Has a resale HDB flat caught your eye? As our society’s demographics shift to favor smaller family sizes, married couples often seek to set up their own nests and purchase housing properties of their own. Gone are the times where multiple families stay under the same roof. Yet, many still favor living near their parents – close proximity offers convenience to visit them for filial piety or even to drop by for a meal now and then. As such, there has also been grants rolled out to encourage such behavior, including applying for PHG (Proximity Housing Grant).

Who can apply for Proximity Housing Grant?

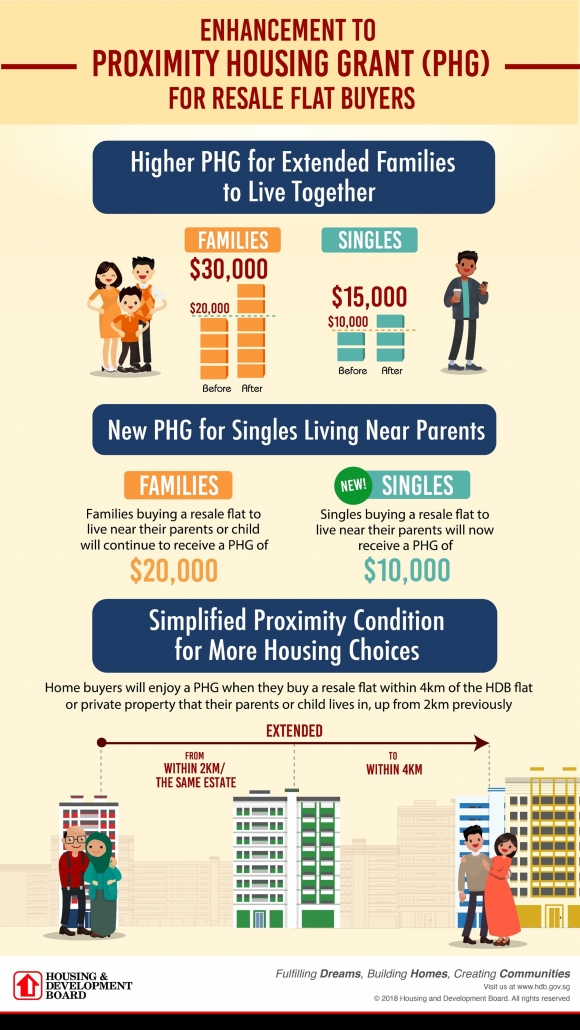

Married couples living with their parents are eligible to $30,000 to live with your parents, in which they are listed as co-applicants or essential occupiers and $20,000 to live near your parents. This means your new resale HDB flat should be within 4km of your parents HDB flat or private residential property. If they are not the owner of the private residential property, it must be owner-occupied by immediate family members, such as child, parent(s) or siblings.

Similarly, singles are eligible to half this amount at $15,000 to live with your parents and $10,000 to live near your parents (i.e. within 4km). Parents looking to downgrade from their flat into a smaller HDB Resale flat can also apply for the PHG if they meet these requirements.

Things to know before applying for PHG

1. Proximity Housing Grant (PHG) is only applicable for Resale HDB flats

Homeowners buying BTO flats are not eligible for PHG as BTO flats are already subsidized by the state and HDB often does not make profit from building new housing units.

2. Restricted usage of Proximity Housing Grant (PHG)

Like other CPF grants, PHG will be credited into your CPF Ordinary Account (OA) and can be used to pay the down payment of your HDB Resale Flat or to reduce the overall mortgage loan amount. However, it cannot be used for monthly loan instalments.

3. Repayment of CPF Monies upon sale of flat

Like regular CPF usage, the amount of CPF withdrawn to pay for the housing regardless of mortgage instalment or down payment, must be repaid to your CPF account inclusive of accrued interest. This means that withdrawing $100k today for your down payment would result in repayment of principal and interest of about $110k in 4 years’ time, assuming 2.5% interest rate. The rationale for this rule is to ensure that Singaporeans have enough monies in your CPF OA for retirement to set up your Retirement Account (RA) when you turn 55 years of age. However, this also means that the cash proceeds from the sale of the flat will be reduced as you would also need to repayment other stamp duties and your outstanding mortgage loan.

4. Minimum Occupation Period applies to your parents/children

Parents must continue to live in your flat of in their flat (which is 4km from your flat) over the duration of your Resale HDB flat’s Minimum Occupation period (MOP), which is typically 5 years. If your parents have plans of downgrading from your family home to a smaller 2-room flexi unit or upgrading to a condo in a better location, this would render your application invalid. The rationale for such a rule is to ensure that the property is held for owner-occupation and not for investment purposes, as this would null the purpose of PHG which is to encourage family members to stay closer to each other. Thus, be sure that your parents have no plans of moving before getting the PHG.

5. Remaining Lease

Like most CPF grants, the resale HDB flat you are eyeing on should have more than 20 years of remaining tenure left in order to enjoy / apply the PHG. This would also set a comfortable buffer for your mortgage loans.

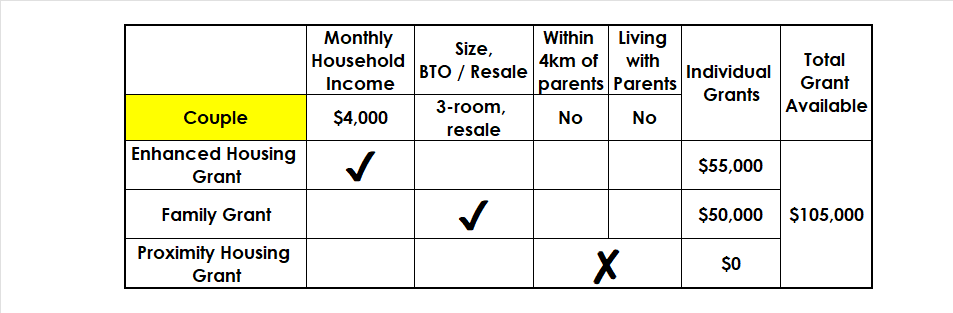

Example

One example would be a Couple who earns $4,000 monthly as a household. Since they live more than 4km from their parents and do not live with their parents, they are not eligible in applying for PHG. However, they are eligible for other grants including Enhanced Housing Grant (EHG) which offers up to $80,000 based on their income over the past 12 months, as well as Family Grant (FG) which considers the size and type of HDB flat and disperses up to $50,000.

Other Unique Grants You Might Be Applicable For

If both you and your spouse are second-timers and living in a two-room subsidised flat (non-mature estate) or HDB rental flat, you may apply for the Step-Up CPF Housing Grant. This $15,000 grant would be applicable for 2-room flat in the open market only, or 2-room Flexi flat and 3-room flat from HDB directly. There is an income ceiling of $7,000 monthly household income, and the new flat must have at least 20 years remaining on the lease tenure

Additionally, if only one applicant is not a Singapore Citizen or if you are applying for your first BTO flat under the singles scheme after turning 35 years old, you may also consider the CPF Housing Grant for Resale Flats (Singles). First timer Singaporeans applying as a single enjoy $25,000 for 2-toom to 4-room resale HDB flats or $20,000 for a 5-room resale flat.

Enhanced CPF Housing Grant for Singles, EHG (Singles) would offer up to S$40,000 for new or resale flat purchases. To be eligible, the average gross monthly household income must be $4,500 or below for individuals buying with a non-resident spouse. For instance, a couple earning $48,000 as a household in the past 12 months would be eligible for this grant as their monthly gross income is $4,000.

Conclusion

As household sizes get smaller and nuclear families prefer having their own homes, Proximity Housing Grant (PHG) is a useful grant that offers children the opportunity to live near their parents. Many older folks who purchased their homes earlier on live in mature estate, where there are limited BTO options and resale prices have grown exponentially over the years. Applying for PHG offers some buffer for children who wish to locate near their parents

However, it is crucial that you do your homework beforehand. Understanding the terms of the HDB grants and ensuring the resale flat you are eyeing is within 4km of your parents’ property is paramount before you pay your Option Fee. You may use this HDB e-service tool to check the distance of your potential flat from your parents’ flat.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!