Back in June 2020, the US Federal Reserve (Fed) announced that Fed interest rates will drop to ‘near zero’ and maintain that level until at least the end of 2022. The main reason for holding Fed interest rates near zero (0-0.25%) is to stimulate the coronavirus-hit US economy, which is expected to shrink by 6.5% in 2020.

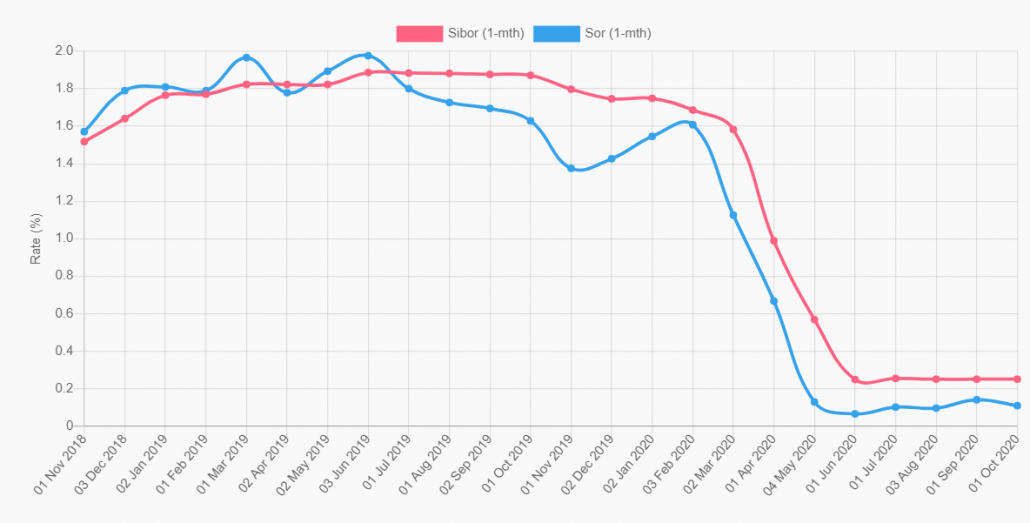

Fed interest rates and interest rates in Singapore, termed the Singapore Interbank Offered Rate (SIBOR), are highly correlated. This means that banks who pegged the interest rates of floating rate home loans to SIBOR, will remain low until the end of 2022.

This has reversed the recovery of SIBOR rates in 2019, after taking a huge hit in the 2008 Financial Crisis. For a decade, SIBOR-pegged mortgages were especially affordable 2019 when the index finally recovered to pre-crisis rates. To put things into perspective, the current 3-month SIBOR rates has declined to less than 0.5 per cent from 1.5 per cent just a year ago.

Lowered interest rates could help homeowners alleviate monthly mortgage payment expenses as well as shorten their mortgage repayment terms. As such, many Singaporeans are looking to refinance or reprice their home mortgage loan packages.

Fixed vs Floating Home Loan Mortgage Rates:

Here is a quick overview of the types of mortgage rates:

| Types | Description |

| Fixed Rate | Rates are fixed throughout the lock-in period. This provides stability. |

| Board Rate (Floating) | A bank managed rate, and the bank has full discretion on how they want to move it. |

| SIBOR rate (Floating) | This is a highly transparent rate and has a correlation with the US Federal Reserve Interest Rates. |

| Fixed Deposit Rate (Floating) | This is pegged to the Banks’ fixed deposit interest rate, plus a spread added on top of it. |

SIBOR rate (Floating)

Mortgages pegged to SIBOR rates offer transparency as rates are all published and not determined by the bank themselves. This keeps the spread across various banks competitive as they are all pegged to the same index. Rates changes every 1 or 3 months, depending on the banks and mortgagees will know exactly why instalments increase and can monitor index performance or historical trends online.

Unlike the other floating rate, the board rates, SIBOR does not only move in one direction. In economic downturns, such as the one we are experiencing right now, the rates will drop and that is when we see more people refinancing their home loans.

Refinancing vs Repricing

When one refinances, you are taking out a loan with another mortgage institution in order to pay off your existing loan. This is done during a period of lower interest rates and make savings on home loans.

With refinancing, the new institution would have to assess your credit background, ask for payslips as well as conduct a valuation of the property. Refinancing will involve conveyance and valuation fees and if a homeowner refinances within the lock-in period, they would be subjected to a repayment fee of 1.5 per cent of the outstanding loan.

With proper mortgage advisory, you can possibly reduce the amount of legal fees, valuation fees and any lock-in penalty fees that you may be liable for.

Whereas repricing allows homeowners to switch their existing home loan package to a more competitive loan package within the same institution. Depending on the homeowners’ property objectives, repricing typically costs around $500 to $800.

Current Trends in the Property Market

As interest rates are expected to stay depressed for the coming years, many households are taking this opportunity to review their home loans. Furthermore, a low interest typically supports the property market as it becomes much cheaper to fund bigger purchases. In the US, competitive mortgage rates drove home sales above pre-COVID-19 levels. Singapore has also exhibited similar trends as home purchases rose following low SIBOR rates. According to data provided by the Urban Redevelopment Authority, private home sales in Singapore hit an 11-month high in August with 1,256 private homes sold and a 11.8 per cent year-on-year increase. HDB resale prices have also risen 1.4% in the third quarter following interest rate cuts.

While low interest rates can be seen as an opportunity to take on additional loans to fund purchases in an investment asset, there are many other variables and risks to consider. As low interest rates are driven by an economic recession and an unprecedented epidemic, it may not be in the interest of many to take on more debt in the midst of a grim outlook for the labour market.

Afterall, financing a property is a long-term commitment that can stretch decades and low interest rates right now does not mean low interest rates forever. When the pandemic recedes, banks will once again raise rates to combat inflation and SIBOR will rise.

For now, mortgage packages with a floating rate pegged to SIBOR will be the go-to for most homeowners and potential home buyers. However, banks are offering new and attractive fixed rate packages to lure customers away from SIBOR rates. When the economy starts to recover, interest rates may start rising again and such longer fixed rate package will become the most feasible on hindsight.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!