Following the increase in Additional Buyer Stamp Duty (ABSD) April 2023, Singaporeans must pay 20% ABSD if they intend to purchase a second property. Hence, would you be interested to find out how you can still purchase a second property without incurring ABSD?

With more than 10 years of experience under his belt, Alvin Lock has worked with the most prestigious local and international financial institutions in Singapore. His expertise lies in retail and private banking space, including investment advisory, legacy planning and property loans. In this article, he demystifies the process of decoupling and shares his knowledge on creative financing.

Pre-planning: Purpose / Affordability

Pre-planning: A popular term used since the implementation of cooling measures; decoupling is a technique that many have adopted in hopes of avoiding ABSD. The outcome would be for each spouse to own a property each, without incurring ABSD, which is imposed from your second property purchase onwards.

Most couples who consider decoupling will do so instinctively – after all, most would want to only pay the required minimum amount of taxes to achieve optimized property financing while abiding with the governing law. Since the couple would be staying together, this means that they would be able to stay in one property as owner-occupied and another property for investment purposes to be rented out.

Of my clients who consider decoupling, they have already owned their first property for a few years. Their family profile and financial capability may have changed, which means their current home may no longer be meeting their needs. Deliberating on upgrades to a larger house or moving to a more prestigious location does not need to be synonymous with selling their current residence, as market conditions may not be favorable.

Another common reason would be the current property has great potential for capital appreciation, and it would be a disservice to them to sell their property given the current circumstances. If you are in a similar situation, you could consider decoupling.

Thus, when considering from the sole perspective of investment, decoupling is one of the best options in today’s legal climate. However, this comes with caveats and one of the first questions I ask clients is their financial situation as affordability is a major factor.

While some couples prefer for banks to consider their combined income, experience has taught me to also assess the individual spouses’ ability to service their monthly mortgage installments. This is a crucial factor in pre-planning for decoupling in the near future and can be achieved through securing an In-Principle Approval (IPA), which is the banks’ means to assess your mortgage quantum.

Manner of holdings: Joint Tenancy or Tenancy-in-Common

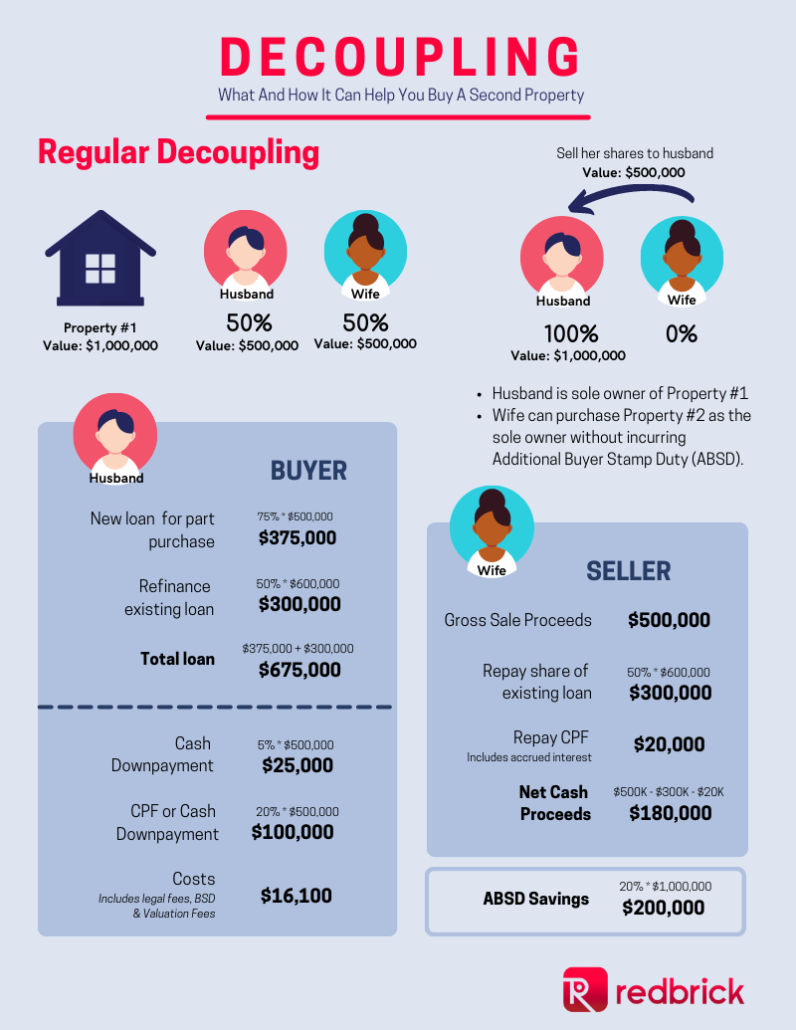

The second key consideration is the manner of holdings. Generally, co-ownership of properties in Singapore is either under Joint Tenancy, in which parties own the property together as a whole, or Tenancy In Common, where each individual owns a specific proportion of the property. Couples typically own their marital homes in Joint Tenancy. When decoupling, it would be assumed that both individuals own 50% of the property, and one partner will buy over the other party’s share of 50%. As mentioned, the main goal of decoupling is to save on ABSD.

The process of buying over the other party’s share is important, especially for couples as this would be a related sale/purchase, but also an at-arm’s length transaction at the same time.

Decoupling: What does it mean to buy over the other party’s share?

1) New Loan Structure

We can generally consider it from the buyer and seller’s perspectives. In a $1 million property that is held in 50-50 shares by a couple, John and Mary. Mary will sell her share of 50% valued at $500,000 to John. Mary will in turn purchase their second property as a sole owner.

The amount payable for the part sale/purchase for the current property would be determined by their current manner of holdings. If Mary and John are currently holding 10% and 90% (respectively) under Tenancy in Common, John will only need to buy over 10% shares from Mary.

In most cases of decoupling however, the manner of holdings will usually be Joint Tenancy (i.e., 50/50 share). As the share amount to be purchased is often significant, financing for John (Buyer) would be essential for his part purchase, and he would also have to refinance half share of the current outstanding loan amount as well.

| Value of Property | $1,000,000 |

| Existing Loan | $600,000* |

| Manner of Holdings | 50-50 |

| Financing part purchase from Mary | 75% * $500,000 = $375,000 |

| Refinance John’s share of existing loan | 50% * $600,000 = $300,000 |

2) Seller’s CPF Refund

After paying off her share of the remaining loan, Mary would also have to use the rest of her sales proceeds to refund the CPF used and interest accrued from her CPA Ordinary Account. After refunding the CPF, she can keep the balance as cash proceeds. In some cases where there are insufficient proceeds to repay her share of the outstanding loan, and/or to refund her CPF OA monies used, Mary would then have to “top up” these shortfalls using cash.

3) Costs involved

Nothing in life is free – much like decoupling. Although it comes with some costs, spending an additional $20,000 to $30,000 may prove to be worth it given the significant tax savings from ABSD. As mentioned, for a property valued at a million, you would be having tax savings of roughly $200,000. Hence, paying a fraction of the price to decouple would then be meaningful.

A key component of the fees involved would also be the legal fees which is estimated at $6,000 based on my experience. If this was a typical 3rd party property purchase under $2 million, the legal fees would be about $2,500. Since the part purchase has to be conducted at arm’s-length for the law to recognise the transaction as commercial in nature, both parties would then need to be represented by 2 separate law firms.

Furthermore, to uphold the spirit of a commercial transaction, the property’s valuation should match the open market value. To determine the market value, banks will need to engage their own professional property valuers, and hence valuation fees will also be required.

Another component of the fees are the stamp duties incurred on the part purchase. While all property purchases have to pay Buyer’s Stamp Duty (BSD), only properties that were bought under 3 years ago will incur Seller’s Stamp Duty (SSD) as well.

Decoupling: How much ABSD do you need to pay?

Following the hike in ABSD, the current ABSD rates for second property owned by Singaporeans is 20%. This would translate to roughly $100,000 for a 500k property and $200,000 for a property valued at a million. As reiterated, many have turned to decoupling to save on these taxes.

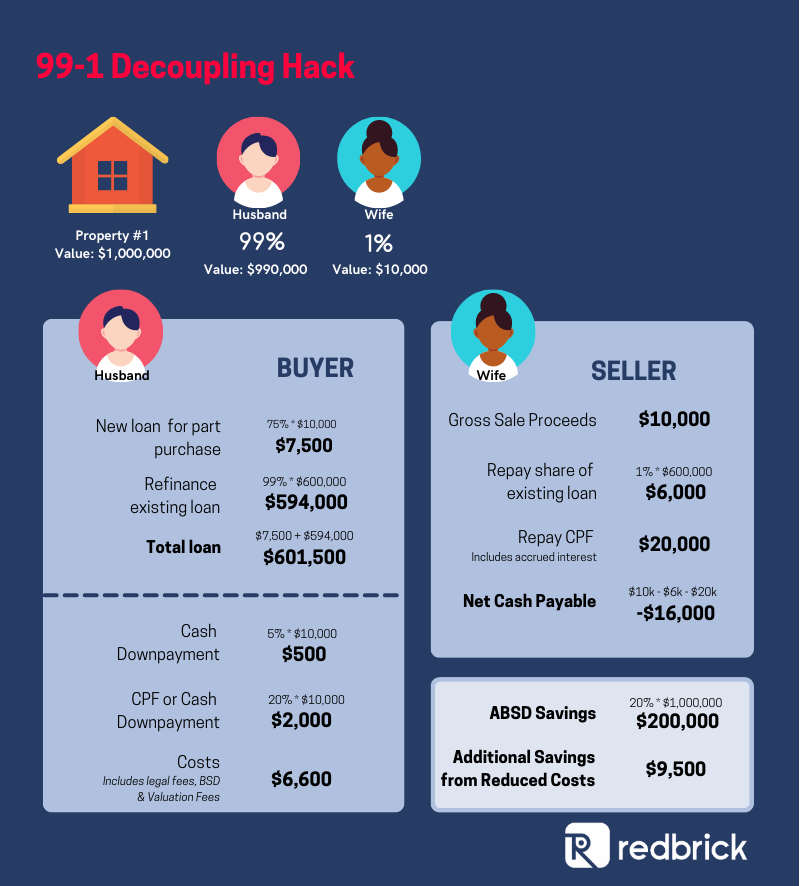

What most people don’t know is the 99-1 “hack” where John (from our earlier example) owns 99% of the property and Mary owns the remaining 1%. When decoupling, John need only buy over Mary’s share of 1%, and BSD and SSD will be applied only on this portion. When compared to a regular couple holding the property in equal shares as they may have done little planning (in terms of current ownership and future purchases) when purchasing their marital home, this innovative approach takes more planning ahead of time, but can help you reap greater tax savings!

Here’s an example:

Both Couple A and Couple B bought a property worth $1,000,000 2 years ago and is looking to decouple as their loan lock-in period has ended. Couple A had also preemptively planned and now holds their shares in 99-1. On the other hand, Couple B had bought their marital home in equal shares of 50-50.

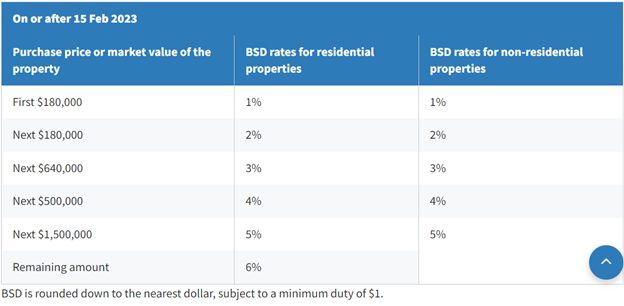

BSD Rates from IRAS

| Couple A | Couple B | |

| Shares | 99 – 1 | 50 – 50 |

| Part purchase | $10,000 | $500,000 |

| BSD Payable | $100 | $9,600 |

| SSD Payable | $800 | $40,000 |

| Total tax payable | $900 | $49,600 |

As shown, Couple A paid only $900 as compared to Couple B who paid $49,600 in tax payables.

Conclusion

In the spirit of growth – be it for your family or finances, decoupling is generally a great way for couples who are exploring new properties and considering owning more than what they currently have. Obviously, it also comes with complications. It is not a walk in the park as there are considerations and much planning beforehand. Ultimately, those who choose to make use of decoupling should have a thorough understanding of their finances and decide on their manner of holdings beforehand. If you are considering decoupling as a mechanism, feel free to find out more from us. It could save you thousands simply by having a proper consultation with us, and it wouldn’t cost you a thing!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!