We all know that property prices are on the rise. You’ve probably seen an increasing number of HDB flats being sold for over S$1 million. The latest HDB flat to be sold for over $1 million was a Punggol loft at $1.22 million in 2023. And here’s the kicker: there were more than 10 interested buyers! It’s no surprise to see why updated cooling measures are implemented to fight the overheating property market

Aside from the September 2022 cooling measures, the latest set of cooling measures from April 2023 update was rolled out, and there have been various big changes.

What are cooling measures?

Cooling measures are usually implemented in a bid to lower property prices in the market, when housing prices increase. As there are an increasing number of HDB flats that have crossed the SGD $1m mark, the Singapore government sees the importance of stepping in to cool the property market.

What are the main objectives of the September 2022 cooling measures?

1. Ensure that home buyers do not take up loans they cannot afford

2. Moderate demand, and ensure that resale flats remain affordable for all

The cooling measures were introduced in September 2022, in a bid to moderate demand in the property market, as well as encourage prudent borrowing.

Singapore’s updated cooling measures come after increases in domestic mortgage rates, due to continuous rises in global interest rates. The rise in interest rates will make it harder for borrowers to service their loans, given that home loans remain one of the biggest loans one will take in their lifetime. It is thus important for cooling measures to be introduced to curb and minimise these effects.

What was introduced in the September 2022 cooling measure announcement?

1. Tightened loan-to-value ratio

The loan-to-value limit for HDB loans will be tightened from 85% to 80% to encourage more financial prudence when taking on loans. This means that

2. Interest rate floor

In addition, an interest rate floor of 3 percent for HDB loans will be applied.

3. Waiting time for private home sellers

In order to ensure affordability and prevent flipping of property, the latest cooling measures include a wait-out period of 15 months. Previously, private property owners were allowed to purchase non-subsidised HDB flats as long as their private properties were disposed of within 6 months of buying the flat. However, the latest September 2022 cooling measures mandate that private property owners who have sold their property will have to wait for 15 months before they are allowed to purchase a non-subsidised HDB resale flat.

Individuals who are looking to downgrade from a private property to a HDB flat will feel the effect of the latest cooling measures. Compared to before when they could purchase a HDB flat with their proceeds from the sale of their private property immediately, now they have to wait for 15 months before purchasing one. Many thus face the problem of having to find accommodation for 15 months, before they are allowed to move in.

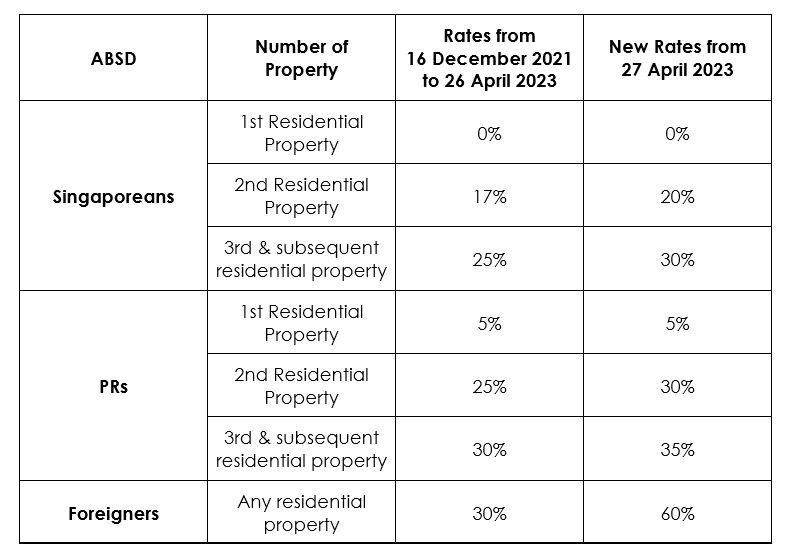

In addition to the September 2022 updates, the latest April 2023 cooling measure update involves increased ABSD when buying residential property in Singapore.

ABSD, which stands for Additional Buyer Stamp Duty, is a stamp duty charged when households buy property in Singapore. For Singaporeans, you are only subject to ABSD when you purchase your second and subsequent property, whereas for Permanent Residents (PRs) and foreigners, you will be levied on any property purchase.

ABSD however, is not applicable to HDB properties, as you are not allowed to purchase it as an additional property. If you were to purchase one while owning a private property, you are mandated to sell off the private property in 6 months.

The changes to ABSD for Singaporeans, PRs and foreigners are as follows.

From 27 April 2023, foreigners have to pay an additional buyer’s stamp duty (ABSD) of 60% when purchasing any residential property in Singapore. This is the largest hike in ABSD, doubling from the previous 30%.

Married couples with at least one Singaporean spouse may be eligible for refund of ABSD under certain circumstances. To do so, the couple has to either sell their first residential property within 6 months of either the purchase date of the second property if it is a completed property, or the date when the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second property is issued, whichever earlier, if the second property was not completed at the purchase time.

Singaporeans and PRs are not exempt from this, however. There are also changes in the ABSD charges for Singaporeans and PRs purchasing their second or more property.

Do note that if your property is purchased in a joint tenancy, MOF, MND and MAS have stated that the highest ABSD rate will apply.

With the updated cooling measures, you are now aware of what is applicable to you. However, cooling measures can change frequently, so make sure you continue to keep up to date with the updates!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!