In real estate, timing is everything.

Timing your decisions to buy and sell property is the key to maximising profits. Experts usually do so by studying the fluctuations of prices within the real estate cycle.

Whether you are a homeowner, investor or a renter, it is important to understand how the property cycle works in order to make the most of your property.

What are property cycles?

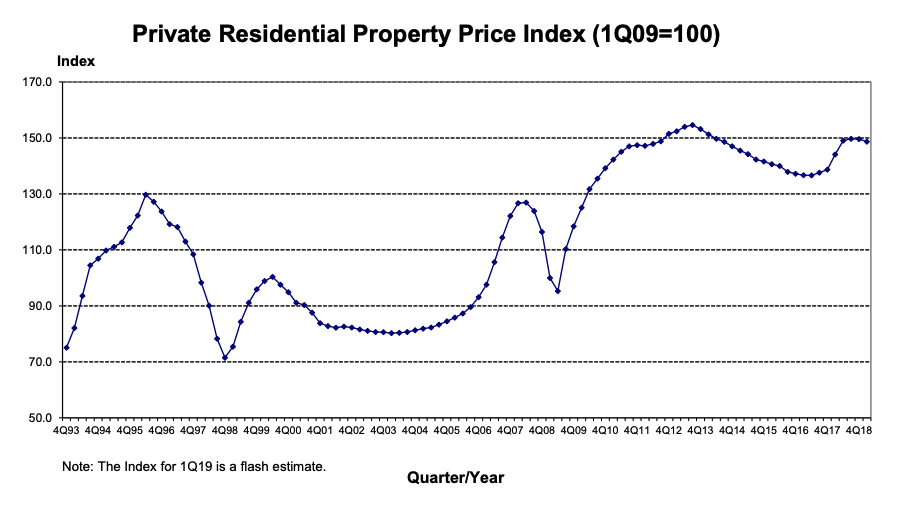

Some experts argue that there is no such thing as property cycles. In fact, by merely looking at the property price index graph, it is hard to deduce that there is a consistent and regular cycle in place.

In the past 10 years, Singapore’s private property prices have been on the rise. Even though it has decreased from 2014 to 2017, we can see that the prices from 2014 to 2018 are still higher than anything before.

Interestingly, we notice that these values tend to rise in waves. In some quarters, there is strong growth while in some there is slow growth or even a plunge.

Source: URA

How a property cycle develops

This is slightly similar to the chicken and egg question. After all, it is a cycle, right? So how did it start?

Usually it begins with population growth, a simple reason for an increase in demand. When demand increases, naturally, prices of houses start to increase. Both rental prices and new homes will start to get more expensive.

For many, they are buying new homes. For investors, this looks like a good time to buy property, as prices seem to be increasing, which means they can sell the property at a higher price in the future.

Slowly, this incentivises developers to build more property and for new developers to begin construction works to meet this new demand.

However, a typical condominium development takes about 2 years to be developed, so we can say that the supply of real estate is very inelastic.

Usually, many developers jump on board and cause an oversupply of property. When there are more available units than buyers, prices start to drop. We can observe this in the case of Singapore, where property prices have been falling since 2014.

When prices fall, many investors sell their property if they expect it to fall further. This injects more supply of property in the market, and prices and rentals continue to drop. They may or may not fall to as low as before its peak before picking up again.

What are the phases of property cycles?

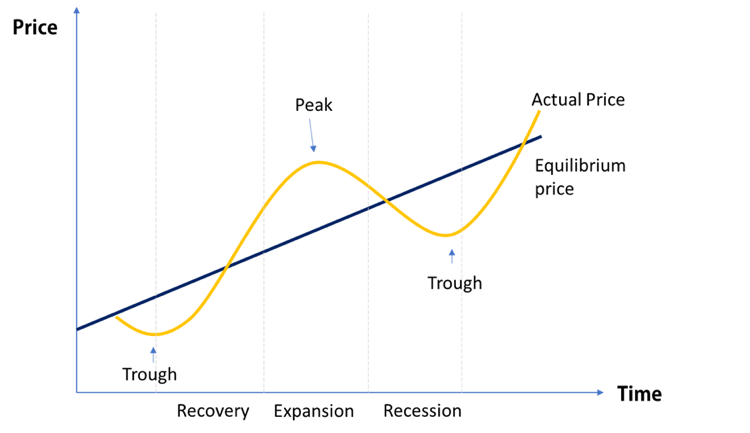

The above graph shows a general increase in price of houses, while the actual prices increase in waves. The phases of a property cycle are – Recovery, expansion, peak and recession and trough.

Recovery – Usually, when the real estate market is recovering, demand is slow. There are a few indicators that show that the market decline is coming to an end.

These trends are typically showing an increase in demand, such as increase in property viewings, or decrease in vacancy rates.

Given that this stage is hard to identify, investors who suspect an impending recovery should buy property at this point in time for strong returns in the upcoming expansion phase.

Expansion – During this phase, real estate prices will increase rapidly. It is also commonly known as the ‘boom’ phase.

As investors and homebuyers gain confidence in the rising housing prices, they tend to push up the demand by buying up even more houses.

This phase is usually accompanied by a growing economy and creation of more jobs. Rents start rising and vacancy rate decreases.

At this time, many developers refurbish and renovate old property to resell it in the market, in order to capitalise on growing rental and property prices.

Peak – As investors and buyers drive up prices, as mentioned before, construction picks up and the price increase starts to slow down.

Experts deem this point as the best time to sell your property if you do not intend to keep it past the next cycle.

We can identify a peak with these characteristics:

- Property prices have risen consistently for a number of quarters

- Property transactions have increased

- High levels of borrowing to buy property

- Housing gets less affordable

- Government cooling measures

- High levels of construction

The above data can usually be found on URA’s website or in many web articles that provide year-on-year statistics on property prices and vacancies.

Recession – During this phase, prices start to decrease. This can be due to various factors such as oversupply and property cooling measures. Property investors slowly withdraw from the market.

As prices decrease, more and more people start selling their property for fear that prices might drop further.

Characteristics of this phase are: Increasing vacancy rates, lacklustre demand and falling rents.

Trough – This is the lowest point of the real estate cycle. Usually there are subtle signs of recovery and investors who can identify this phase will be handsomely rewarded for taking risks in a property downturn.

When is the best time to invest?

The rule of thumb is that we should always buy low and sell high. This means that we should buy property when the cycle is at its trough and sell them at its peak.

However, it is hard to distinguish which part of the cycle the property market is at because it is hard to predict future prices, and data provided on the internet might not be up to date.

Another reason is that the cycles are often disrupted by unpredictable external factors and one important factor is cooling measures by the Singapore government.

Cycle disruptors in Singapore

The cooling measures introduced since 2013 were implemented to “keep price increases in line with economic fundamentals”.

To put it simple, the government wants to keep the property prices stable and sustainable.

The cooling measures include the Additional Buyer Stamp duty rates introduced almost a year ago. With Exceptions to Singapore Citizens, and Singapore permanent residents purchasing their first residential property, the ABSD rates have increased 5% across the rest of the groups of individuals. There was a 10% increase for companies buying properties.

| Rates on or before 5 July 2018 | Rates on or after 6 July 2018 | |

| SCs buying first residential property | 0% | 0%

(no change) |

| SCs buying second residential property | 7% | 12%

(revised) |

| SCs buying third and subsequent residential property | 10% | 15%

(revised) |

| SPRs buying first residential property | 5% | 5%

(no change) |

| SPRs buying second and subsequent residential property | 10% | 15%

(revised) |

| Foreigners buying any residential property | 15% | 20%

(revised) |

| Entities buying any residential property | 15% | 25%

(revised) Plus, additional 5% for developers |

Source: MOF

This increase in tax payable will slow down investor take up of property. We can take this as a good indicator that prices will remain robust and the increase will start to slow down.

In essence, if you are keen to buy or sell property, it is always important to observe where the market is on the property cycle, as well as to read up on news on upcoming supply, demand and cooling measures in order to make the most of your sale or purchase.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!