For many, property assets are often passed on as gifts from parent to child upon their death, expressly written and documented in the form of a will. The will serves as an official documentation and proof of entitlement to the property. However, some properties may fall between the cracks, and the benefits and rights to the property are not transferred to the intended beneficiaries for several reasons. These are termed as ‘Residual Properties’ – properties that are not conferred successfully. In this article, we will take a look at how the Singapore law handles such ‘Residual Properties’ and highlight the importance of having a comprehensive will as part of your long-term asset management.

Before we dive in, here are some possible difficulties that beneficiaries may face when laying claim to a property from their deceased benefactors, resulting in Residual Properties:

- Property which was willed to be bequeathed to the beneficiary was sold and converted into monies proper to the testator’s (person who initiated the will) death

- The distribution of the property under the will is illegal or invalid for any reason;

- The testator acquires a new property(s) after the creation of the will

- A mistake in the will

- Intended beneficiary passed away prior to the successful succession of the property

- Any other reason that obstructs or inhibits the execution of the will

These factors may lead to the dispute of how the subject property should be divided and handled.

What are the steps taken by the Courts in determining the status of the property?

Step 1: Determining if there is a valid Residuary Clause

When it comes to all things concerning land, the Law requires all transactions and interests in land to be documented in writing under the Torrens System. In the case of Residual Properties, the Courts have taken a systematic and consistent approach when determining if the property falls within the scope of the Residuary Clause. Under this clause, the Courts recognize and acknowledge that the property has been successfully bequeathed to the intended beneficiary(s) when there is explicit and clear indication of the beneficiary’s name(s) and the mode of property disposal. An example of a common residuary clause in a will include:

“To hold the rest and residue of my estate upon trust for my [husband] if he shall survive me by a period of sixty days, but if he does not, then for my children [name of child 1], [name of child 2] in equal shares”

The absence of either element will lead to a failure in the ability to enforce provisions under the Residuary Clause. Following which, the Intestate Succession Act (Cap.146 of Singapore) would be relied upon to redetermine the mode of property disposal (Step 4).

Step 2: If will contains Residuary Clause, Courts will determine the scope of which falls within the clause

When it is established that a will contains a valid Residuary Clause, the Courts will then proceed to decide which property(s) falls within the scope of the clause, and therefore would determine which properties would be upheld to the provisions under the Residuary Clause and awarded to the intended beneficiaries. Often, one dilemma that the Court is faced with is whether a specific property falls within the scope of the residuary estate (it cannot be assumed that all properties in a willed estate fall under the Residual Clause unless expressly written).

Step 3: The Court will interpret and apply the residual clause accordingly

In some wills, terms used may result in ambiguity and disputes over its interpretation. One example is one such case where the testator willed for his residuary estate to be divided amongst the “lawful natural and/or adopted sons”. The use of words “lawful natural” would mean that illegitimate sons would be entitled to the Residual Property proceeds. On the other hand, the use of “natural and/or adopted” which could exclude illegitimate sons.

This resulted in a contradiction of the testator’s intentions, which was filed as a motion by the executor of the testator’s will. The High Court eventually ruled that the latter interpretation would have been the testator’s true intentions. But this highlights the importance of drafting an accurate and comprehensive will that covers any potential loopholes and room for contestation.

Step 4: Absence of Residual Clause leads to Intestate Succession Act

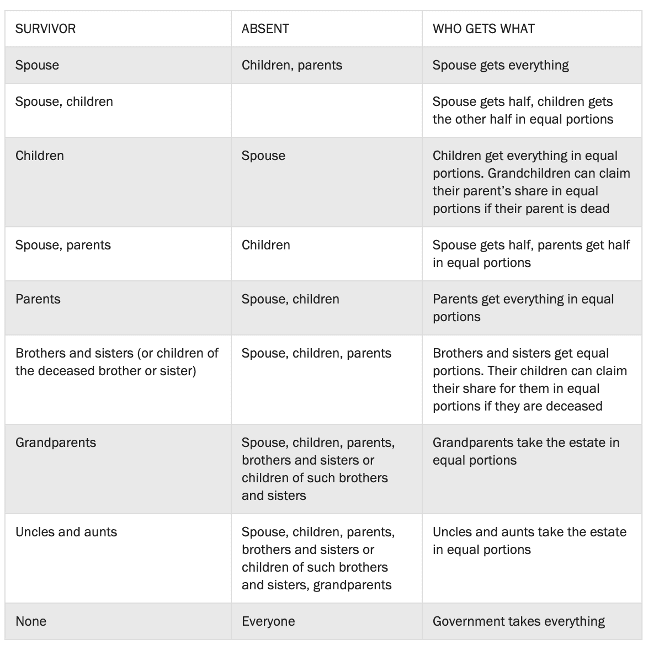

Should the testator have passed on without leaving a valid will, the Courts will enact the provisions under the Intestate Succession Act. Assuming the testator is domiciled in Singapore at the time of death, all of the testator’s residuary property in Singapore including immovable (e.g real estate) and movable properties (e.g bonds, cash) will be redistributed in the following manner:

When a will is drafted ambiguously, it often results in legal disputes which can be quite a hassle given the hefty legal fees and time involved. Therefore, we strongly suggest that you take some time to review your will, and if you have yet to create one as part of your long-term asset management and protection!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!