Perhaps it’s your first time buying a property. Or maybe you’re a seasoned property investor, with over a decade of experience. While this guide makes for a great checklist for first timers, it’s always good to revisit and make sure you don’t miss anything out. What are some of the considerations to make and steps to take when it comes to financing your property purchase? Read on to find out.

1. How do I get an In-Principle Approval (IPA) or Approval-in-Principle (AIP)

An In-Principle Approval (IPA), or Approval-in-Principle (AIP) enables you to know what your borrowing capacity is before going ahead and approaching the banks for a loan. It is a non-binding, conditional approval issued by individual banks that typically remain valid for approximately 30 days. Potential buyers should first ascertain the potential loan amount that they are able to get before committing to a property purchase. Do note that the actual amount approved eventually may differ from the eventual approved amount, after the bank reviews and processes your application.

Here’s a typical, 4-step process that potential buyers usually go through before obtaining an IPA:

Step 1: Groundwork

- Work out a rough estimate of what you can afford for the loan.

- Have an idea what kind of properties/developments you are intending to purchase – whether it is an HDB flat or private property.

- Compare different mortgage packages and shortlist a few that you might find feasible. You would then be able to have a rough idea of which banks to approach to get your IPA.

- Check if you are able to meet the prevailing Mortgage Servicing Ratio (MSR) limit before committing to a purchase of an EC or HDB. Check your MSR level with our MSR calculator:

Step 2: Apply at the banks

- Apply and request for the in-principle approval from the different banks you have shortlisted earlier. Do note that the IPAs obtained from one bank are not allowed to be used at another. Should you wish to obtain your loan from a different bank, you would be required to make a separate application.

- Remember to prepare your required financial documents. Typical documents required include: Pay slips, CPF contribution histories, credit card statements and if applicable, any existing housing loans that you have.

- Different banks offer different packages: At this stage, you will be receiving information on the different packages available for your consideration. We will explore the different types of rates offered by mortgage loans in the next section below.

Step 3: Assessment

- Here, we take a back seat and wait while the banks do their due diligence to assess your eligibility and amount that you can potentially loan from them.

- Banks will process your application by checking if you fit their criteria, followed by a background check. Some of the criteria include your current Total Debt Servicing Ratio (TDSR) level and possibly, your Mortgage Servicing Ratio (MSR) for HDB properties.

Tip: Be truthful! Try not to hide other information such as the number of credit card statements. After all, the bank would still be able to check the loans and your credit credibility when they approach Credit Bureau Singapore (CBS) for your credit report.

Step 4: Receiving an outcome

- You will soon receive a response for your application. Typically, it takes about three days to approve an IPA.

- Do remember though, getting an IPA is non-binding – you are not obliged to the bank to commit to their loans.

- Lastly, the typical validity period of the report is about 30 days.

2. What’s the difference between fixed and floating rate mortgages

Financing your mortgage may present you with a whole new dilemma as well. There are many different types of mortgage packages available in the market for you today, but your decision on which package to take on ultimately hinges on one factor: your risk appetite. Here are the two most common types of mortgage packages in the market as of today:

(i) Floating Rate Mortgage

Floating interest rates are pegged to a separate, reference rate. These are usually indexes, such as the Singapore Interbank Offered Rate (SIBOR) or the fixed deposit home rates with a spread. Examples of the latter include the DBS FHR Loan where their interest rates are pegged to the average of the 12-month and 24-month fixed deposit rates, for deposits ranging from $5,000 to $9,999. If you’re someone who’s able to take risks and ride through fluctuating interest rates or have strong sentiments and forecast about future interest rates, the floating rate might be for you.

(ii) Fixed Rate Mortgage

If you’re more risk-averse and prefer to know exactly what the interest rate is for your monthly payments, the fixed rate mortgage might be for you. Fixed rate mortgages feature a fixed interest rate for a certain, specified time period. After which, it will become a floating rate loan. However, do note that fixed rate mortgages usually have lock-in periods with possible prepayment penalties.

3. How much upfront cash do you need when buying a property?

Now that you’ve decided to go ahead with the purchase, how much cash do you need to fork out first? The typical downpayment and initial fees include the following:

(i) Stamp Duties: Buyer Stamp Duties and Mortgage Stamp Duty

(ii) Legal Fees

(iii) Buyer’s Stamp Duty and potentially,

(iv) Additional Buyer’s Stamp Duty

Once your loan has been approved, you will also be subject to a mortgage duty, which is a stamp duty paid on the loan amount.

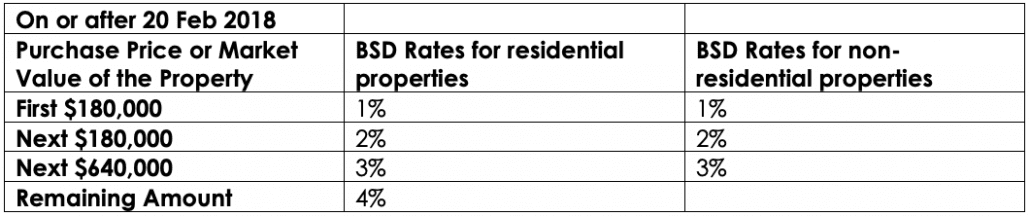

The downpayment is typically 5.0 percent of the purchase price, while the Buyer’s Stamp Duty is calculated via rates as prescribed by IRAS as outlined in the table below:

Purchasing a property may very well be one of your biggest financial commitments – there are a lot of considerations, preparations and decisions to make throughout the entire purchase process. To help ease you through the process, consult a mortgage advisor who can walk you through by helping to compare mortgage rates to providing advisory services for any questions that you may have.

This post was first published on PropertyGuru.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!