Renovating your home can be a substantial expense. Depending on your choice of design theme, scope of work involved, resale or new flat, private or HDB, the entire renovation cost can vary greatly. According to interior design platform Redbrick Homes, the expected renovation cost can range from $30,000/$40,000 (3-room HDB BTO/Resale flat) to $50,000/$65,000 (5-room HDB BTO/Resale flat). Forking out this lump sum at a go can be a stretch for many, especially for newlyweds who have just spent on wedding costs. There are several options available to finance this renovation cost, most commonly used are Personal loan and Renovation loan. Let’s look at the key considerations and differences between the 2 types of loans for you to make an informed decision.

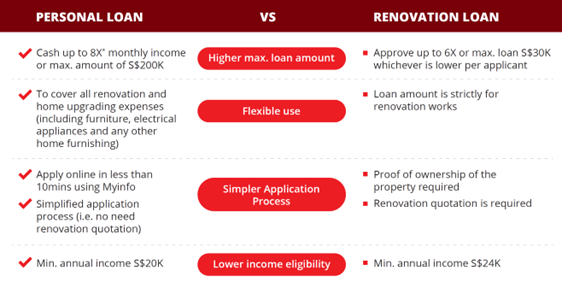

Personal Loan vs. Renovation Loan

- Loan Quantum

You can borrow up to 6x your monthly income for Renovation Loan but there is loan amount cap of S$30K. On the other hand, Personal Loans in the market can offer as high as 8x your monthly income for customers with annual income of S$120K or more and higher maximum loan amount of $200K. Therefore, Personal Loan may be a better choice in terms of meeting your required loan amount given the expected renovation costs are likely to be in excess of S$30K.

- Use of funds

Renovation Loan is specifically designed for home renovation or improvement purposes, so the funds can only be used for approved renovation works e.g. hacking, carpentry, interior design, flooring etc. For Renovation loan, the funds are typically disbursed in the form of cashier’s order addressed to the specified renovation company undertaking those approved renovation scope of work. For Personal Loan, there is no need to specify purpose and the funds are typically disbursed to the bank account of the applicant to allow flexible use of cash. When undergoing home renovation, there will be substantial costs arising from purchase of furniture, lighting, décor and appliances. This is where the flexibility in use of funds can come in very handy and allow you to manage how you would like to utilize the funds.

- Application Process

As Renovation loan is a specific purpose type loan, there will be additional documentation e.g. renovation quotation, proof of ownership etc required in the application process. Personal Loan offers a simpler application process without the need for such documents. Many lenders also avail Personal Loan via online application form using MyInfo.

- Upfront fees

Apart from interest rates, upfront fees can add to the cost of borrowing and should not be neglected. Upfront processing fees and even insurance fees as percentage of approved loan amount are commonly levied for Renovation Loan. Given the huge loan quantum required for renovation, such fees may amount to a significant sum. Besides adding to cost of borrowing, as the loan will be disbursed nett of such fees, you will receive a lower disbursed loan amount to cover what you require for your renovation works.

Here’s a quick summary of comparison.

Consider CIMB Personal Loan to do up your dream home, at interest rates as low as 2.80%*p.a. (EIR from 5.28%p.a.) and no processing fee*. What’s more, you can get up to $2,000 cashback* upon approval. Apply online in less than 10mins. There is no need to download an app and no prerequisite to have a CIMB bank account or CIMB credit card before you apply. That’s how hassle free it is. Why wait.

*T&Cs apply. Refer to CIMB website for more information.

Content sponsored by CIMB Bank Berhad, Singapore Branch (“CIMB”). The information shared above is provided strictly on a non-reliance basis and does not constitute any form of advice from Redbrick Mortgage or CIMB. You should make your own assessment of your financial situation and needs.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!