With a million and one things to take note of when purchasing a home, it is no wonder buyers are overwhelmed with information. Although there is a wealth of property-related content online, it is still easy, especially for first-time buyers, to feel lost and confused on where to start.

But fret not because we will be breaking down one of the many property jargons often thrown around — Buyer’s Stamp Duty, or BSD for short. So, what exactly is BSD and how does this affect your residential property purchase?

What is Buyer’s Stamp Duty in Singapore?

Buyer’s Stamp Duty in Singapore is a tax on documents signed when purchasing or acquiring either residential or non-residential property. This is a tax borne by property buyers and is independent of one’s nationality. BSD is a progressive tax introduced through the Stamp Duties Act. With a change in rates in 2018 , the government has attempted to make the tax more progressive, targeting big-ticket purchases including expensive private property purchases or en-bloc property purchases by developers. This change would have little impact on properties below or slightly above the $1 million mark.

Must I Pay Buyer’s Stamp Duty in Singapore?

Whether or not you would have to pay Buyer’s Stamp Duty in Singapore depends on how you acquire your property, or the manner of acquisition. While there are some rare exceptions, the majority of purchasers will be affected by BSD and will have to pay this tax. Furthermore, BSD is not dependent on the number of properties owned which differs from Additional Buyer’s Stamp Duty (ABSD) in this aspect. This means that you would still be taxed BSD as a Singaporean Citizen even on your first property purchase.

How Much Buyer’s Stamp Duty to Pay?

Buyer’s Stamp Duty in Singapore is calculated from whichever value is higher between:

- Purchase price of the subject property stated in the Option to Purchase (OTP) or the Sale and Purchase (S&P) document

- Market value of the subject property as reflected in the valuation report

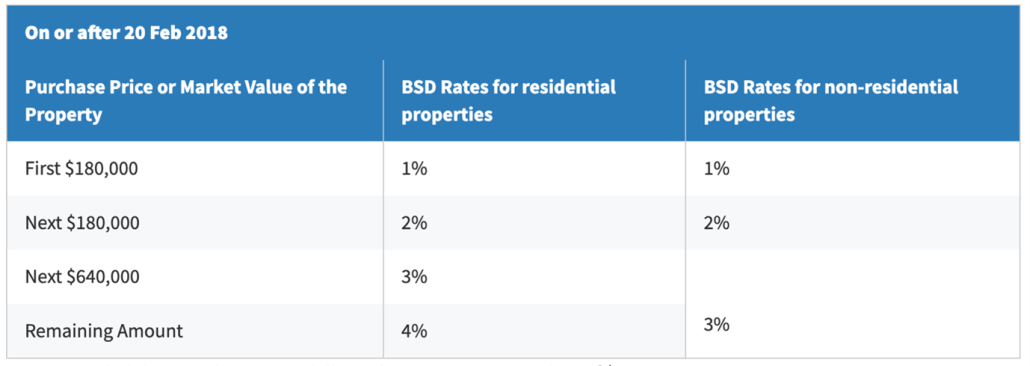

Prior to 20 February 2018, BSD on all property was taxed increasingly up to a maximum of 3%. Changes to the BSD rates were first brought up during Budget 2018, where different rates were introduced for residential properties that were sold above $1 million. The change resulted in BSD rates for residential purchases being taxed up to 4% while non-residential rates remained at up to 3%. The current BSD rates, as of 20 February 2018, are as follows:

Let’s illustrate this with an example. Suppose you have just signed an OTP with a seller for an apartment for $1.5 million. This is the property purchase price stated in the S&P agreement However, the valuation report reflects an open market value of $1 million for this apartment. Since the purchase price is higher than the market value, BSD will be computed as a percentage of $1.5 million. The BSD you would have to pay for this purchase would be calculated as such:

- For the first $180,000

- BSD payable = 1% x $180,000 = $1,800

- For the next $180,000

- BSD payable = 2% x $180,000 = $3,600

- For the next $640,000

- BSD payable = 3% x $640,000 = $19,200

- For the remaining $500,000

- BSD payable = 4% x $500,000 = $20,000

Therefore, your total payable BSD would be the sum of the above, amounting to a total of $44,600.

When to Pay Buyer’s Stamp Duty?

You are required to stamp a document before you sign it. Otherwise, should the document be signed before stamping, you would need to stamp it and pay BSD within a stipulated time frame. Thus, it is crucial to take note of when and where the document for the property purchase is signed as this will impact when your BSD is due . For documents carried out in Singapore, BSD must be paid within 14 days of the date of execution. On the other hand, for documents signed overseas, BSD must be paid within 30 days of being received in Singapore. Failure to do so would result in IRAS imposing consequences such as charging a late penalty or even legal action.

How to Pay Buyer’s Stamp Duty?

Payment for BSD can be made via a few platforms such as:

- GIRO for Stamp Duty

- AXS

- FAST via DBS/POSB Account

- eNETS

- Internet Banking Fund Transfer

- Telegraphic Transfer

- Services Bureaus (SingPost)

- Cheque/Cashier’s Order

For Singaporeans, BSD can also be paid using your CPF Ordinary Account savings. However, as BSD is payable within 14 days from the date of purchase in most cases, you would have to prepare enough cash to pay off this amount first. You can then apply for a one-time reimbursement from your CPF account when submitting your application to use CPF funds to finance your property. Do take note that in cases where a HDB loan is taken, this stamp duty reimbursement is subject to eligibility.

The Importance of Buyer’s Stamp Duty

Buyer’s Stamp Duty in Singapore is one of the most important aspects of the property purchase process as it is a tax that almost all buyers have to pay. It is also important to differentiate BSD from Additional Buyer’s Stamp Duty (ABSD) or Seller’s Stamp Duty (SSD), particularly if you own multiple properties or you intend to dispose of your property within 3 years.

With sky high property prices in Singapore, it is more crucial than ever to take note of the various fees and taxes to pay when purchasing a property so as to be more prudent in your home financing journey.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!