The thought of selling the family home to fund retirement is one of the toughest decisions any parent has to face. This isn’t just a house; it’s the place where your kids grew up, where every scratch on the floor and dent on the wall holds a memory.

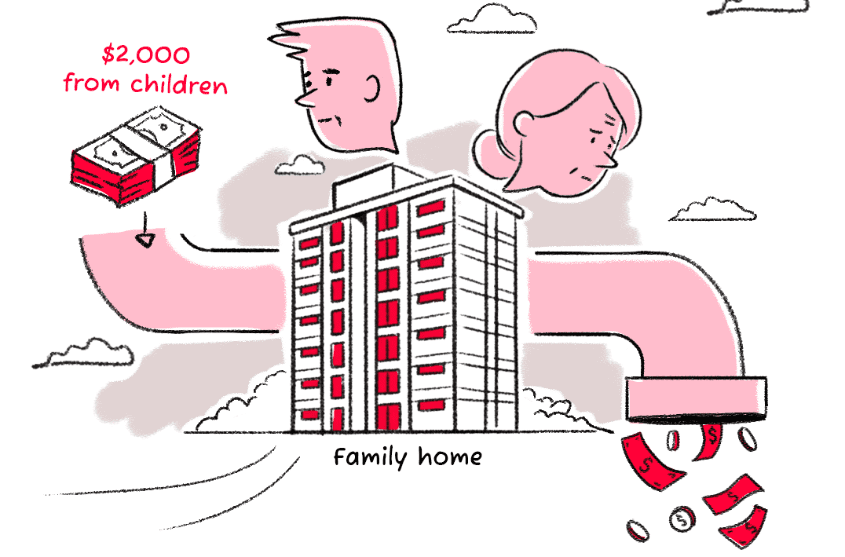

So, when the time comes to retire, you’re faced with a brutal choice. You can stay put, but you’ll have to rely on a monthly allowance from your children. Or you can sell the place you love for cash.

This is a false dilemma. There’s a third option that lets you keep the home and turn it into a financial powerhouse.

The Old Plan vs. The Smart Plan

The traditional path is simple: your kids give you, say, $2,000 a month. Over 20 years, that’s $480,000. It’s a lifesaver, but here’s the cold, hard truth: every single cent of that money is consumed. It’s spent on groceries, bills, and daily living. At the end of 20 years, it’s all gone. Your kids have supported you, but there’s no lasting financial asset to show for it.

The smarter plan uses that exact same money to build wealth for the family. It’s financial arbitrage, and it’s a game-changer.

How It Works: The Home Equity Loan

Your fully paid home is a massive, untapped asset. It’s a wall of bricks and cement, but it’s also a pile of cash waiting to be unlocked.

A home equity loan is a loan taken out against the value of your property. It’s often referred to as a “cash-out refinancing” for a fully paid property. You get a lump sum of cash, and your kids’ monthly “allowance” isn’t an allowance anymore. It’s a loan repayment to the bank.

Let’s use the same example:

- The old way: Your kids give you a pure allowance of $2,000 a month, for a total of $480,000 over 20 years.

- The new way: You take a $400,000 home equity loan. Your kids pay the bank $2,000 a month for 20 years to service this loan. The total interest is about $86,000, far less than the allowance.

Now, what do you do with that $400,000 in cash?

The Power of Compounding: Making Your Money Work

This is the most crucial step. You take that $400,000 and invest it in a stable, dividend-paying fund that yields, say, a conservative 6% per year.

That investment doesn’t just sit there. It grows. It compounds.

- A 6% return on $400,000 is a monthly passive income of $2,000.

- This is the exact same amount your children were going to give you, but now it’s being generated by your money, not just theirs.

Over time, this is where the real magic happens. The interest on your loan is an amortization curve that starts high and falls. The growth on your investment is a compounding curve that starts slow and accelerates. These two curves work in opposite directions, and the gap between them is the wealth you are creating.

The Risks and The Reality Check

No financial strategy is without risk, and this one is no no exception. This only works if you are disciplined and understand the following:

- Market Risk: The investment could go down in value. That’s why you should invest in a stable, diversified fund, not some high-risk stock. The goal here is passive income, not a lottery ticket.

- Interest Rate Risk: The bank’s interest rate could rise over time. You need to plan for this and factor it into your calculations.

- The Need for Discipline: This strategy only works if you take the money and invest it, not spend it on a new car. The “allowance” from your children must go to the bank to service the loan.

The Final Verdict: A Legacy, Not Just an Expense

This is not a get-rich-quick scheme. It’s a smart, responsible way to manage your family’s assets.

By using this method, you achieve something powerful:

- You get to stay in your beloved home.

- Your children’s support builds a financial asset instead of disappearing into monthly expenses.

- At the end of the loan, your children inherit a fully paid property AND a huge investment fund that is still producing income.

Your home is more than just memories. It’s a source of security and a powerful tool to build a legacy for your children. With the right strategy, your home can give you the joy of staying where you belong while creating something that outlives you.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!