As you begin your journey to financing your new home, you may be familiar with its two forms – the fixed rate and floating rates.

While we understand the current environment favours the Fixed rate packages given a lower cost, there are people who would still prefer a floating package due to various reasons, such as a shorter lock- in period from certain banks, interest offset feature on deposits and a more optimistic interest rate outlook over the mid-term.

While exploring Floating packages, you may encounter terms which are relatively new, such as the Singapore Overnight Rate Average (SORA). Amidst the high interest rate environment, what do you need to know about SORA rates to enable you to make a well-informed decision? Does it offer a fair representation of the market? Is there any potential in choosing this type of packages? We will walk you through the important information that you must know before making your decision.

What is SORA?

SORA – a volume-weighted average of borrowing transactions in the unsecured overnight interbank market. SORA is based on interbank transactions and it offers better visibility on interest rates and thus, your mortgage loan instalments. SORA products can now be easily compared to other home loans in the market, which ultimately benefit the borrower, in making long-term decisions.

SORA is often identified as backward looking, as it is based on overnight transacted rate, with it being opposed to SIBOR which is based on future estimate of lending rates. Unlike SIBOR, SORA’s computation will not incorporate term and credit risk.

With SORA being backward-looking rate, eliminating the usual spikes and dips you often see in SIBOR movements, hence resulting in a smoother curve in SORA. Such rate will fill in a sweet spot between a volatile SIBOR rate and a premium fixed rate.

How is SORA computed?

SORA is determined by actual transactions in the unsecured overnight interbank SGD cash market between 8am and 6.15pm (inclusive).

Banks are required to provide data on all eligible transactions every working day. MAS will conduct data validation checks to compute SORA accordingly. This is then published on the MAS website the following day at 9am.

What are the different types of SORA rates?

There are 2 types of SORA being offered by the banks, the 1-month SORA and the 3-month SORA.

For the 1-month SORA and 3-month SORA, interest rates are based on a compounding period of 1 month and 3 months of the historical SORA rate respectively which is published daily on the MAS website.

Where can I find the current SORA rates?

Almost all banks in Singapore offer SORA-pegged home loan packages now. While current SORA rates are published on the MAS website, SORA home loan rates differ for each bank due to the additional Bank margin they charge on top of it. You can go directly to each bank to find out what they are offering for each package.

Or you can simply speak with us and we will do the detailed comparison for you, before recommending on which is best suited for you.

What is the difference between SORA and SIBOR?

1. SIBOR is subject to higher market volatility compared to SORA.

- SORA is backward looking as it considers the average rate of actual interbank lending transactions, while SIBOR is forward-looking as it considers rates banks plan to borrow at.

- SIBOR change can be triggered by event, and the SIBOR rate on that day can spike drastically, followed by some drop in the next few days. It would make a huge difference if your interest reset date falls on this particular day when the “special event” happened.

2. SORA does not have a credit and risk premium.

- Credit risk is mitigated due to its usage of an overnight short tenor. SIBOR however, has a high credit and risk premium. As we are unsure of how interest rates will rise in the future, the term premium is used as compensation for the uncertainty of future interest rates. This could be why SIBOR was higher than SORA even during the post covid period before any talk of rate hikes began.

3. SORA makes it easier for borrowers to compare loans between different banks, as usually the same SORA reference rates are used.

4. Transparency is also assured for SORA, as SORA is aligned to new best practices in other key major markets, where the global consensus shifts towards the robustness of overnight interest rates benchmarks like SORA.

5. SIBOR is computed by 15 participating banks now, which means it may not reflect the actual expectations among all banks in Singapore.

The transition from SIBOR to SORA will ensure a more transparent system, as MAS publishes key statistics regarding SORA daily. SORA will allow market participants to access information regarding SORA in a standardised and transparent manner.

How does SORA rates affect me?

If you have a SIBOR pegged home loan package now, do note that you will be switching over the SORA in the near future. Some might have already received the news from bank that it will be converted to SORA automatically if they do not choose a new package.

Just like how MAS phased out SOR in the past, banks and financial institutions will gradually convert their SIBOR packages into SORA-pegged ones. Some banks may offer borrowers the freedom to switch to the SORA package with no additional fee and lock-in period.

Should I go for a 1-month or 3-month SORA-pegged home loan package?

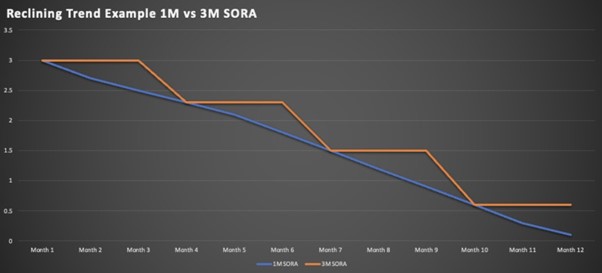

There are several indicators you should weigh before deciding on a floating rate strategy. The 3-month SORA rate has a longer refresh period of 3 months compared to the 1-month SORA, making it a less volatile option. When interest rates were rising, the 3-month SORA rate can be said to be a better option.

However, the 1-month SORA rate will be the better choice under a rate decreasing environment. As 1-month SORA rates have a shorter refresh period, borrowers will reap greater benefits in a low interest rate environment.

Especially if you are looking at a purchase with an extended Option to Purchase, you need to look at the completion date of the property transaction, which is when your loan will officially start. As we progress towards the end of year with possible declining rates, it is up to you to decide whether you prefer stability over opportunity like how the graph below illustrates:

Lastly, do lookout for different terms and conditions from various banks. Some banks require redemption to be done on a particular Rate Review Date. This could be an issue for future planning to sell or refinance if your can only redeem 4 times a year on the 3- month SORA packages with such a clause.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!