trainers. We wanted to enter the field of financial education so that we could point people in the right direction and make personal finance easily accessible without complex financial jargon. This equips them with the tools to reach their hopes and dreams, rather than simply teaching financial concepts.

Q: What are some of the milestones you have reached on a personal level?

Alvin: I didn’t start the business because I had hopes of turning it into a billion-dollar empire. I started the business out of enjoyment and the fact that I get to do what I enjoy doing. At the same time I observed myself growing together with the business. Having more customers and a bigger team to manage naturally requires me to become better. The growth is satisfying and the challenge keeps me going.

Q: What does success mean to you?

Alvin: Personally, success is having the freedom to do what I want to do. What really pushed me to start the business was my mentor, Mr. Dennis Ng, who was a mortgage broker back then. He asked me, “What do you want in your life, assuming you have already achieved financial freedom?”

My initial answer was to travel the world, as I’m sure many would say.

After which he asked, “Okay, after you’ve travelled the world, then what?”

That made me realize that I had not thought about this question deeply enough, and that my response to travel the world was not a personal one. Instead, it was something that the people around me have always mentioned to the point that I just adopted it.

His point was that financial freedom was not the end goal. However, if there was something that we wish we could accomplish some time down the road, we should just start now instead of setting up imaginary barriers which results in procrastination.

Success to me means being independent, and not following people’s judgement which may cause us to do things that make us miserable, all to impress people that we may not even like.

Q: What do you do in your free time?

Alvin: I enjoy reading and having the space to think. Running is great for clearing my head and I play FIFA on my Nintendo Switch from time to time.

Q: What is one interesting fact about yourself that people don’t know?

Alvin: I used to play the violin in Primary 2 until secondary school and during my university days. I took it up mainly because my mother discouraged me from doing Taekwondo as she was concerned for my safety.

Q: Why the name Dr Wealth?

Alvin: Our holding company is known as BigFatPurse, but we adopted the name Dr Wealth after we acquired the company! It sounded more apt and less like we were selling purses.

Q: What is a regular workday like?

Alvin: It’s fairly routine – I start the morning by checking the news on the financial markets since we do provide some simplified commentary on the news through our channels. After I send the kids to school, I will begin work which may consist of meetings, writing articles, analyzing stocks or engaging the community. Once a week, we will plan the content for our social media and weekly newsletter.

Q: How does your organization maintain its appeal to consumers?

Alvin: It is great that there are a lot of financial bloggers now, which signals greater demand for information on finance in general. We stay relevant by talking about the ever-expanding financial markets and being acquainted with new topics such as cryptocurrency. We also have more media channels now and have come a long way from the early days of written blogs. We also adjust our content to make it more relatable and relevant for the age group on the respective platforms.

Q: What are some important values that the organization prides itself with?

Alvin: Empathy. Our society is mainly top-down in many areas, and empathy guides us to do the right thing for the man on the street. As an education company, it helps us to understand their struggles and we can then determine the relevant topics to address this emotional aspect. It is also very important for our trainers so that they understand the challenges that our students face and help them overcome them

Q: Could you describe your current property of residence?

Alvin: My family just moved into our Bidadari BTO, and I enjoy the convenience of its short proximity from the city and the MRT station. It takes less than a 10 mins drive to our workplaces and the childcare centre. It would take me less than 30 mins even if I go by train.

Q: What do you look out for when searching for a property?

Alvin: Simply being within walking distance to the MRT station. Singapore is fairly small so no matter where you live, you can always take the MRT to where you need to go.

Q: Do you believe in the “leverage all I can” or “pay down as soon as I can” school of thought?

Alvin: Definitely “leverage all I can”. If you don’t leverage the property, annual appreciation will be about 3-6%. I believe that leverage is one of the best advantages that you can have in property investing, if you are able to obtain a cheap loan. As long as your property appreciates faster than the interest rate, I would opt for leverage.

Q: What kind of advice would you give to new homeowners and aspirin property investors?

Alvin: Be aware that while you can take a rational approach by listing the pros and cons of a property, if you are purchasing a home to live in, the emotional factor will overwhelm a lot of the decision-making process. The same is true when deciding whether to sell your home or not. While this is okay for your home, choosing an investment property requires a more rational and stringent approach.

Q: Which is your favourite estate in Singapore and why?

Alvin: Anywhere in the East, partly because I grew up there but definitely because of the food!

If you are thinking of putting your money to work in the stock markets, you can explore more about the courses conducted, follow Dr. Wealth on Facebook, Instagram or Telegram.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!