“Confirm will appreciate one (sic)” and “Buy Condo from developer confirm make money (sic)” are what on-site property agents or that busybody relative of yours would claim when hard selling the idea to you of purchasing a brand new condominium unit from the developer during a show flat viewing. A decision not made any easier with stunning and intricately built artist’s impression project models standing right before you, beckoning for you to take part in a dream lifestyle promised with the latest facilities and amenities, it can be rather difficult to make a truly informed and objective decision.

However, here at Redbrick Mortgage Advisory, your financial well-being is our priority and that begins with financial prudency above all else. Putting a hefty chunk of your resources into an avenue that you may not know everything about can be a risky venture that could land you in a potential future loss, a detrimental situation you should avoid at all costs! In this article, we will debunk this long-standing absolute statement, and give you an objective view of what really went down for owners who bought into the hype in previous condominium launches. Additionally, we will put into question the battle between resale condominiums and new condominium units in deciding which is the most ideal as an investment vehicle.

We all fall prey to walking out of a show flat only to have a bittersweet aftertaste wondering “How nice it would be if I could buy a unit here” while being confronted with the hefty price tag that comes along in order to upkeep a dream lifestyle in the development. Developers are the most strategic when it comes to baiting its prospectus, with promises of ‘Early Bird Discounts’ and the exclusive ‘VVIP discount’ that can come in various forms such as absorption of a certain percentage of the stamp duty payable.

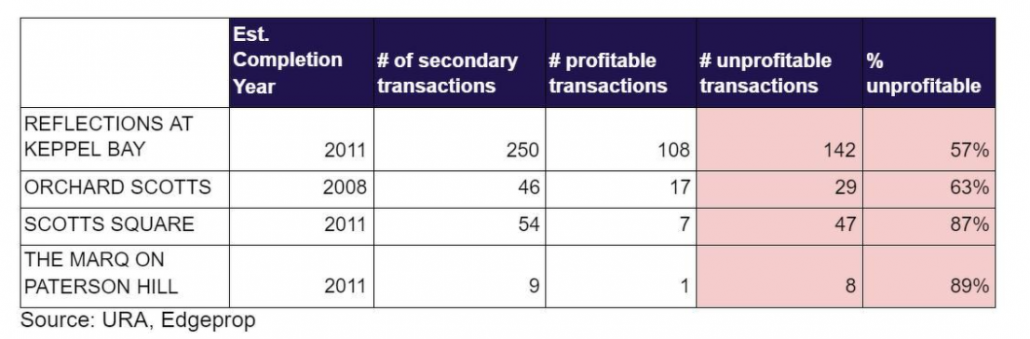

In a recent publication by EdgeProp using data from URA, studies were done on an estimated 856 past transactions involving newly completed projects between the years of 2018 and 2020. It was found that 6.5% of all recorded transactions in the study were resultant in losses. The loss was so jarring in the new condominium project located in District 4, Reflections at Keppel Bay that it made headlines on major financial review pages and had sustained a depressing loss of $2,147,900, trailing behind was Orchard Scotts and Fulcrum. The same people who boldly claim that all projects would “make money” would have to eat their words, especially for those who placed undeniable and unshakeable faith in units located along Core Districts and prime land such as Orchard Road. A loss can happen to any project anywhere, therefore it is crucial to bear in mind that no condominium launch is a guaranteed bet!

Now comes the big question for investors: “Which is better – resale condominiums or new-launch condominiums?” As we all know, investors are all here with one single goal: To attain positive rental income. In this portion, we will take a look at the respective pros and cons of each investment option to hopefully present you with a newfound perspective on where to best park your resources!

1. Resale Condominium – old may be gold!

Pros: Immediacy of cashflow

The most immediate benefit that comes from choosing a resale condominium is the immediacy of rental. After the completion of the S&P, the property is now yours and you are free to do whatever you deem necessary! Unlike new condominium launches that often take between 3 to 4 years till completion, resale condominiums provide immediate cashflow. In fact, it is common for seasoned real estate investors to purchase resale condominiums only, and best if they come with existing tenants from the previous landlord. Resale condominiums if chosen right, the investor himself can avoid forking up a single cent in mortgage payments so long the existing rental income is able to cover repayments to the bank. Additionally, there is public data available on platforms such as SRX which allows for everyday individuals like yourself to retrieve past rental data about similar properties in your vicinity.

Pros: A keen eye for the undervalued

For those that have dabbled long enough in the real estate rental market would find themselves constantly on the hunt for underrated and undervalued properties. Unlike new condominium launches that are usually sold (even with VVIP discounts and Early Bird Promotions) near real value, the resale market holds much more surprises than you may think! These undervalued properties are often sold below market rate, due to several possible reasons such as liquidation due to foreclosure from mortgage defaults or even a sudden death of a relative previously living in the home. These mini pockets of properties that fall through the cracks in the real estate market requires a keen eye and careful inspection and hopefully lady luck beams on you while on your search!

Cons: Possibly higher maintenance cost and older amenities

As condominiums get older, so will they undergo more wear and tear which would expand greater resources to maintain and upkeep. This results in overall higher maintenance payable per household, unlike new condominiums which generally are expected to come with minimal or no defects. Should there be any, new homeowners are entitled to the necessary repairs free of charge for 1 year under the Defects Liability Period. Unfortunately, any defects in a resale unit will have to made good by the owner himself usually by hiring a personal contractor.

2. New Condominiums

Pros: Lower maintenance cost and new is always better

Who does not love having new things? With new condominium launches, all amenities are brand new, including gym and swimming facilities. Modern day condominiums have beyond-ordinary amenities and services including concierge services, bowling alleys and even a driving range. Do not underestimate the importance of having new amenities as it actually does impact the rentability overall! With newer amenities, maintenance and repair works are kept minimal, hence the payable maintenance would be relatively lower as well.

Pros: More discounts available

As mentioned, developers are likely to bait its prospective buyers with promises of discounts that can come in various forms such as absorption of a portion of the stamp duty or provide in-built carpentry works to reduce the need for massive renovation costs! While we mentioned that there is a possibility of undervalued resale condominium units in the market, it requires time and skill to look out for such units and it is not a guaranteed find. If you are new to the investment scene but have spare cash resources lying around, you might want to consider making a trip down to an ongoing show flat happening

Cons: Unpredictability and uncertain financial conditions

This is especially important especially if the condominium launch is situated in a less popular region or has its own locational disadvantages (e.g. far from MRT, lack of surrounding amenities). Especially for regions that rarely see condominium launches, it can be difficult to find comparison data to predict potential rental yield, capital appreciation and past transaction data. Betting your money on such a project can be risky, with a potential that there is an extended lag time between the key collection date and the time you actually begin collecting rental income, which could result in financial losses. Hence, it is crucial to consider your financial capabilities and whether you are truly ready to stomach the possibility of having zero rental income and paying for your monthly mortgage promptly for a few months!

For new investment enthusiasts, it is recommended to place your bet with a resale condominium as opposed to a brand-new launch. Unless you have valuable insider information or are so certain about your evaluation about the future prospects of the new launch project, it is always better to err on the side of caution supported with past data. Still feeling unsure on which is the best avenue to allocate your resources? Get in touch with us today and let us help you chart out the best investment plans suited for you!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!