Unsure about the legal processes behind buying an uncompleted property? Buying a new property is no small liability, and it may seem like a confusing task, but don’t worry! Let us guide you through the steps and everything important you have to know when buying an uncompleted property.

Let’s start off with the processes you have to take to buy an uncompleted property. Broadly, there are five stages to the purchase process, as follows.

1. Basic Checks

The most important thing a buyer has to do when buying an uncompleted property is to do his/her due diligence. This would include checking all legal documents such as the verification of developer’s licence, CONQUAS, quality mark and any other encumbrances.

Verifying the developer’s licence is an extremely important step that you should not miss. They will either be issued with a sale or no-sale licence. Developers with a sale licence have to obtain building plan approval before commencing sale. Whereas those with no-sale licences are not allowed to sell any residential units in the development. The developer’s housing developer’s licence can be checked on the URA page here.

CONQUAS, which stands for the Construction Assessment System is another important step you should take into consideration when buying non-completed property. CONQUAS, together with quality mark (QM) ratings would reveal the workmanship of completed projects the developer has undertaken. This would be extremely helpful in giving you an indication of the developer’s project quality.

2. Visiting the Show Flat

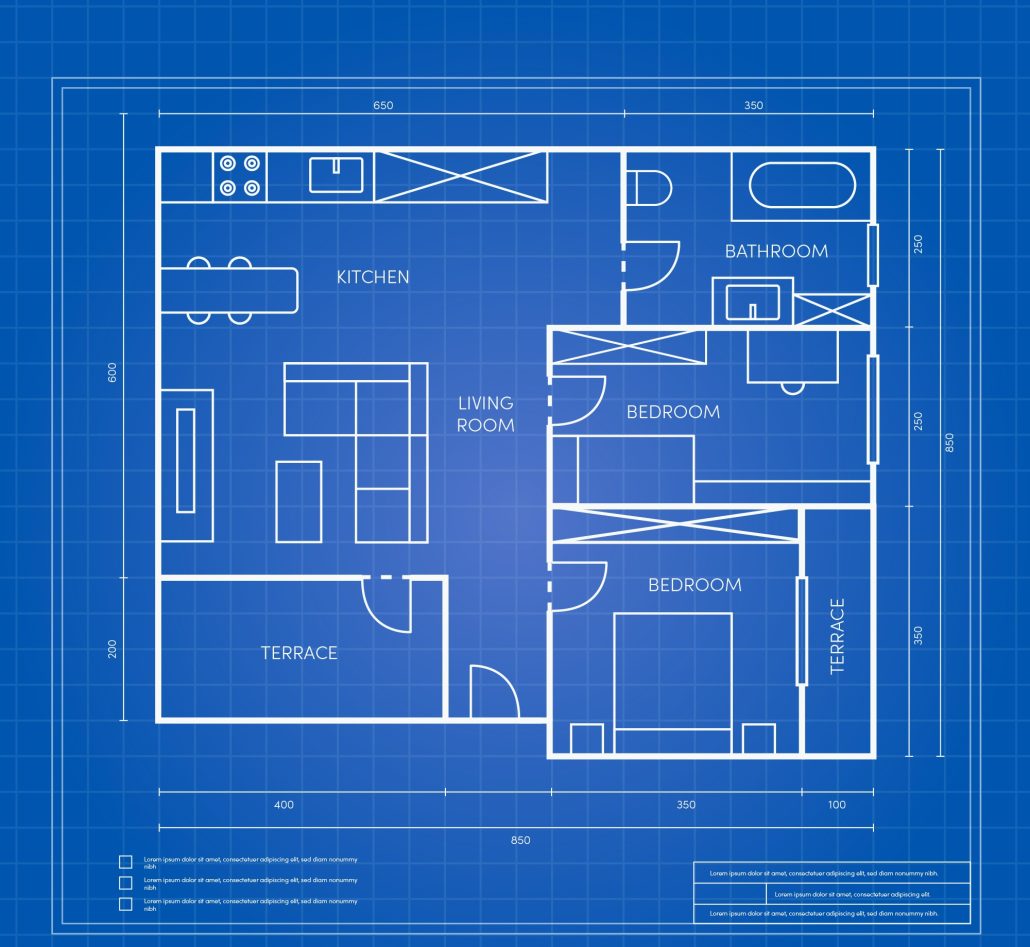

It is important for you as a buyer to visit the show flat of the property you are interested in. So that you can learn more about the property and the specific unit you are looking at. At show flats, it is mandatory for the developer to display all plans and models accurately, under the Housing Developers (Show Unit) Rules. This would include location plans, site plans, project models, unit models, and a show unit. These must be either drawn or built to scale, which will therefore give you a good guide on what you can expect when you take over the unit after purchase.

Here are some tips for you when entering the show unit.

- Look out for the floor plan and written notice at the entrance. It will let you know the floor-to-ceiling heights of the rooms. The building plan approval number and date, as well as a breakdown of the unit (i.e. living room, air conditioner ledge etc).

- Look out for written notices which state the materials, fittings, installation, and appliances that will be provided when you purchase the home.

- Fixtures such as cupboards and wardrobes will also be installed in the show flat. These will be exactly the same fixtures you receive when moving in. Take a look at them and decide on whether it is to your liking.

- It is mandatory for some units and developments to have household shelters. Do check if they are present, by looking out for a written notice displayed at the entrance of the show unit.

3. Booking the Unit

Before you proceed with the booking of the unit, the buyer should review the set of mandatory information provided to you by the developer. You should review this information very carefully to ensure that you are satisfied with the unit before proceeding to pay the booking fee, which is also known as the Option to Purchase (OTP) for the unit. This booking fee will range from 5% to 10% of the purchase price.

After you are granted an OTP, the developer would deliver the S&P, and the title deeds for your review within 14 days of the OTP. After which, if you decide to exercise the OTP, you should sign all copies of the S&P and return it back to the developer. At this point, you will pay the balance down payment (i.e. 20% of the purchase price less booking fee paid) to the developer. Do note the option has to be exercised within the 3 weeks after the delivery of S&P and title deeds to you.

In the case where you decide not to exercise the OTP, you should submit a written notice to the developer. If it was not exercised before expiry, 76% of the booking fee will be refunded back to you.

4. Signing the Agreement

The S&P, which stands for the Sale and Purchase Agreement, is a private contract between the developer and the buyer. It is mandatory for licensed developers to use this form of S&P. The S&P would include information such as Vacant Possession Date, developers’ obligation, share value and sub-sale of the unit.

5. Collection of Keys

The last step of buying an uncompleted property is to collect your keys! After the TOP is issued, you will be able to inspect your unit, housing project and common property. Report any defects to the developer in order for rectification works to be done. The defects liability period will last for 12 months from either the date you receive vacant possession of the unit, or the 15th day after you receive notice that the TOP has been issued, whichever is earlier. In the scenario where you find any defects during this period, you should report it to the developer, following the procedures written in the S&P.

So, here are all the steps you need to know when buying an uncompleted property. The steps can be complicated, especially if you are a new buyer, or have only purchased private completed property before. Hopefully, this article has been a good introduction to the general steps you should take when buying uncompleted property.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!