Beyond conservation shophouses as part of our landscape, they are financial assets too. If you are keen to own one, read on to find out more.

Along the picturesque streets of Chinatown, conservation shophouses have always been a highlight of Singapore’s streetscape especially in conserved areas. Beyond seeing it as part of our landscape, shophouses are also great financial assets yet not many have explored the value of it. If you are interested in owning a piece of history for its ‘conserved’ status, these prestigious properties located at the heart of Singapore might just be for you!

With a wealth of experience in helping clients with their loan positioning, Jo’an Tan has personally structured over $900M worth of loans across 900 properties, by no means an easy feat and a strong testament to her ability and achievements. Jo’An is an associate director at Redbrick Mortgage Advisory and in this article, she will shed some light in this overlooked sector of conservation shophouse.

1. What are the requirements for one to purchase a conversation shophouse?

There are 3 types of conservation shophouses, commercial, residential and mixed commercial-residential shophouses.

Commercial shophouses have no restrictions, eligible for anyone (including foreigners) to purchase. On the other hand, conservation shophouses with ‘residential’ components can only be purchased by Singaporeans and Permanent Residents (PR). This is mandated by Singapore Land Authority (SLA) under Residential Property Act. In other words, residential shophouses are classified as landed and foreigners must seek special approval to purchase such properties.

PRs who wish to purchase conservation shophouses with ‘residential’ components also need to have secured the PR status for at least 5 years, and must seek Land Dealings Approval Unit (LDAU) approval beforehand. From such categorisation alone, we can tell that the conservation shophouses are highly coveted and important properties that are protected by the law.

2. What taxes are imposed on these conservation shophouses?

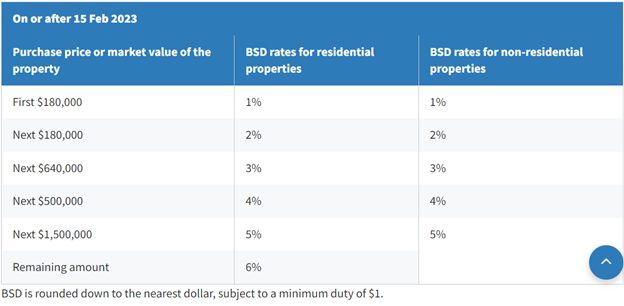

There are 2 types of stamp duties for any purchase/acquisition of Singapore properties.

Buyer Stamp Duty (BSD) is imposed on all properties to prevent property speculation and charges up to 6% depending on the value of the property.

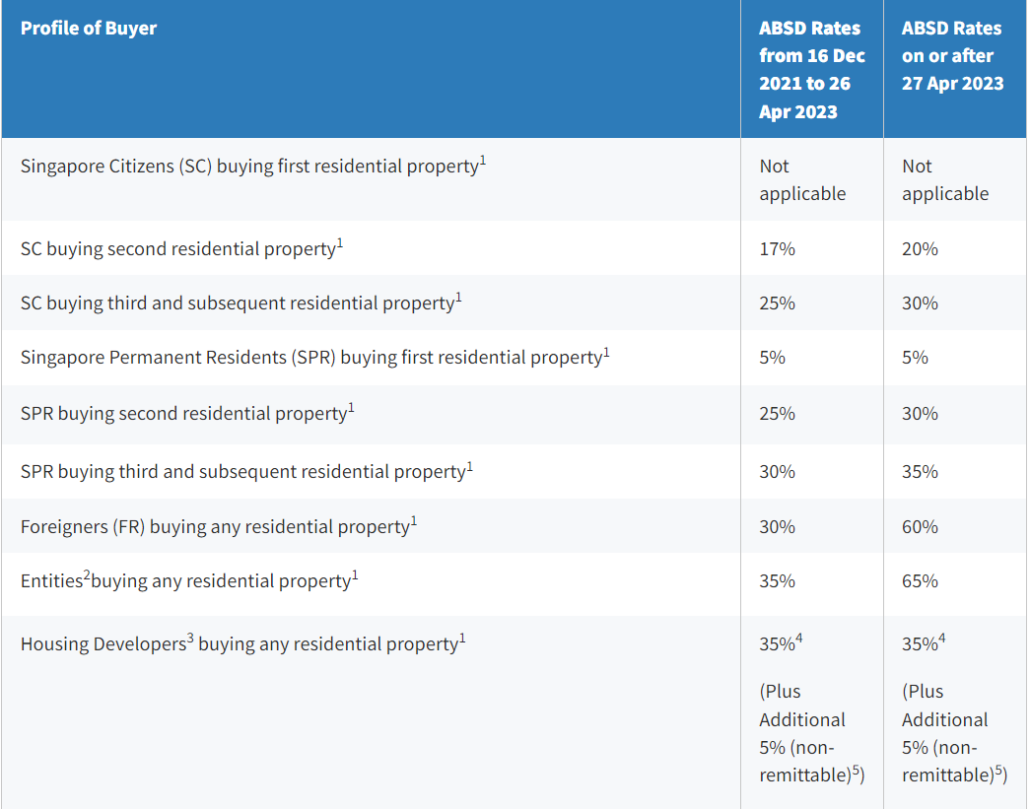

On top of paying for BSD, buyers of residential properties also might need to pay Additional Buyer Stamp Duty (ABSD), depending on the profile of the buyer. This is part of the cooling measures for the residential property market to prevent speculation, which could cause a property bubble, if not regulated. This means if you are purchasing a shophouse with a residential component, you may be required to pay for additional taxes such as ABSD, depending on the following factors:

- Whether the buyer is an individual or entity

- The nationality of the buyer

- The count of residential properties owned by buyer

As shown in Table 2 below, ABSD could rack up to hefty sums. Permanent Residents purchasing their 3rd property would incur 35% ABSD, which could amount to $350,000 for a $1 million purchase. It is thus, an important consideration for investors when deciding to purchase residential shophouses and mixed (i.e., Commercial-Residential) shophouses.

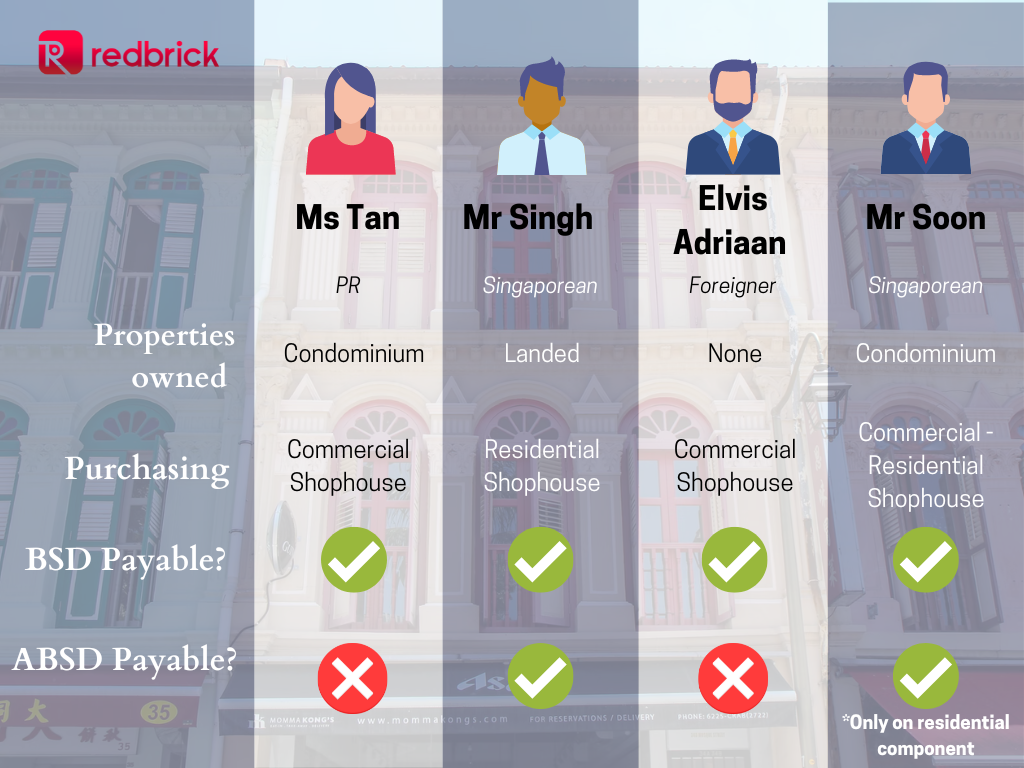

To better illustrate how this might affect your purchases, here are some scenarios:

Scenario A

Ms Tan is a PR in Singapore and currently owns condominium jointly with her husband. She wishes to purchase a commercial shophouse. In her case, she will only be liable to pay BSD and no ABSD is involved as ABSD is only taxed on residential properties.

Scenario B

Mr Singh, a Singaporean, owns a landed property in Dakota and is thinking to purchase a residential shophouse for investment purposes. Since the measure is targeted to prevent undue speculation, there will be both BSD and ABSD charged in his case.

Scenario C

As a foreigner working in Singapore, Elvis Adriaan does not own any residential property in Singapore and he wishes to purchase a commercial shophouse. As there is no residential component, he only has to pay BSD and no ABSD is involved.

Scenario D

Born and raised in Singapore, Mr Soon is a Singaporean in his mid 40s and owns a condominium in Bukit Timah. He plans to purchase a mixed Commercial-Residential shophouse. He will have to pay for both BSD and ABSD, but ABSD will only be charged on the component of the property which is attributable for residential use.

3. What is the general profile of someone purchasing a conversation shophouse? What are some specific restrictions and obligations that buyers should be aware about?

Conservation shophouses are typically owned by Singaporeans, where there is a group who may have inherited the property. However, since the announcement of increasing ABSD by the Singapore government in 2018, there are more foreign investors interested to explore into non-residential properties in Singapore especially the commercial shophouses.

Foreigners are generally not allowed to buy residential landed properties in Singapore (with certain exceptions/ criteria). However, that does not deter foreign investors who are keen in owning a prime land in Singapore. Given that there are only around 6,500 shophouses under conservation in Singapore and these shophouses are located at Singapore’s prime districts.

There has been a general increase in transactions for the sale and purchase of shophouses. In particular, foreigners and non-Singaporean controlled entities are buying up shophouses from Singaporean owners in the last 4 years.

According to the Urban Redevelopment Act, shophouses are protected due to their heritage and historical value. As such, homeowners / investors who have purchased a conservation shophouse face certain restrictions when it comes to renovation works, such as having to seek clearance before any air-conditioning can be installed.

In addition, the original elements of a shophouse have to be conserved such as the front facade, walls, building colour & paint so as to retain the inherent spirit and original ambience of the historic buildings as far as possible.

4. What are some common mistakes made by people who buy shophouses for residential purposes?

When it comes to conversation shophouses, one needs to take note that it is unlike purchasing a typical residential or commercial property. More often than not, clients who have had little or had not done due diligence before purchase, would have experienced further complications after purchasing.

Length of Tenure

There are shophouses which comprise a leasehold title of 99 years, 999 years or even freehold. However, one should note that some resale shophouses have a shorter remaining tenure. Some investors are not able to take the maximum leverage offered as most financiers will consider the remaining lease as part of the approval criteria.

For instance, Mr Tan is buying a $1 million shophouse and is eligible for LTV of 75% based on his profile. However, as there is only 60 years left on the lease, the bank only offers him a loan of $600,000. Even if Mr Tan has sufficient savings for his downpayment, this could potentially affect the capital appreciation and investing in a shophouse may not have the wealth preservation it appears to offer.

Value vs Price paid

“Price is what you pay for, but value is what you get.”

Warren Buffett’s golden advice says it all. One needs to be able to differentiate that price does not equate to value. A highly priced property may not necessarily mean it is valuable, and the reverse is also true. Investors should never rush head-first into a sale thinking that pricier properties are always better investments.

It is important to consider the ways in which properties are conventionally valued, such as proximity to amenities, accessibility to MRT stations, amongst other factors. However, things may get blurry when it comes to putting a value to culture, history, and heritage. The conventional valuation might not be aligned to your definition of value, or the financial benefits that you may expect.

Encroachments

It is common for encroachments to be present in shophouses which may not be obvious upon visual inspection of the property. There were incidents of many older shophouses which have balconies or parts of the building encroaching on state land.

In some cases, a Temporary Occupation Licence (TOL) may be issued for such encroachments. As TOL fees are payable on a yearly basis for these encroachments, buyers must be aware of the amount payable, as such fees would contribute the monthly maintenance fees..

Prospective buyers should always keep in mind that the law favours caveat emptor or “buyers beware”, which would require buyers to do their due diligence before purchasing in the properties. Shophouses have been known to locate in the most prestigious parts of Singapore and are a key to our local heritage.

The rise in prices of such properties is also testament to their investment value. However, they may not be for everyone due to potential encumbrances, additional fees and potential restrictions. If you are unsure of whether a shophouse is suited for your financial needs and profile, feel free to reach out to our mortgage advisors for an obligation-free consultation.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!