The recent Budget 2024 announcement made on 16 February 2024 made headlines for the many announcements and changes made to the current schemes. Property was one of the main aspects mentioned in DPM Lawrence Wong’s speech. So, how will the recent changes affect you? In this article, we will delve deeper into the impacts of the changes on you, as homeowners.

What is the aim of Budget 2024?

If you didn’t know, the Singapore Budget is announced every financial year to address any problems that Singapore may be facing and reorganise themselves to prepare for the year ahead.

With the vision “Move Forward with Confidence, Build Our Shared Future Together”, Budget 2024 aims to support Singaporeans from all walks of life. Measures that were announced include: Tackling Immediate Challenges for households and businesses, providing more assurance for families and seniors, and creating more paths for equality and mobility.

What has been announced in Budget 2024?

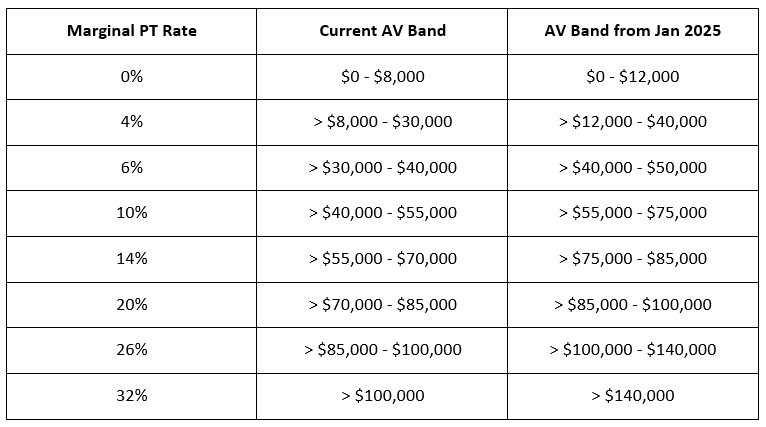

With regard to property, you may be happy to know that property tax has been set to be reduced. The Annual Value (AV) bands for owner-occupier residential Property Tax rates will be raised from January 2025. Updates have also been made to the ABSD rates, to benefit a larger group of people.

What has changed for the AV bands?

The lowest AV band bracket is currently $0 to $8,000 but will be raised to $12,000 come 2025. Likewise, the highest AV band bracket will be raised from more than $100,000 to more than $140,000.

Here is a table depicting the changes to the AV bands:

Why was this change made?

Market rents have been on the rise since 2022, causing many homeowners’ AV to be over the $30,000 mark. This caused a lot of unhappiness amongst those who did not benefit from rental hikes, yet have to pay higher taxes. The change in property tax rates is thus the best and most fair way for homeowners, especially those who are not landlords.

Budget 2022 announced the two-step change in property taxes for residential properties as a way to target the higher-end segment of the market. This was expected to only affect the top 7% of the owner-occupied market, but it affected approximately 13% instead. As announced by DPM Lawrence Wong in his 2024 speech, the new property tax changes aim to reduce this amount back to the initial planned 7%, while “still upholding the intent of the property tax changes and ensure that those residing in higher-value properties continue to pay their fair share of taxes”.

How will the changes affect homeowners?

The new tax rates mean that a majority of homeowners are expected to be able to enjoy similar, or lower property tax bills at each AV level. However, this is only assuming if the property’s AV remains the same, and without any rebate.

To cushion any impacts the changes to property tax may cause, the government will be providing a one-off rebate in 2024. One group of Singaporeans that will benefit from this is retirees.

The Inland Revenue Authority of Singapore’s 12-month interest-free Giro instalment plan will be extended to up to 24 months, to help retiree living in higher-end homes who face cash flow issues.

Eligibility Criteria:

a) All owners of the property are aged 65 and above;

b) The applicant must owner-occupy the residential property (i.e., live in the property they own); and

c) The applicant’s Assessable Income must not exceed $34,000 (based on latest tax assessment

available).

Eligible retirees can apply for EGS Residential Property (Retirees) via myTax Portal from 19 Feb 2024 onwards.

What are the changes made to Additional Buyer Stamp Duty (ABSD)?

Historically, ABSD remissions were tailored to support Singaporean married couples in buying replacement properties, a policy questioned for its exclusion of single homeowners. The government’s rationale focused on moderating residential property demand, including that for second homes.

However, recent increases in the Government Land Sales (GLS) program’s housing supply, aiming to match purchase demand with economic fundamentals, have paved the way for policy evolution. Consequently, the ABSD concession has been extended to singles over 55, facilitating those interested in downsizing. This change reflects a responsive adjustment to housing policy, aiming to accommodate the shifting demographics and needs of Singaporeans.

With the above in play, it is timely that the ABSD concession be extended to singles above 55 years old, to help singles who are looking at downsizing their existing property.

Singles above 55 years old who make purchases on or after 16 February 2024 will be able to claim a refund of ABSD on their new property if they sell their first property within six months of buying the downsized property.

The policy also includes measures to support seniors facing cash flow issues, indicating a broader aim to address various societal needs rather than focusing solely on the aging population.

What are the benefits of the ABSD changes on developers?

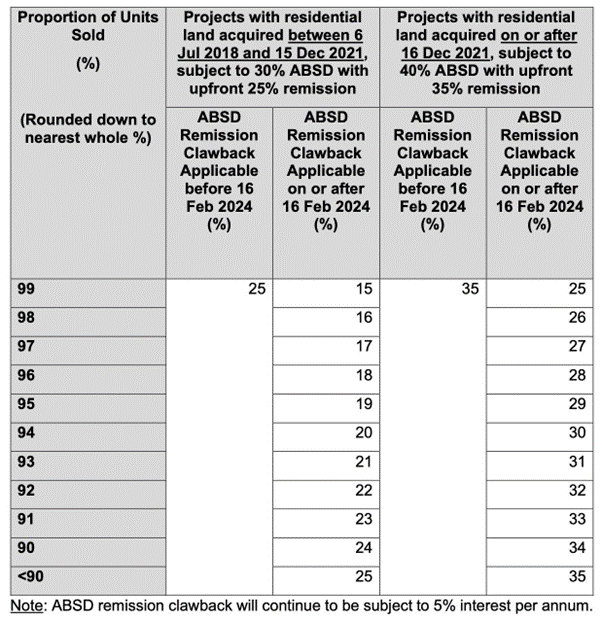

The recent changes to the Additional Buyer’s Stamp Duty (ABSD) rules for developers in Singapore are seen as a positive move that provides developers with more flexibility in selling units. Specifically, developers now have a lower ABSD clawback rate if they sell at least 90% of their development within five years from the land acquisition date, a change from the previous requirement of 100%.

This adjustment is aimed at ensuring a timely release of housing supply while offering developers some leeway, acknowledging challenges in the property market and contributing to the industry’s sustainability.

The Budget 2024 announcement has brought about many improvements and updates to the current schemes to reach the government’s aim of making Singapore a fair community for all. Seeing how quickly the government has responded to the changing environment of Singapore, we can expect that more improvements will be made in the years to come, as Singapore aims to create a better society and community for everyone to live in.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!