You might have heard about Seller’s Stamp Duty (SSD), but what is it exactly? In this article, we will cover everything you need to know about it.

Here’s an overview of what will be covered in this article:

- What is Seller’s Stamp Duty?

- How much SSD should I pay?

- How to calculate my holding period?

- Who is exempt from paying SSD?

Firstly, what is it?

Seller’s Stamp Duty (SSD) is a residential property tax sellers must pay when selling their property within the holding period of 3 years.

The 3-year holding period is calculated from the date you acquire the property.

Who has to pay Seller’s Stamp Duty (SSD)?

SSD is applicable to residential property acquired on or after 20 February 2010.

What is the holding period?

According to IRAS, the holding period is calculated based on the date of purchase/acquisition to the date of sale of a property.

It refers to one of the following:

- Date of Acceptance of the Option to Purchase (This excludes an Option to Purchase subject to the execution or signing of the Sale and Purchase Agreement)

- Date of Sale and Purchase Agreement

- Date of Agreement for Lease (for new HDB flats)

- Date of Transfer where the above 3 options are not applicable

How much Seller’s Stamp Duty (SSD) do I have to pay?

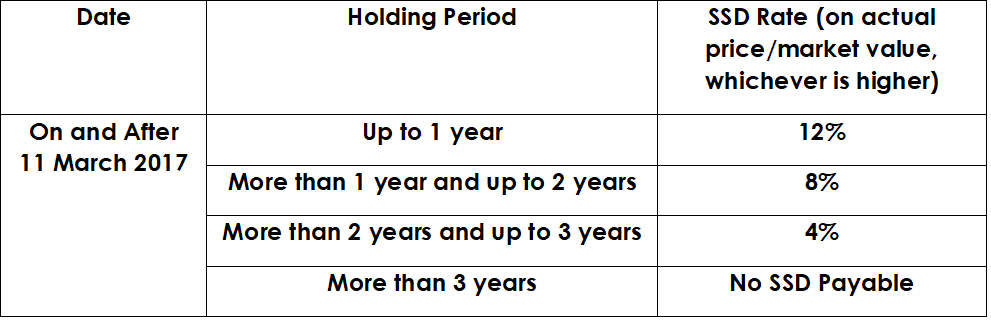

If you purchased your property on or after 11 March 2017, do take note of the updated SSD rates below. The SSD payable is dependent on the actual price or market value of the property, whichever is higher.

SSD payable is rounded down to the nearest dollar.

For purchases made before 11 March 2017, the SSD payable can be found on the IRAS website here.

How do I calculate my Seller’s Stamp Duty (SSD) payable?

Example 1: Mr. Tan purchased his property on 15 November 2019 and sold it at $1.35 million after holding it for 9 months.

Since holding period falls under the ‘Up to one year’ category, an SSD rate of 12% will apply.

$1,350,000 x 12% = $162,000

Example 2: Ms. Lee purchased his property on 5 July 2014 and sold it at $1.35 million after holding it for 2 years and 7 months.

According to the IRAS website here:

Holding period falls under the ‘More than 2 years and up to 3 years’ category, thus an SSD rate of 8% will apply.

$1,350,000 x 8% = $108,000

Why is Seller’s Stamp Duty (SSD) necessary?

SSD is a property cooling measure to ensure that buyers do not house-flip and control property prices. It was first introduced in 2010 to safeguard potential buyers from the high property prices caused by a result of others buying and selling quickly for profit. So, although it may seem like a negative measure at first glance, if you want to buy a property for long term use, SSD in fact shields you from the otherwise absurdly high prices.

Important to Note

Before purchasing a property with en-bloc potential (Many of us think that it is a fast way to gain profit), take note that if the property undergoes an en-bloc within the holding period, SSD still applies.

Let’s say you have purchased a property at $1 million in January 2019. If the en-bloc is successful in February 2020, an SSD rate of 8% would apply as you would have held the property for ‘more than 1 year and up to 2 years. So, is it profitable to purchase a property with en-bloc potential? That’s for you to decide.

Who is exempted from Seller’s Stamp Duty (SSD)?

Sellers are exempt from SSD under the following scenarios, even if it is within the minimum holding period.

- Licensed housing developers under the Housing Developers (Control and Licensing) Act when selling residential properties developed by them

- Residential property owners whose property has been acquired by the government under the Land Acquisitions Act

- Public Authorities when exercising their functions and duties

- Individuals that have been declared bankrupt, and as a result are required to dispose their property

- Companies that dispose their residential property upon involuntarily winding up

- Foreigners when selling their residential property under the Residential Property Act

- HDB flat sellers who sold their flats in the open market before HDB claimed them under the Selective En bloc Redevelopment Scheme (SERS), who bought or acquired their flats on or after 30 August 2010

- HDB flat sellers who return their flats to HDB due to re-possession by HDB or under SERS

- Someone who already owns an HDB flat but inherits another flat on or after 18 December 2015. Under HDB’s regulations, he/she is required to dispose one of them

- Someone who owns a non-HDB flat but inherits an HDB flat on or after 18 December 2015. Under HDB’s regulations, he/she is required to dispose of the inherited HDB flat

- A married couple in which both husband and wife owns an HDB flat each. HDB regulations state that one of the flats must be disposed of.

If you fall under one of the above scenarios, you would be exempt from paying SSD.

So, here’s the takeaway for you. If you don’t want to incur additional costs, it is best to wait 3 years before selling your property.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!