When taking out a loan, it is important to understand the true cost of borrowing, not just the stated interest rate listed. In Singapore, the cost of borrowing has multiple factors to consider, such as how interest is calculated (monthly or daily basis), types of interest rate you choose, and whether there are any additional costs that are involved in taking up the loan. Here’s an analysis of the important factors to take into account.

How Interest Rates Are Calculated: Flat Rate, Monthly Rest, and Effective Interest Rate

Flat Rate:

- You pay interest on the original loan amount, even as you repay it (think of your car loan and personal loan).

- While it might seem cheaper, it’s usually more expensive than other computations.

- Example: Borrow $50,000 at 5% flat for 5 years, you pay $12,500 in interest.

Monthly Rest:

- Interest is calculated on the remaining loan balance each month.

- As you repay, the interest you pay also decreases.

- More affordable for borrowers compared to flat rates (think of your mortgage loan in Singapore)

Effective Interest Rate (EIR):

- Shows the true cost of borrowing in Singapore, considering how interest adds up and your loan balance decreases.

- Always higher than advertised flat rate.

- Banks must disclose EIR to show transparency on actual cost, you can commonly see this whereas your interest rate is 5%, but effective interest are actually 9%.

Fixed Versus Floating Rate

Other than considering how interest rates are calculated, borrowers have to consider the types of interest rates provided for their loan. Borrowers often have the option to choose between a fixed rate or a floating rate loan especially when it comes to mortgage.

Fixed Rate Loans: A fixed-rate loan secures your interest rate for a specific time frame, offering stability and predictability. You will know the exact amount of your monthly payments, which is advantageous when interest rates as you “hedge” on to the lower fixed rate. vice versa

Bear in mind though, fixed rates are typically higher than floating rate in most cases due to the “stability” nature, and if you’re thinking about early repayment – chances are there’s a penalty involved.

Floating Rate Loans: On the flip side, floating rate loans change in accordance with market conditions. Typically, they are tied to a benchmark rate, like the Singapore Interbank Offered Rate (SIBOR) or the Singapore Overnight Rate Average (SORA). Even though floating rates are typically lower than fixed rates at first, they have the potential to increase, causing your monthly payments to go up.

Effective Interest Rate (EIR) – What Your Loan Actually Costs

The Effective Interest Rate (EIR) is the key figure borrowers should pay attention to. It represents the actual annual cost of the loan, factoring in not only the nominal or flat interest rate but also the effects of compounding, additional fees, and the repayment schedule. A loan with a lower fixed interest rate but a high effective interest rate may result in higher expenses for you.

Unlike the flat rate (which calculates interest on the initial loan amount for the entire tenure), the EIR adjusts for the fact that the loan balance decreases over time as you make repayments. EIR reflects the real cost, including administrative fees. This provides borrowers a more accurate representation, helping them compare different loans on a like-for-like basis.

Why Is the EIR Higher Than the Flat Rate?

Banks often advertise loans using the flat rate to make them appear more affordable. However, the flat rate does not take into account the decrease in the principal amount as you repay the loan. Since EIR includes compounding interest and considers the decreasing loan balance over time, it typically yields a higher amount than the flat rate.

For example:

Flat Rate: You borrow $100,000 for five years with a flat rate of 5%. You would pay 5% interest on the full $100,000 for the entire loan tenure, which results in $25,000 in total interest ($100,000 × 5% × 5 years). The flat rate might seem like a reasonable deal, but it doesn’t reflect how the loan is repaid.

EIR: The EIR is higher because it takes into account that you are paying down the principal with each installment, so you’re not borrowing the full $100,000 for the full five years. In this case, the EIR might be around 9%, reflecting the true cost of the loan over time.

How is EIR calculated?

Effective Interest Rate (EIR) – What Your Loan Actually Costs

When borrowing money, the Effective Interest Rate (EIR) is the most important figure to pay attention to. It represents the actual annual cost of the loan, factoring in not only the nominal or flat interest rate but also the effects of compounding, additional fees, and the repayment schedule.

Unlike the flat rate (which calculates interest on the initial loan amount for the entire tenure), the EIR adjusts for the fact that the loan balance decreases over time as you make repayments. Because it reflects the real cost, including administrative fees, the EIR gives borrowers a more accurate picture of how expensive their loan truly is.

Why Is the EIR Higher Than the Flat Rate?

Banks often advertise loans using the flat rate to make them appear more affordable. However, the flat rate does not consider the reduction in the principal amount as you repay the loan. Since EIR includes compounding interest and considers the decreasing loan balance over time, it almost always results in a higher figure compared to the flat rate.

For example:

Flat Rate: You borrow $100,000 for five years with a flat rate of 5%. You would pay 5% interest on the full $100,000 for the entire loan tenure, which results in $25,000 in total interest ($100,000 × 5% × 5 years). The flat rate might seem like a reasonable deal, but it doesn’t reflect how the loan is repaid.

EIR: The EIR is higher because it takes into account that you are paying down the principal with each installment, so you’re not borrowing the full $100,000 for the full five years. In this case, the EIR might be around 9%, reflecting the true cost of the loan over time.

How EIR Is Calculated

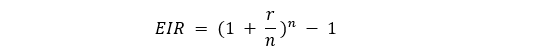

The EIR is calculated using a formula that accounts for the interest compounding period and loan repayments. The formula is as follows:

Where:

- r is the nominal interest rate

- n is the number of compounding periods

While the formula looks complex, what it essentially does is spread out the interest cost over the entire loan term, showing what percentage of the loan you’re actually paying each year in real terms.

What Effects Your EIR?

Several factors impact your EIR, including:

- Loan Tenure: The longer the loan tenure, the higher the EIR, since you’ll be paying interest for a longer period, and the compounding effect becomes more pronounced.

- Frequency of Repayments: If interest is compounded monthly, your EIR will be higher compared to loans that compound annually.

- Additional Fees: EIR includes various fees like processing fees, administrative charges, or insurance. These can push the EIR higher than what the flat rate suggests.

- Repayment Structure: The more frequent the repayments (monthly or quarterly), the higher the EIR due to interest compounding more frequently.

Other Cost of Loans

Apart from interest rates, other fees and charges can significantly add to the cost of borrowing in Singapore. These include:

- Processing Fees: Many loans come with a processing fee, often a percentage of the loan amount. This is a one-time fee charged upfront.

- Late Payment Fees: If you miss a payment, expect to incur late payment fees. These fees vary depending on the lender but can be steep.

- Prepayment Penalties: Some loans impose penalties if you repay the loan early. This is especially common with fixed-rate loans where lenders want to ensure they earn the interest over the full tenure.

- Legal and Valuation Fees: For property loans, borrowers often need to pay legal fees and property valuation fees, which add to the overall cost.

Conclusion: Cost of Borrowing in Singapore

Understanding the various methods of interest rate calculations, such as flat rate, monthly rest, and effective interest rate, is essential when assessing the true costs of borrowing. Moreover, choosing between fixed and floating rates relies on both your financial situation and current market conditions. Make sure to consider additional expenses such as processing fees, late charges, and prepayment penalties. By considering all these factors, you can make informed decisions and manage the cost of your loan effectively.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!