Every owner’s top priority is to maximise interest savings and reduce monthly repayments. However, in the ever-changing interest rate environment, it may be a challenge to decide on whether to reprice or refinance. Let us bring you through each strategy, and hopefully you will be able to make an informed decision on which option better suits you.

What is the difference When You Reprice Or Refinance?

Repricing refers to switching to a new home loan package under the same bank, renegotiating your terms with the current bank. Refinancing on the other hand, refers to closing your present home mortgage loan account, and setting up a new home loan account under another bank.

Let’s now jump into the details of each option.

Why Repricing May Be Better For Me?

1. No Repayment Penalty

You don’t have to completely pay off your loans before conversion for a repricing package. Refinancing, on the contrary, does have a repayment penalty period. If you would like to refinance your home loan within your lock-in period, you will incur a penalty fee. Lock-in periods would typically last between 2 to 5 years. This may vary for some banks, but it is typically 1.5% of the remaining loan.

2. Shorter time required

Repricing typically requires a shorter period of time for application. It usually takes a total of 5 weeks for the whole repricing process to take place. Refinancing requires a total of approximately 13 weeks, making it an extremely long process. A 2-month notice period has to be served for refinancing, compared to the 1-month notice period for repricing.

3. Lower Fees and Costs

Lower bank fees and costs will be incurred for repricing. Usually, this will only include admin fees, which will cost around S$500-S$1000. For example, DBS Bank would charge a repricing fee of approximately S$800 for the conversion/administrative fee. Similarly, OCBC Bank would charge a one-time processing fee of S$500, unless your existing contract allows for a switch at no cost. In addition, repricing usually requires no legal fees, valuation fees, or early repayment penalties.

On the other hand, legal and valuation fees incurred for refinancing usually cost more than S$2000. Legal fees typically range from approximately S$1800-S$2500, and valuation fees range between S$200-S$450.

Why Refinancing May Be Better For Me?

1. More Savings Due To Lower Interest Rates

Refinancing with another home loan under a different bank that has a lower interest rate will allow you to enjoy lower monthly repayments. As you have more options, repricing typically provides you with more attractive home packages, despite the higher initial costs you would have to bear from the refinancing.

2. Better Opportunities

Compared to repricing, you have more options available for your home loan. Options provided at your current bank may be limited or offer higher interest rates compared to others. Refinancing will thus allow you to customise your home loan according to your preferences.

What Is The Refinancing Process Like?

After you have done your research, and compared all the home loans available on the market for refinancing to make sure that you will be securing your best deal, you would have to serve a notice to your current bank and do a valuation for the property. You would then have to find lawyers to do the conveyancing for the refinancing of the loan. One thing to note, however, is that you should not merely approach any available lawyer! The lawyer of your choice has to be included in your preferred bank’s list of lawyers. Your lawyer will then finally, apply for your new housing loan on your behalf.

Which Is Better – Fixed Or Floating Interest Rates?

This would typically depend on the interest rate environment and your personal preference. Fixed interest rate loans will be better in times of rising interest rates environments, as you get to enjoy the lower interest rate that you “fixed” it at. This may also be a better choice for some of you as you will be able to predict accurately your monthly repayment amounts. On the other hand, if there is a falling interest rate trend, floating-rate home loans are better. When the reference rate rises, the borrower’s monthly repayment will increase, and vice versa.

Several banks in Singapore also offer hybrid home loans, allowing you to customise your loan with fixed and floating rates. DBS is one of the banks that offer this option.

What Are Some Other Factors To Look Out For?

1. Loan-to-value ratio

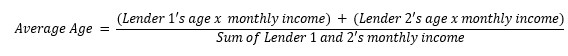

The amount you are allowed to borrow would depend on your age. If your loan tenure + age exceeds 65, there will be a cap imposed. For joint borrowers, the average age of the borrowers will be used. The calculation is as follows.

2. Loan Tenure

The shorter your loan tenure, the higher your monthly home loan repayments, and vice versa. Of course, shorter tenures would also mean that you would incur a lower overall interest.

Which Is Better: Reprice Or Refinance?

There is not necessarily a better option between repricing and refinancing. Extra effort is needed for refinancing but it may be a more attractive option for some, due to the increased savings you would enjoy.

However, if you are unable to spend a lot of time researching on the different home loan packages available by other banks, you can always speak with a mortgage advisor. However, do remember that regardless of whether you choose to reprice or refinance, do it after your lock-in period to avoid unnecessary fees.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!