What is CPF & what can it be used for?

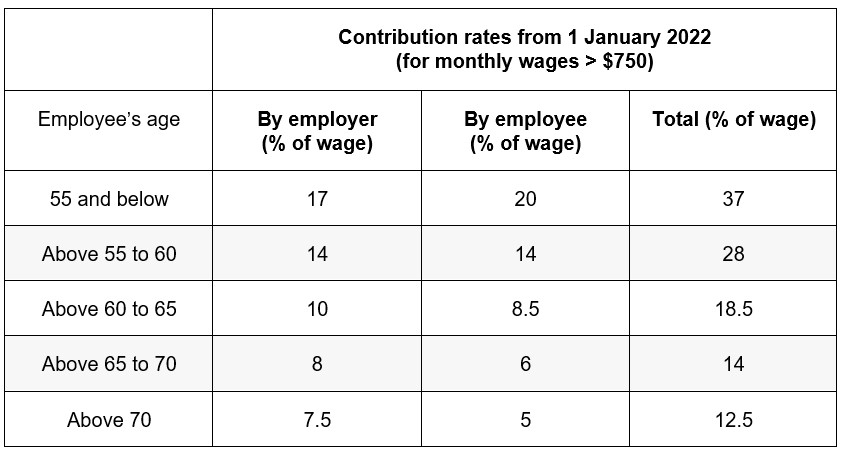

If you don’t know yet, 20% of the gross income of all Singaporeans and PRs below 55 years old is directed into their CPF account. CPF acts as a social security net and offers a savings account for your mortgage repayments.

You will have 3 accounts (eventually 4 accounts)

- Ordinary Account (OA)

Your CPF Ordinary Account (OA) is aimed to help you achieve homeownership. It can be used for

- Downpayment

- Monthly mortgage

- Stamp duty

- Home Protection Scheme premiums

- Special Account (SA)

Special Account is created for your retirement needs as monies will be transferred to your CPF. When your Retirement Account (RA) is set up when you turn 55 years old, the Basic Retirement Sum (BRS) will be transferred to your CPF RA, and you can withdraw the remainder.

- Medical Account (MA)

As its name suggests, monies in your Medical Account can be used for your medical expenses, including your trips to your nearby polyclinics.

- Retirement Account (created when you are 55 years old)

Lastly, your Retirement Account (RA) is aimed at ensuring Singaporeans like you and I get to enjoy payouts during our golden years for a comfortable retirement.

How much CPF can I use?

The first consideration would be Cash Over Valuation (COV). It is only applicable to resale HDB flats, and refers to the difference between the agreed sale price and the valued price. COV must be paid in cash and it is not applicable for properties with valued price equal to or more than the agreed price.

Mortgage payments for both private properties and HDB flats can be paid using CPF. It is notable that for resale HDB flats, you may only use the amount after considering your retirement needs. In other words, you must set aside funds for your Basic Retirement Sum (BRS) first.

Bank loans are also limited by 120% of the valuation limit, which refers to the lower of your valuation price or sale price. The remaining lease tenure must also be able to cover the youngest buyer until he or she is 95 years old.

Opportunity Cost If You Use CPF To Pay Off Your Home Loan

It is common for Singaporeans to use their Central Provident Fund (CPF) for mortgage repayment due to the limited options for CPF usage and the significant portion of salary that it occupies. This approach is convenient as the regular contributions to the CPF Ordinary Account (OA) can often cover the monthly mortgage payments, providing a convenient and stress-free option. However, it’s important to evaluate the long-term financial implications and weigh the pros and cons before making a decision on the mode of repayment.

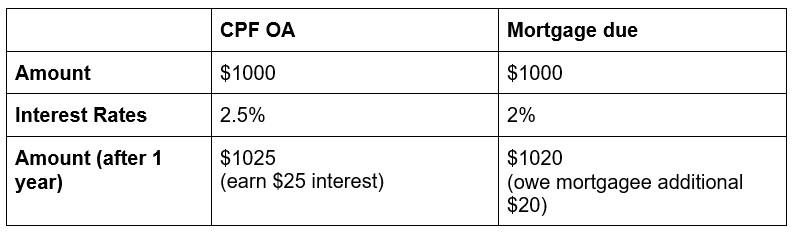

By using funds in your OA to repay your loan installment, you are losing out on the monthly interest rate offered by CPF at 2.5%. Essentially, if the interest rates your mortgage is subjected to is lower than 2.5%, paying mortgage installments via CPF OA is unprofitable. For instance, if your mortgage interest is at 2% per annum, you are giving up 2.5% interest to pay the cost of 2%. Here are some numerical figures to help you sort it out:

As shown, you will be essentially losing out on the additional interest rate of 0.5% on your CPF OA when you pay using CPF OA. On the flip side, the floating interest rates (pegged to 3-month SORA rates) are hovering around 4.25%.

Current spike in rates may be temporary, hence, if you are thinking of using CPF to repay your loans, it will be wise to plan with the bigger picture in mind as using CPF to pay is irreversible.

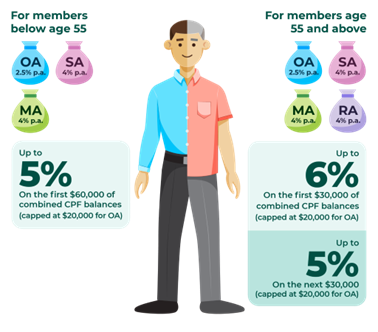

While 0.5% to 1% might not sound much on paper, the actual cost of these compounded interest is much greater. Interest rates offered by CPF are relatively high compared to risk-free options in the market and are guaranteed by the government. The compounded effect of such interest further adds to the opportunity cost.

You can also top up your Special Account (SA) via cash or your OA monies, and the former enjoys some tax relief. Given the high interest rate of 4% pa enjoyed in your SA, the actual opportunity cost of paying for your mortgage loan via CPF is much higher than simply 2.5% alone!

Furthermore, there are many attractive SRS schemes that offer investment opportunities for higher interest rates. The monies in both OA and SA can be used for this purpose, and there are some tax benefits for SRS investments.

Conclusion: Should You Use CPF To Pay Off Your Home Loan?

For those looking to build wealth in their earlier years and have surplus cash available, using cash instead of CPF for mortgage repayment may be a more beneficial option. Another alternative could be to pay a portion of the monthly installment in cash. It is important to weigh the pros and cons and consider your financial goals and priorities before making a decision on the mode of repayment. It is always good practice to consult with a financial or mortgage advisor for personalized advice and a more comprehensive understanding of the options available.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!