Do you want to live in a condominium, but feeling concerned about the high price? Executive Condominiums (ECs) might be the one for you! Read on to learn more about what they are.

What is it?

Also known as the property for the “sandwiched class”, Executive Condominiums (ECs) are a hybrid of public and private housing, catered to middle-income Singaporeans who are not eligible to buy a HDB flat due to the income ceiling cap. ECs are developed by private developers, but managed by HDB for the first 10 years. ECs boast the same facilities and amenities as private condominiums, with swimming pools and gyms among others, within its development.

Am I eligible for Executive Condominiums (ECs)?

To be eligible, you must qualify for any of the following schemes.

1. Public scheme

2. Fiance-Fiancee scheme

3. Orphans Scheme

4. Joint Singles Scheme (If you want to apply for an EC under this scheme, all individuals have to be above 35 years old.)

The main applicant should be a Singaporean citizen aged 21 years old and above. The co-applicant of the unit should either be a Singapore citizen or Singapore Permanent Resident (PR). Your monthly household income should not exceed $16,000 to be eligible to purchase an EC.

All applicants and occupiers should also not have an interest in any local or overseas private property and have not disposed of any private property in the last 30 months before the application for the purchase of an EC.

If any applicant has an interest in an HDB flat, the interest should be disposed of within 6 months of the completion of the EC to be eligible as well.

What are some restrictions that Executive Condominiums (ECs) have?

As Executive Condominiums (ECs) are considered public-private property, ECs are bounded by several HDB rules. ECs are considered and maintained under HDB for the first 10 years. The minimum occupancy period (MOP) for ECs is 5 years, similar to HDBs. This means that you would have to wait 5 years from the Temporary Occupation Permit (TOP) rate before you are allowed to sell your EC. However, ECs are privatized after the 11th year. At this point, EC prices will generally rise due to the privatization of the property, as compared to private property, whose prices generally depreciate over time.

What kind of lease does it hold?

Executive Condominiums (ECs) hold a 99-year lease.

What are some advantages of owning Executive Condominiums?

1. ECs are more affordable than private condominiums

Executive Condominiums (ECs) are 25% to 35% cheaper than private condominiums. This makes it a popular choice for many due to its affordability. Furthermore, owners get to benefit from the privatization of the EC after the tenth year, making it a great investment opportunity for many.

2. EC prices tend to rise after the tenth year, as compared to HDB flats

HDBs and Executive Condominiums (ECs) all hold a 99-year lease. The main difference is that ECs are only managed under HDB for the first 10 years, after which they are privatised. As private properties tend to yield higher prices than that of HDB flats, EC owners get to enjoy this capital appreciation.

3. You get to enjoy the same facilities and amenities as private condominiums owners

A huge benefit of living in an Executive Condominium (EC) is that owners get to enjoy the same quality of amenities and facilities as private condominiums. Some of these are: Swimming Pools, Clubhouse, Gyms, and BBQ pits.

4. You are eligible for CPF housing grants

There are 2 types of CPF housing grants available for Executive Condominiums (ECs). These are:

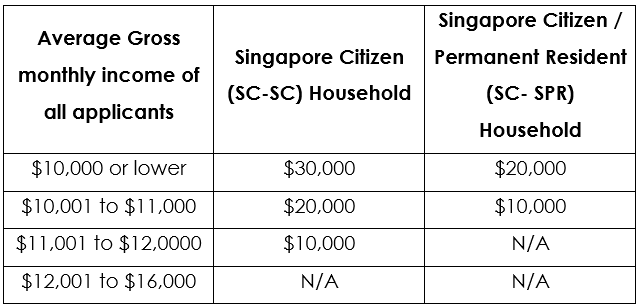

a) Family Grants:

Depending on the average gross monthly household income of all persons in the application, the amount of family grant you will be granted will differ.

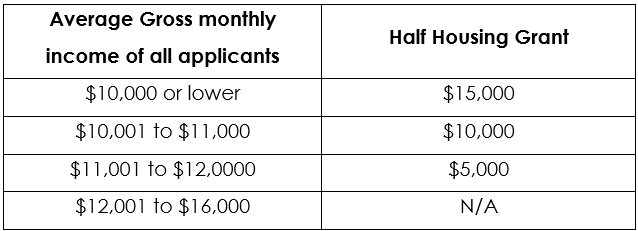

b) Half Housing Grant

Half Housing Grants are granted to households where one is a first-timer Singapore Citizen, and your co-applicant is a second-timer who has previously taken a housing subsidy. The amount will be granted as follows:

What are the disadvantages of owning Executive Condominiums?

1. You may not be allowed to buy an Executive Condominium

You are only allowed to purchase an Executive Condominium (EC) if you have met the eligibility criteria stated previously, which includes one of the following: Public scheme, Fiance-Fiancee scheme, Orphans Scheme, and Joint Singles Scheme.

2. High Down-Payment

Unlike HDB flats where you are only required to pay up to 10% for the down payment, you would have to put down a down payment of 25% for ECs. Out of this 25%, 5% must be paid in cash, and the remaining 20% can be paid using a combination of CPF and cash. This may be difficult for individuals or households who are not financially stable.

3. There is a Minimum Occupancy Period

As Executive Condominiums (ECs) are hybrid developments that are managed under HDB for the first 10 years, the 5-year minimum occupancy rule will apply to ECs. This means that you are not allowed to sell your EC till after the 5th year.

4. Executive Condominiums (ECs) are usually located in more remote locations

Executive Condominiums (ECs), unfortunately, are located at more ‘ulu’ estates, further away from the city center. They also can be a distance away from the nearest public transport, making it an inconvenience if you don’t own a private vehicle. Some locations include Yio Chu Kang, Woodlands, Choa Chu Kang, Tampines, and Seng Kang. But this is also why ECs are a lot more affordable than private condominiums! So, which is more important to you – location or price?

5. Executive Condominiums (ECs) are subject to Maintenance Fees

Since Executive Condominiums (ECs) essentially offer the same facilities as private condominiums, you will be subject to maintenance fees. This is paid on a monthly basis and can go up to $400/month. Some feel that this is not worth the money as they rarely use the facilities provided, so make sure you take maintenance fees into consideration when choosing your EC development.

Conclusion

Executive Condominiums (ECs) are a good option for many due to its affordable price. This makes it an extremely popular choice due to its growth potential, both for investment purposes, or merely to live in. There are a few ECs which are recently launched, so keep your eyes peeled! Some of these include Tenet at Tampines, Copen Grand at Tengah, and Bukit Batok West Avenue 8. If you are interested in purchasing an EC, these could be good options for you!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!