The Covid-19 situation has changed much of how the world functions. As we head into 2021 and beyond, governments all over the world have initiated policies to ensure that their economies do not crash. Interest rates are one of the many ingredients required to regulate the economy. In this article, we shall discuss about interest rates and how interest rates affect the property sector in Singapore.

Hard Truths of Interest Rate

Interest rate is the fee that is paid by a borrower to a lender for the utilization of money for a specific time-period. Generally, they are communicated in rate terms per annum. Most residential loans compute interest through compounding the principal loan quantum and lower interest rates make it less expensive to borrow. The general pattern of interest rates flux can majorly affect our speculations. Consequentially, as a real estate investor, it is essential to consider various patterns in interest rate. A low interest rate environment will encourage leveraged property investments while a higher interest rate environment will encourage perfected property investment.

In a low interest rate environment, a low-interest-rate environment can be a boom for real estate investors if they position themselves and their portfolios in the right way. Generally, low interest rates can raise demand for houses, pushing up the prices of houses. One will typically see more property transactions. However, the caveat is if the property prices increase too much, demand can be affected, and the market may slum.

In a higher interest rate environment, borrowing costs increase. Property owners tend to spend less on borrowed monies. When they are combined with amplified lending standards, banks offer fewer credits. This lack of leveraged funds typically results in less property transactions since property prices are a significant portion of an individuals’ portfolio of investments (Del Negro et al., 2019). However, in a higher interest environment, we may eventually see more property loans being perfected as homeowners may not want to be exposed to the higher interest.

So, what affects interest rates? Some of the factors that affect interest rates include inflation, government policies, bond markets and the real estate market. For example, Inflation erodes the purchasing power and to maintain the same purchasing power, lenders have to increase interest rates. Governments being the invisible hand can initiate policies to regulate interest rates. Amongst the reasons they do so is to ensure that markets do not enter into a slum or for property prices to be rocket high.

Implications on Singapore’s Property market for 2021

Globally, the COVID-19 pandemic had prompted a value remedy for the business land renting and investment markets in 2020. Although the geopolitical pressures and the unpredictable pandemic situation will keep on blurring the way to recuperation in the property market, it is anyone’s guess on whether the property situation will be less serious one year from now. Surprisingly, the Singapore property market performed relatively well in such unperfect times, but it could be because of the invisible hand at work. For example, property prices spiked 9.1 per cent in the preceding 12 months of 2021.

As mentioned earlier, a low interest rate environment will mean that borrowing cost is low and people are more willing to borrow to invest in property. This may inevitably drive-up housing demand. For example, upgraders will be keen to take advantage of the low interest rate environment to upgrade their houses while people looking for rental income may look towards earning a spread between the rental yield of a property and the prevailing lower mortgage rate.

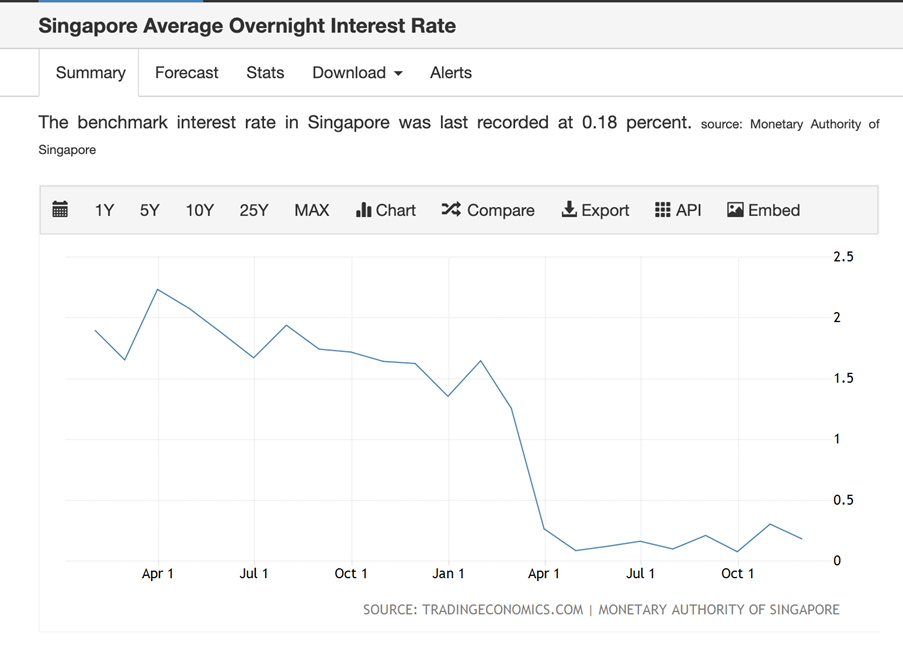

As of now, Singapore is enjoying a low interest rate environment. However, a low interest rate environment carries some risks for the Singapore property market beyond 2021. Deputy Prime Minister Heng Swee Keat mentioned in an interview with Bloomberg News on 17 February 2021 that “interest rates today are ultra-low, and in some cases even negative, so this can lead to a significant mispricing of asset prices and a significant risk of investing in the wrong places”. To avoid these pitfalls, the Singapore government has initiated property cooling measures such as higher stamp duties and tighter home loan limits. All these to ensure that property remains affordable.

Are you an astute mortgagor?

Generally, a mortgagor can be eligible for refinancing once the lock-in period of his existing home loan lapses. When you refinance, it means you are essentially taking out a brand new loan on your property. Refinancing can allow an individual to review the loan tenure, the interest rate on the loan and the loan quantum. An astute mortgagor can generally make use of refinancing to adjust his cashflow and to free up equity for other uses.

The refinancing process can be quite cumbersome. Apart from the comparisons of different loan offers, generally, the property will be required to be revalued and the borrower’s credit rating will have to be investigated upon. Legal work will have to be completed as well. All these will take time and cost.

As a property investor in Singapore, a lower interest rate environment makes it attractive to refinance my property and free up equity for other uses. That is of course, if there is a calculated risk that the returns of my other investment are more than the cost of refinancing and borrowing. However, on whether one should buy a second property in a lower interest rate environment, it really depends on your objectives and available means. There are cooling measures in Singapore that could dampen your interest in owning a second property. For example, the additional buyer stamp duty for Singaporeans on a second property is 15%.

Refinancing is undeniably a good tool to employ. However, one has to be mindful that refinancing entails costs and may not be suitable for everyone.

This article may appear heavily loaded if you are not familiar with economic jargon or the specifics of interest rate determinants. The nightmare of identifying and executing changes to your personal portfolio should not keep you awake at night. Always get professional unbiased advice with an in-depth evaluation of your property portfolio before making any decisions!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!