Perhaps you might have heard of the term ‘GCBs’, but you merely brushed it off as just another type of property. However, you must know this – GCBs, or Good Class Bungalows, is the most prestigious segment of landed property in Singapore. These are houses for the ultra-rich; the ones who can afford to spend about S$20 million to buy and live in one. In a nutshell, GCB ownership encapsulates the measure of your wealth.

As such, we are sure you are super curious about this class of property which is enshrouded in exclusivity and mystery. Hence, to provide a brief overview, this article will explain to you what exactly are GCBs, how the GCB market is faring and how you can go about purchasing one.

What are GCBs?

GCBs are mainly owned by ultra-high net worth individuals in Singapore – owning a GCB unit symbolises one’s status as a very wealthy individual. There is only a supply of about 2,500 units, in approximately 39 specially allocated (and protected) residential areas in Singapore. These areas include the prime residential districts 10 and 11, as well as prominent bungalow estates of districts 20, 21 and 23. Size-wise, in order to be classified as a GCB, the landed property must have a land area of at least 15,070 sq ft and designated in the aforesaid zoned residential areas. However, in order to maintain the exclusivity and nature of the prime neighbourhoods, it cannot be built more than 2-storey high (which includes an attic and a basement as well).

Now perhaps you might wonder – apart from all these technicalities, what about the facilities? Well, firstly it is important to understand that land size and facilities are important factors that justify the high cost of GCBs. Usually priced from S$10 million onwards, they are remarkably more expensive with bigger plots, swimming pools or unique facilities. By this, here are some examples of the interior of some GCBs to depict why they are, indeed, the crème of the crop of Singapore’s properties:

It is important to understand that there is a scarce supply of this obviously exclusive property. Currently, there are only about 1,000 Singaporeans living in such properties. Hence, if you have the purchasing power and affordability, and lucky enough to be able to purchase one – you can bet you are at the top of the property food chain in Singapore, having obtained a property of unparalleled prestige and status.

GCB Market Overview:

In general, Singapore’s economy has been faring well based on the latest statistics, as its economy grew by 2.5% year-on-year (YoY). Simultaneously, the private residential market too showed a remarkable pick-up rate for demand. On a quarter-on-quarter (QoQ) basis, private home sales grew by 34.6% with a total of 7,000 units, while secondary sales increased even more significantly by 74.6%.

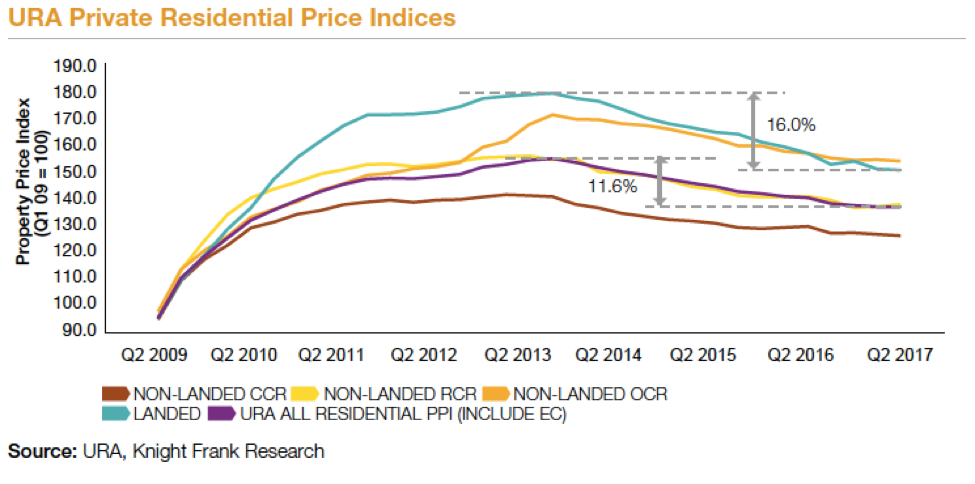

What is interesting is that this phenomenon might be due to investors and homeowners taking advantage of the seemingly bottomed-out market, where prices are at an all-time low, as indicated by the latest URA Private Residential Price Indices chart.

Now, what about the GCB market? After a rather quiet season over the past year, the latest quarter has shown a remarkable jump in transactions for this type of luxurious property. In the second quarter of 2017, the GCB market rebounded, and recorded a triple increase quarter-on-quarter (QoQ), with 17 transactions made, amounting to a total of S$348.2 million as compared to S$115.7 million previously.

Simultaneously, according to Colliers, the average price of land area was significantly higher by 22.8%, perhaps caused by smaller GCB plots (<1400 sqm) that have been sold. Compared to just 2 in the previous quarter, there have been 9 properties transacted in Q2 2017. Due to the sudden upsurge in these investment activities and prices caused by this latest quarter, the total value was S$463.9 million, a huge 55.5% increase for the first half of 2017 as compared to the same period last year.

Outlook-wise, a similar trend is projected to continue over the short to mid-term horizon. As residential prices continue its downwards trend – especially so for landed properties – market sentiments are optimistic and there is significant interest returning from local investors and homeowners who view this time as an excellent counter-cyclical investment opportunity.

How to find GCBs for sale

Amidst knowing that prices for GCBs are probably on the low side right now, perhaps you might be enticed to buying one for yourself. However, you may be wondering how to go about finding one. As such, here are some quick sources to go about doing so:

- Agents and developers

The conventional route is to contact Singapore-based property agencies to enquire about the availability of any GCBs who are of excellent value in the market currently. These agencies include those such as ERA, PropNnex, and Colliers amongst others.

Similarly, there are also GCB developers such as Simon Cheong, or SC Global Developments which you may wish to directly enquire to.

- Property Auctions

Besides contacting them directly, another place where you can actually purchase GCBs on sale (and below market price), are property auctions in Singapore. Held at Amara Hotel, there are currently 5 companies who conduct these auctions, and it perhaps may be an excellent idea to subscribe to their mailing lists in order to know when exactly they are holding their auctions. For instance, a GCB at Belmont Road was offered at the auction at an attractive price at a recent property auction held by Knight Frank in September 2017.

- Property Websites

Finally, of course, is the availability of information on property websites such as PropertyGuru, that lists the available GCBs on sale. You can then contact the agent for the particular property directly to make enquiries or express your interest pertaining it.

All-in-all, should you be extremely interested in luxurious living and establish a prestigious status for yourself, take a look into GCBs where the previously tepid market is currently heating up. There may not be another attractive investment proposition over the mid to short term, where prices are expected to increase again amidst the market recovery.

On that note, if you are a foreigner who wishes to purchase it as well, you may wish to refer to our article, ‘Foreigner’s Guide: Investing in Singapore properties’ where we provide a quick but comprehensive detail about the how-to-dos of it. Also, it is important to utilize the right financing options in order to maximize the value of your property.

Henceforth, in the event that you do purchase a GCB, it is recommended to contact an established local mortgage advisory company such as Redbrick to guide and facilitate your latest purchase in order to make it more ‘value-for-money’ and reduce and unwanted costs.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!