Are you someone that has always had the urge to invest in commercial property, but has been held back by uncertainty? If that is you, don’t worry! Here, you can find the A to Zs of buying a commercial property in Singapore.

Commercial Property… What is it?

There are 3 types of commercial properties in Singapore – Retail, Industrial and Hotel.

Retail property includes shops, shophouses and malls. Industrial refers to workspaces such as B1 (Offices, warehouses) and B2 (factories). Hotels include hotels and hostels.

What can you do with commercial properties?

Just like residential property, commercial property owners can either lease out the place to tenants for monthly rental income, or use the property for one’s personal use.

Who can buy a commercial property?

Unlike Residential Property, there are no restrictions as to who can buy Commercial Property. Singaporeans, Permanent Residents (PRs) and Foreigners are all allowed to purchase commercial property.

Foreign companies who are registered outside of Singapore are also allowed to buy commercial property in Singapore.

Now, let’s dive into the pros and cons of purchasing commercial property.

Pros of purchasing Commercial Property

- Not subject to Additional Buyer Stamp Duty (ABSD)

Even if you already own a residential property, you don’t have to pay ABSD for commercial property. Given that the ABSD can range from 17% to 35% for residential property, this is a huge advantage for those who are interested in investing in property, yet do not want to pay additional for ABSD.

- Not subject to Seller’s Stamp Duty (SSD)

Seller’s Stamp Duty is a tax that owners pay when he/she sells their property within the holding period of 3 years. Aside from industrial property, you do not have to pay SSD for commercial property.

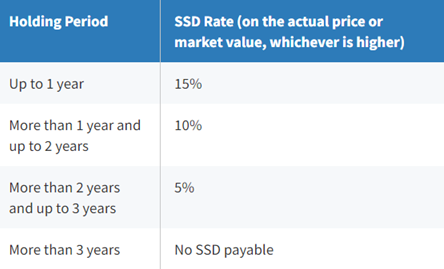

Industrial property pertains to warehouses and factories. According to IRAS, for industrial property acquired on or after 12 January 2013, SSD is payable at rates as seen in the table below.

For example, Mr Tan bought a warehouse in June 2015 at $2,000,000 and sold it at $2,500,000 after 1.5 years. As his holding period falls under the ‘More than 1 year and up to 2 years’ category, 10% would be applied to the $2,500,000. His SSD would thus amount to $250,000.

Cons of Buying Commercial Property

- High Property Tax Rate

Commercial and Industrial property meant for non-residential use are taxed at a flat rate of 10% of its Annual Value (estimated annual rent). Even if you purchased the property for your own personal use, the 10% tax rate would apply.

- Unable to use CPF to finance the property

Unlike Residential property where you are able to use your CPF funds for down-payment and mortgage, you are not allowed to use these funds to purchase commercial property. In other words, you would have to have a higher initial cash outlay to finance the property, as down-payment and mortgage has to be paid in cash.

Here are some other factors you should take into consideration when buying commercial property.

1. Which type of commercial property should I choose?

There are 3 types of commercial property – Retail, Industrial and Hotel. They vary in many aspects, including lease, price, characteristics, risks and benefits.

For example, shophouses. In Singapore, many shophouses are given the conservation status. To protect its unique architectural features, there are restrictions and guidelines guarding the property. Some of these include: intended use, alteration and renovation regulations. According to URA, conservation shophouses should follow the “3R” Principle – maximum Retention, sensitive Restoration and careful Repair. The original structure and architecture have to be retained and restored. URA will only allow for selective replacement when necessary.

Buyers should take these restrictions into consideration when deciding on the type of property to purchase.

2. Is location important to you?

Location plays a large role in every real estate decision. Do you want the unit to be near MRT stations? Expressways? Or are you looking for an outskirt area to house your factory?

For example, a retail shopping mall. Compare a mall in Orchard Road to one in a neighbourhood area such as Admiralty. When people think about shopping, Orchard Road comes to mind. It would definitely be easier to rent out your property to tenants in Orchard Road due to this reason.

On the contrary, if you are looking for a location to house your factory, areas such as Woodlands or Changi may be better for you due to the nature of the buildings around it.

3. What is the property’s intended use?

Each commercial property has its own intended use and guidelines, and this can be found on the URA Master Plan. Knowing its intended use is very important as it is difficult to change.

For example, if you want to change its use from retail to office and it has not been approved previously, you must first apply for planning permission from URA and wait for approval before undergoing the change.

4. What is the property’s tenure?

There is a wide range of leasehold tenures for commercial property. This ranges from 30 years to 999 years, as well as freehold, albeit limited due to Singapore’s scarce land.

Shorter leases of 30 years and 60 years are made available to make it more affordable for small business owners. The shorter lease gives the government the flexibility to redevelop the land if needed.

5. How to finance the property?

Financing would be different depending on whether you are buying commercial property as an individual or a corporate entity. The loan amount you are allowed to borrow depends on the Total Debt Servicing Ratio (TDSR).

For individuals, the TDSR is set at 60% of your monthly income. For corporate entities, the TDSR will depend on the company’s credit worthiness and annual net operating income. This means that the loan amount would differ from company to company. The company’s debt will also be taken into consideration.

Interest rates for commercial property loans are generally higher than that of residential property loans. Here’s a tip: If you are looking at reducing the overall interest incurred, put down a higher down payment!

Buying commercial property may initially seem intimidating, but now that you know more about it, are you excited to start on this ownership journey? Of course, don’t rush into it, and take some time to further understand the commercial market before making a decision.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!