The US Federal Reserve (Fed) started the ball rolling on interest rate hikes in March after inflation reared its ugly head by clocking a 7.9% rise year-on-year in February. Another 6 more interest rate hikes are to come this year, and possibly another 4 hikes next year. The war is also causing prices to climb.

Why is the war causing prices to rise?

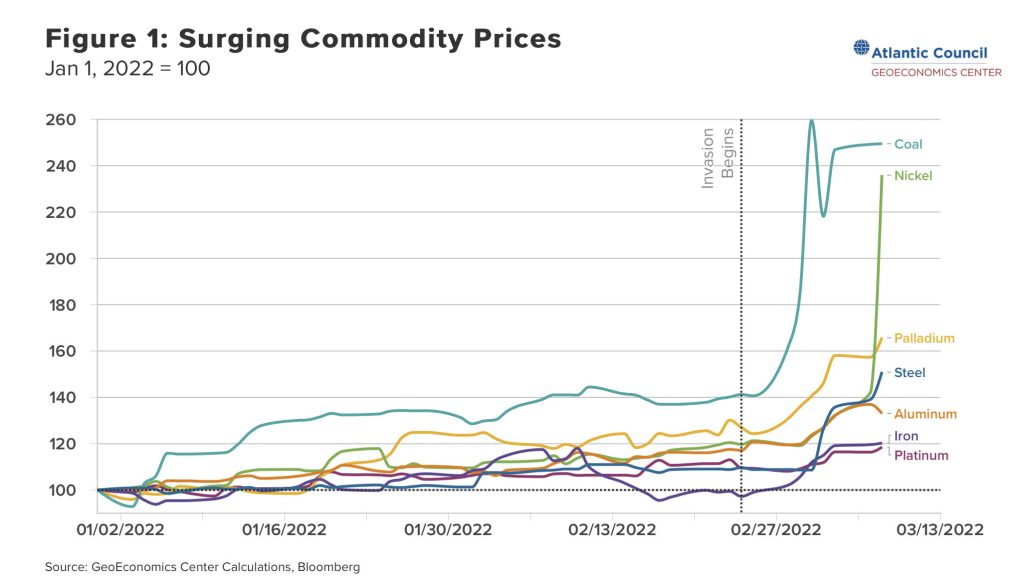

Besides supplying about a quarter of all wheat and barley shipments to the world1, the Russian-Ukraine crisis has also hit crude oil, natural gas, and other strategic commodities, especially coal and nickel.

Russia is the world’s third largest exporter of coal that is used heavily in power generation and energy intensive manufacturing; and Russia is also the world’s largest exporter of nickel, which is an essential to battery technologies.

Inflation will likely stay high till the end of the year or early next year.

Correspondingly, the Fed will also act by increasing interest rates to an expected 1.75% this year, and possibly to an eventual 2.75% next year, which is a quantum leap from near zero rates. And the rate hikes could push the fragile economy into a recession.

Is a recession imminent?

Unicorn Financial Solutions’ macroeconomic indicators are already flashing amber, signalling a possible recession.

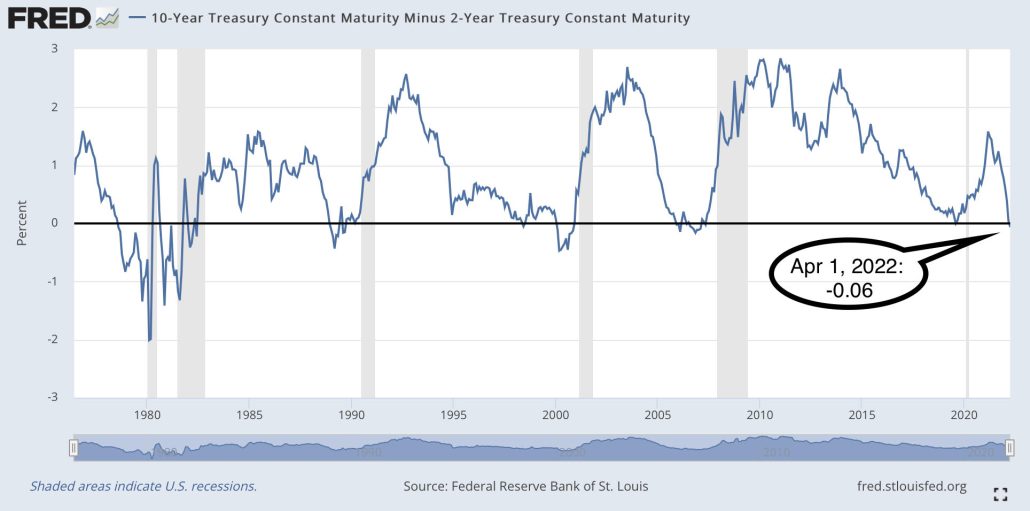

Firstly, the yield curve is inverting.

Historically, recessions follow within one year of the yield curve inversion (when the blue line above meets zero percent), except for one instance in the 1960s. The shaded areas indicated the US recessions.

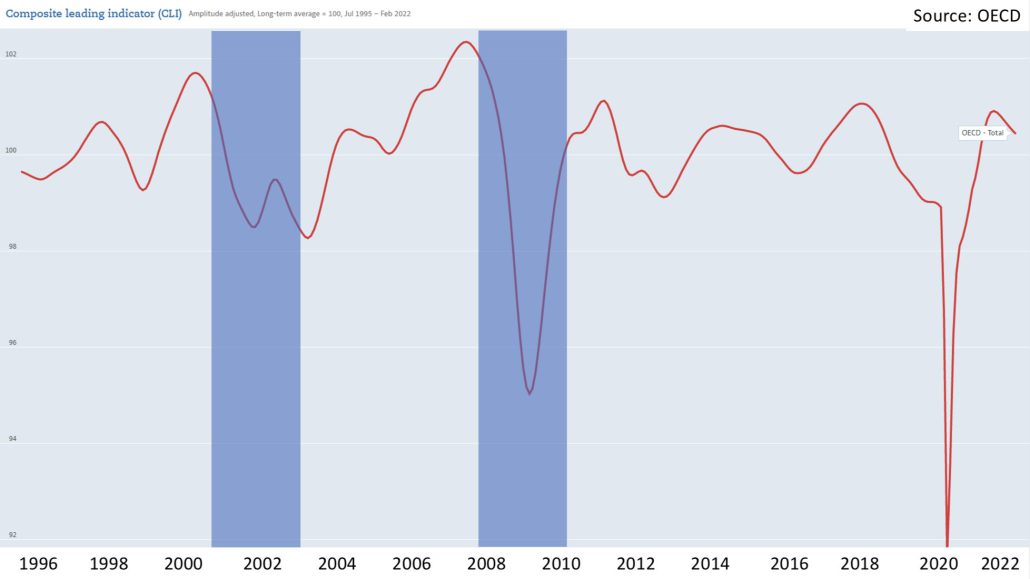

Secondly, the OECD Composite Leading Indicator (CLI, see below) is trending down. The CLI is “designed to provide early signals of turning points in business cycles showing fluctuation of the economic activity around its long term potential level2.” So, even though there were occurrences where the CLI had turned down and not yielded a recession, it was also telling of the economic conditions to come. The shaded areas below also show the recessions.

Composite Leading Indicator – Global

Unicorn Financial Solutions think there are two likely scenarios:

1. As the US Fed frontloads monetary tightening for the first “half” of the year, Fed will stop increasing interest rates as inflation is worn down in the second “half”.

2. The rate hikes pushing the economy into a recession.

How would Unicorn Financial Solutions position the portfolio then?

A recession would be demarcated as ‘Winter’ in terms of their portfolio allocation, and Unicorn could use bonds as a deflationary hedge. It is a myth to believe that returns can only be achieved during “good times” such as ‘Spring’ or ‘Summer’. Even though many plants bloom in spring, many also thrive in the cold, for example, the evergreens like the pine trees.

The amber of their indicators also tells Unicorn that it’s currently Autumn.

In their portfolio positioning, Unicorn look a few steps ahead of the current situation to hedge risks and capture opportunities for you. As such, Unicorn believe their portfolio will remain resilient regardless of the external environment. Having a proper asset allocation will allow Unicorn to hedge against inflationary risks, deflationary risks and black swan events as other asset classes such as gold and bonds can perform when equities do not.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!