According to the law, landed properties are properties that are attached directly to the land that you purchase. These properties may have differing tenures and rules that govern them from the non-landed counterparts in the private sector and in the public sector – flats under the Housing Development Board (HDB).

Types of Landed Property

Landed property in Singapore have varying categories. These can be largely categorised into detached, semi-detached and non-detached housing.

Detached housing are standalone houses such as a bungalow. In the Singapore context, bungalows can be further divided into 2 categories: Good Class Bungalows (GCB) and Bungalows. Bungalows are usually a free standing detached house that does not share a common wall with another property. These houses have a minimum plot size of 400 square metres or approximately 4,360 square feet. They can be built as a single storey housing, 2 storeys or more but it has a maximum site coverage of 40%. They also have a minimum plot width of 10 metres

For a good class bungalow, the plot size is at least 1,400 square metres, and the maximum site coverage is at 35% instead. There is a total of 39 gazetted GCB areas, and some of these include Caldecott Hill Estate, Eng Neo Avenue and Ridley Park.

Semi-detached housing are usually conjoined buildings with a common wall in-between. These properties have different title deeds and usually different owners. These have a minimum plot size of 200 square metres, or approximately 2,160 square feet. These have a maximum site coverage of 45% for 2-storey semi-detached housing. They also have a minimum plot width of 8 metres, unless they are back-to-back semi-detached housing – 10 metres.

However, there are some that fall in between bungalows and semi-detached housing. These are called linked bungalows, they look like a semi-detached house but are considered to have the same land title. Owners are issued a strata title deed – this shows the proportion of the land that they own. Usually, these houses are put under mixed landed property and they have a maximum site coverage of 45%.

Terraced housing is usually a row of houses – of at least 3 units – with 2 corners. Corner terraces are often of a higher value because of the slightly larger frontage of 8 metres as compared to those in the middle of 6 metres frontage. These houses are characterised by shared common walls between houses.

Terraced houses can be further divided into 3 categories: Terrace House 1 (intermediate units), Terrace House 2 (intermediate units) and Terrace House 2 (corner units). These differ in the plot width and plot sizes. For Terrace House 1, these have a minimum plot size of 150 square metre or 1,620 square foot. On the other hand, Terrace House 2 – both intermediate and corner units – have a minimum plot size of 80 square metres or 862 square feet.

In order to be categorised as one of the property type, there is a need for the property to satisfy both categories of the minimum plot widths and plot sizes. The following is a summary of the minimum plot widths and plot sizes for each property type:

| Property Type | Plot Width (min) | Plot Size (min) |

| Good class bungalow | 18.5m | 1400sqm |

| Other bungalow | 10m | 400sqm |

| Semi-detached house | 8m | 200sqm |

| Back-to-back semi-detached house | 10m | 200sqm |

| Terrace house I (intermediate units) | 6m | 150sqm |

| Terrace house II (intermediate units) | 6m | 80sqm |

| Terrace house II (corner units) | 8m | 80sqm |

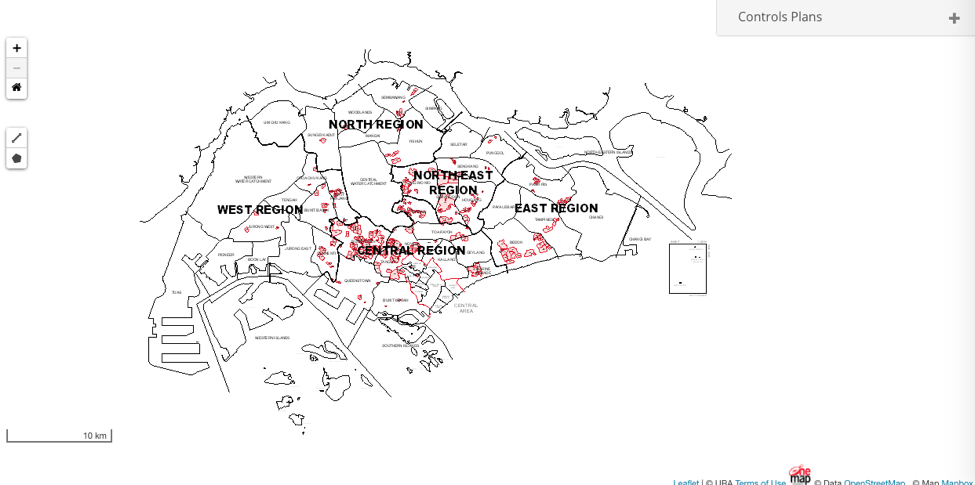

Based on URA’s Landed Housing Area Plan, it aims to safeguard estates with landed properties in Singapore. This is largely due to the rapid urbanisation and build-up of the land. As such, there are some areas in Singapore (marked in red in the map below) that have been marked as preserved estates. Thus, you will always be able to find landed properties in these marked areas. To view the Landed Housing Area Plan, click here.

Here are some things to look out for before purchasing a landed property:

Property Type

As seen from the above, there are a few different types of landed properties. As such, before purchasing a landed property, you will need to decide which type you would like to purchase. On top of that, you will need to decide if you are going to stay there or use it as an investment property.

If you are going to stay in the house, it would be much better for you to go down and take a look at the property and its surroundings – amenities and also the location around. However, if it is the opposite, you may choose not to go down to view the place (although it would always be a good idea to check the property out).

Eligibility

With all types of property purchases, always be sure to check your eligibility before you make the purchase. Foreigners (including Singapore PRs) are not entitled to buying landed properties in Singapore, unless approval has been granted by the Land Dealings Approval Unit (LDAU). An important point to note is that GCBs can be sold to Singapore Citizens only.

The application to LDAU takes about 3 months to process, and once approved, the owner may only purchase the landed property for his/her own residence and not for any other form of investment.

The only exception to this rule applies to landed properties located in Sentosa Cove.

Land Titles

Before purchasing the property, you would have to exercise your option. While doing so, please do check if the owner has offered another person an option as well; there have been cases where multiple options were exercised, only for prospective buyers to realise that and others have also paid the option fee of 1%, and that the landowner pocketed the option fees.

In addition, you would also have to look out for the lease terms on the certificate of title. This would also show the remaining lease on the property. As such, you will be able to make a better decision if the lease term left on the property is relatively short.

On top of that, the certificate of title will also reflect the easements and covenants placed on the property.

Financing Options

When looking to purchase a property, we would often look at the asking price of the property. This allows us to be able to have a rough estimate of how much the property will be transacted at. At the same time, we can also roughly calculate the option fee required, the down payment and also how much we can borrow.

You may also choose to engage our services when looking at home loans for your new properties – private or public housing. Contact us today!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!