You’re finally one step closer to realizing the Singaporean Dream – owning your own property. Prices have been negotiated and you have paid the deposit for the Option To Purchase (OTP). You are going to apply for a mortgage loan and the house of your dreams is within reach at last. Or is it?

Buying properties has always been a complicated process from finding the right property to filing numerous legal documents to financing the purchase. Securing a bank loan is arguably the most important stage of buying a property in Singapore given its impact on your finances for the next 20 years. Yet, many overlook the importance of securing a suitable mortgage until it is too late, which has led to them losing their deposit.

Take a sneak peak of banks’ criterions of mortgage loans in this article, so you will be equipped with knowledge of how banks assess the eligibility of securing mortgages and better place your expectations.

What are the criterions behind mortgage loans?

1. Type of property

Firstly, it is important for buyers to be sure of the market they are looking at. Banks offer different loan packages for private and public housing, otherwise known as Housing Development Board (HDB) flats.

If you are purchasing a HDB flat, you may also consider HDB Concessionary Loan with LTV of up to 85% and currently has 2.6% interest rate. On the other hand, banks usually have their interest rates pegged to variable indexes such as Singapore Interbank Offered Rates (SIBOR) or Singapore Overnight Rate Average (SORA) , which are more volatile than the fixed rate that HDB offers.

2. Number of properties already owned

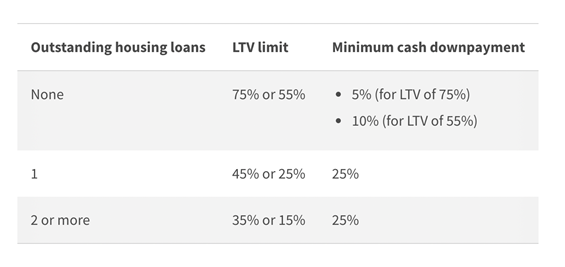

If it is your first property, you get to enjoy a higher Loan to Value ratio (LTV), which would mean that you can borrow more money to finance your purchase. Multiple factors affect LTV, including the borrower’s age, number of properties owned and type of property he is purchasing.

On the other hand, if you own one or more properties, there will be a lower LTV offered, which means you would have to finance the remainder with cash and/or CPF. Essentially, banks will be less willing to lend you more money given your increased financial commitments.

3. Financial Health

Aside from your income, banks also assess your financial health and consider your monthly commitments. This means that they will look at your credit card statements and existing loans to ensure that you are in good financial health, and not overleveraging on debt. If you have been paying off your loan installments on time, banks are likely to offer a higher LTV.

In order to evaluate your monthly commitments, banks use Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) as an estimate. If you are purchasing a HDB flat, your monthly installments cannot exceed MSR of 30%. On the other hand, if you are buying a private property, TDSR sets that all your installments, including car loan must be below 55%.

| Properties | Debt ratio (to Gross Monthly Income) | |

| Mortgage Servicing Ratio (MSR) | HDB Executive Condominiums | 30% |

| Total Debt Servicing Ratio (TDSR) | Private properties (e.g., bungalows, condominiums) | 55% (inclusive of other installments) |

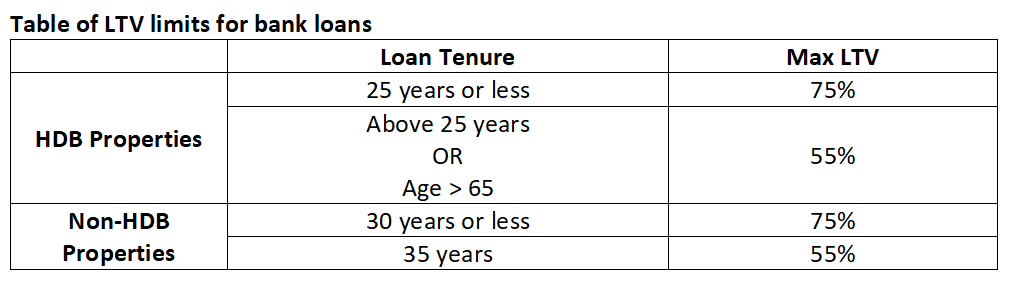

4. Age of borrower & mortgage loan tenure

Another key consideration for banks is the age of the borrower at maturity. If you are going to be 65 or older at the end of the loan tenure, banks are likely to offer lower LTV as there are higher risks involved such as possibility of retirement and defaulting is greater. With a lower mortgage offered, be prepared to fork out a higher down payment.

5. Number of borrowers

In the case of having a single borrower, only his or her age and income will be considered in their home mortgage calculations.

On the other hand, if there is more than 1 borrower, the bank may choose to use Income Weighted Average Age (IWAA). In short, IWAA takes the age of individual borrowers multiplied to their income and averages it. This means that if the younger borrower earns more, the IWAA would be lower and vice versa. With a lower IWAA, the LTV would be higher and you would need to fork out less for your down payment.

Hence, if you are looking to buy a property, it may be more desirable to get your child as your co-borrower instead of your spouse or sibling.

6. Purpose of purchase

Last but not least, banks look at your motivation for purchasing the property. As a rule of thumb, better loan packages are offered for those who are buying houses for their own use, as opposed to those buying for capital investments.

Now equipped with the understanding of banks’ considerations at offering mortgage loans, you can ensure that you check the boxes before paying a deposit on any property. In addition, if you would like to get confirmation on your eligibility to secure a mortgage, you could contact your preferred bank and request for an In-Principle Approval (IPA). IPA refers to banks’ estimates for mortgage loans by assessing potential homebuyers’ financial health and credit history. An IPA could be a helpful indicator for you to plan your finances before you proceed with paying the booking fee.

Alternatively, you could share your property portfolio plans with our Mortgage Advisors and let us make home financing a breeze for you.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!