Have you ever looked at your parents’ or even your own financial journey and wondered if there was a different path, a smarter way to build wealth? What if you could achieve financial freedom, retire comfortably with significant assets, and generate substantial passive income, all without ever touching your hard-earned savings?

Meet Jack and Jill. Their story isn’t about winning the lottery or inheriting a fortune. It’s about a series of calculated decisions, starting with their very first home, that propelled them towards an incredible retirement at 65 with $10 million in properties and a $20,000 monthly rental income. Let’s step into their shoes and see how they did it.

The First Step: A Leap of Faith at 30

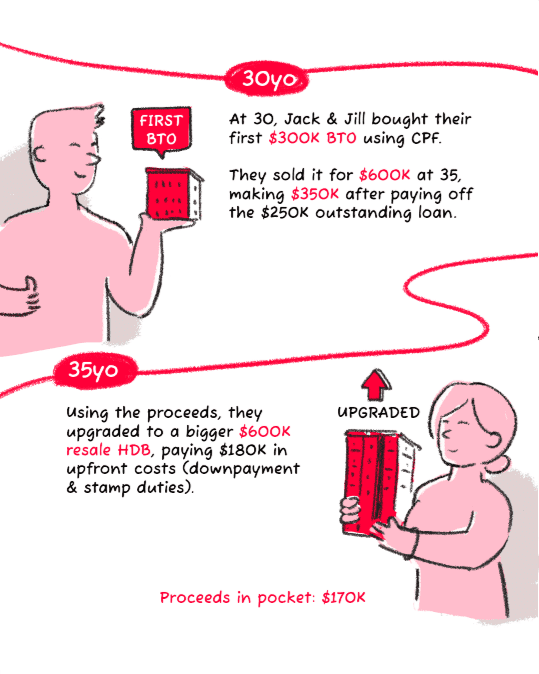

Imagine yourself at 30, perhaps just starting a family or settling into your career. For Jack and Jill, this was the pivotal moment they bought their first Build-To-Order (BTO) flat for $300,000, wisely using their CPF. This wasn’t just a home; it was their first strategic asset.

Fast forward five years. You’re 35 now. The BTO, your starter home, has appreciated significantly. Jack and Jill sold theirs for a remarkable $600,000, making a profit of $350,000 after settling the outstanding $250,000 loan. This substantial gain wasn’t just a windfall; it was the foundation for their next move. With $170,000 proceeds in hand after upfront costs, they weren’t just richer; they were ready to leverage this capital.

Upgrading and Growing: The $600K HDB to a $1.5M Condo

At 35, instead of cashing out and spending, Jack and Jill used those proceeds to upgrade to a bigger $600,000 resale HDB. They paid $180,000 in upfront costs, including the downpayment and stamp duties, leaving them with $170,000 in cash. While it might seem like they spent all their profits, remember, they were upgrading their living space while retaining capital.

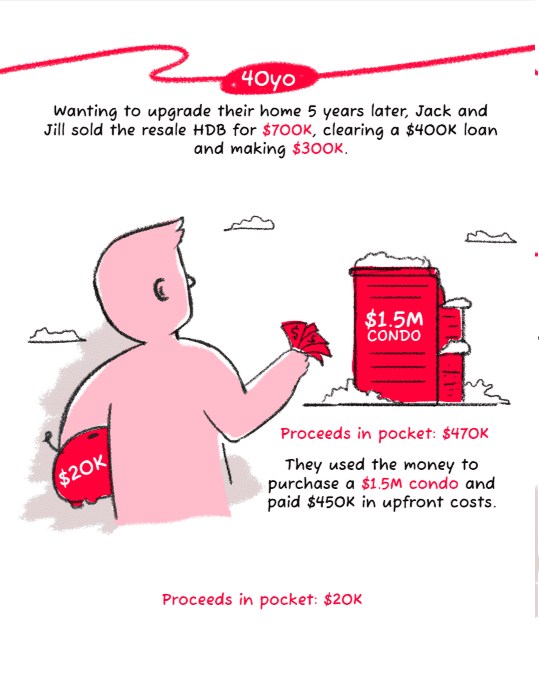

Five years later, at 40, although you have grown accustomed to your upgraded HDB, you needed more space for a growing family. Jack and Jill sold this home for $700,000, clearing a $400,000 loan and making a $300,000 profit. This brought their total proceeds to $470,000. Now, here’s where the calculated risk and leverage truly shine: they used this to purchase a $1.5 million condominium, investing $450,000 in upfront costs. They still had $20,000 left in their pocket after this significant upgrade.

This move wasn’t just about a fancier home; it was about shifting into a property class with higher appreciation potential.

Leveraging Equity for Investment: The Birth of Passive Income

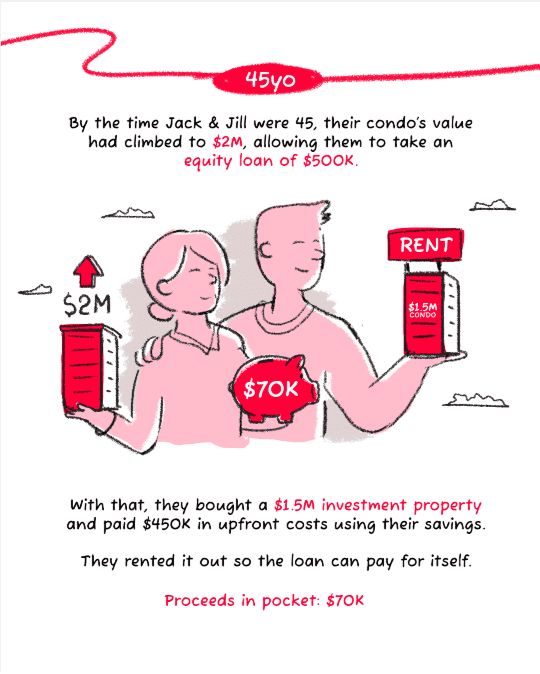

By the time you’re 45, your $1.5 million condo has become a $2 million asset. This is where Jack and Jill unlocked a powerful tool: an equity loan. They took out $500,000 against their appreciated home. With $70,000 in proceeds from their prior transactions and current equity, they made another strategic move.

They bought a $1.5 million investment property, paying $450,000 in upfront costs using their existing savings. Crucially, they rented this property out, ensuring the rental income covered the loan, effectively making it a self-sustaining asset. This was their first step into truly passive income generation, laying the groundwork for their golden years.

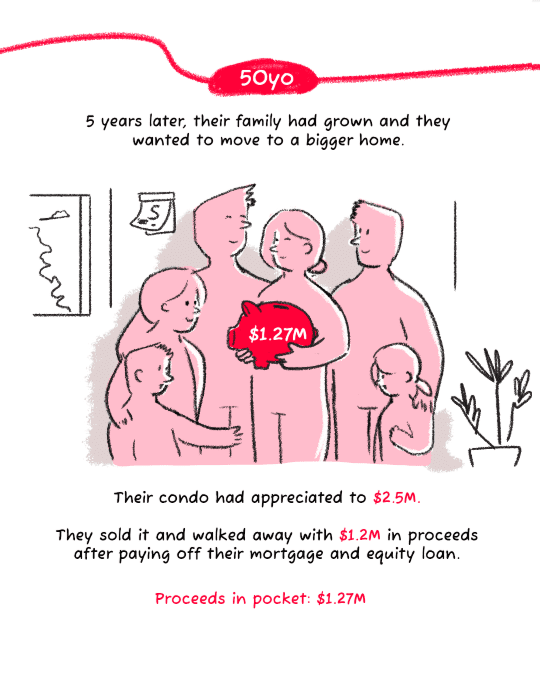

Bigger Homes, Bigger Gains: The Landed Dream

At 50, your family has likely grown, and you might be dreaming of even more space. Jack and Jill were no different. Their $2 million condo had appreciated further to $2.5 million. They sold it, walking away with a substantial $1.27 million in proceeds after settling their mortgage and equity loan.

With this significant capital, they made the leap to a $4 million landed home. Imagine moving into your dream house, knowing you covered all the upfront costs – the full $1.2 million – without even touching your personal savings. This demonstrates the power of reinvesting property gains. They still had $70,000 in cash after this move, proof of their prudent financial management.

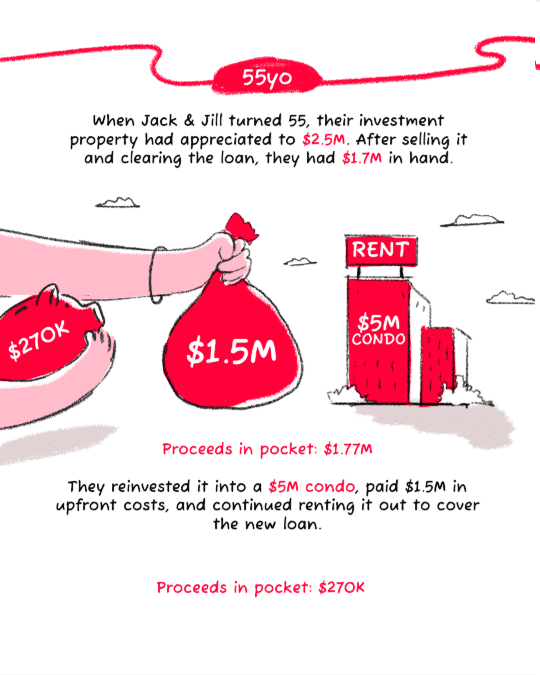

Solidifying the Future: More Passive Income, Less Debt

Five years later, at 55, your investment property has also flourished, appreciating to $2.5 million. Jack and Jill sold it, clearing the loan and ending up with $1.7 million in hand. Did they splurge? No. They reinvested $1.5 million into a $5 million condo, continuing their strategy of renting it out to cover the new loan. This move further diversified their portfolio and solidified their passive income stream. They now had $270,000 in hand from this transaction, adding to their growing reserves.

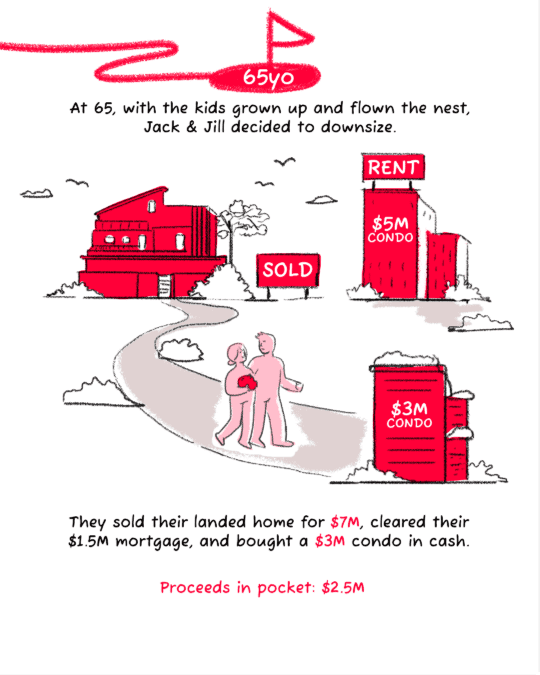

The Golden Years: Retirement Realized

Finally, at 65, with the kids grown and living their own lives, Jack and Jill decided it was time to downsize their personal residence. They sold their $4 million landed home for an impressive $7 million, cleared their $1.5 million mortgage, and bought a $3 million condo in cash. This single transaction left them with $2.5 million in their pocket.

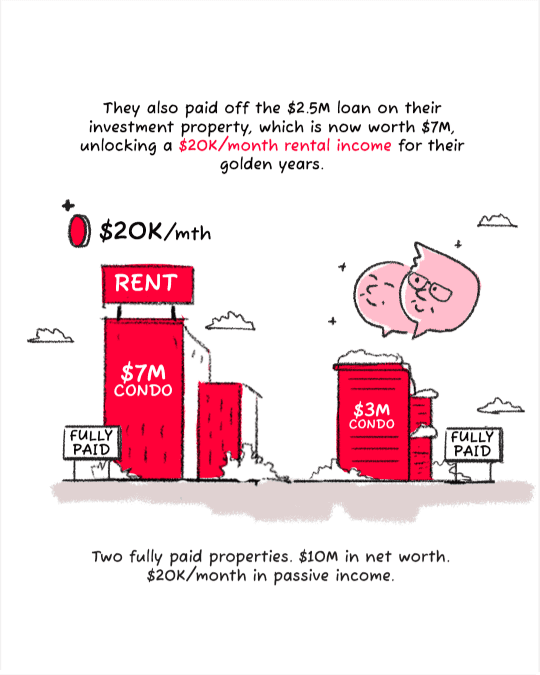

But they weren’t done. They also paid off the remaining $2.5 million loan on their investment property, which had appreciated to a staggering $7 million. This move was the ultimate game-changer: it unlocked a $20,000 per month rental income for their golden years.

The Result: Financial Freedom Without Compromise

Jack and Jill retired at 65 with two fully paid properties worth a combined $10 million. They had a net worth of $10 million and, more importantly, a passive income of $20,000 every single month.

The most incredible part? They achieved all of this without ever touching their personal savings. Their journey is a testament to the power of strategic property investment:

- Early Start: Getting on the property ladder young allows for compound appreciation.

- Calculated Upgrades: Each upgrade wasn’t just about a bigger home, but about moving into properties with higher growth potential.

- Leverage and Reinvestment: Using equity and proceeds from sales to invest in more assets, rather than spending, accelerated their wealth accumulation.

- Passive Income: Generating rental income ensured their investments became self-sustaining and provided a comfortable retirement.

Now, imagine yourself as Jack and Jill. Their story isn’t just a narrative; it’s a blueprint. It shows that with calculated risks, smart leverage, and a long-term vision, financial freedom isn’t a distant dream – it’s an achievable reality.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!