Buying a HDB Build-To-Order (BTO) has always been part of every Singaporean’s dream, and the topic of many dinners. We have always heard about balloting woes, but rarely discuss the various steps to securing a flat, or where the mortgage loan comes into play. If you are interested to find out more about the HDB BTO application, you don’t want to miss this! Here’s a guide that breaks down the 6 simple steps to buying a HDB BTO flat.

Before Purchasing

1. Check for upcoming HDB BTO launches

First, check out your options on HDB’s portal. HDB typically lists the details of upcoming launches a few months prior which includes the exact plot of the apartments as well as the specific flat types and number of units. For instance, the upcoming August 2022 launch would feature the apartments in 6 estates.

While most estates may seem to be similar to the next, mature estates with well-developed amenities, or situated near the city centre are typically more attractive. Some HDB BTOs also offer exclusive waterfront views on prime land, such as Greater Southern Waterfront. Be prepared though, prime location typically attracts way more applicants which makes it harder to even get a queue number.

2. Check your eligibility for HDB BTO

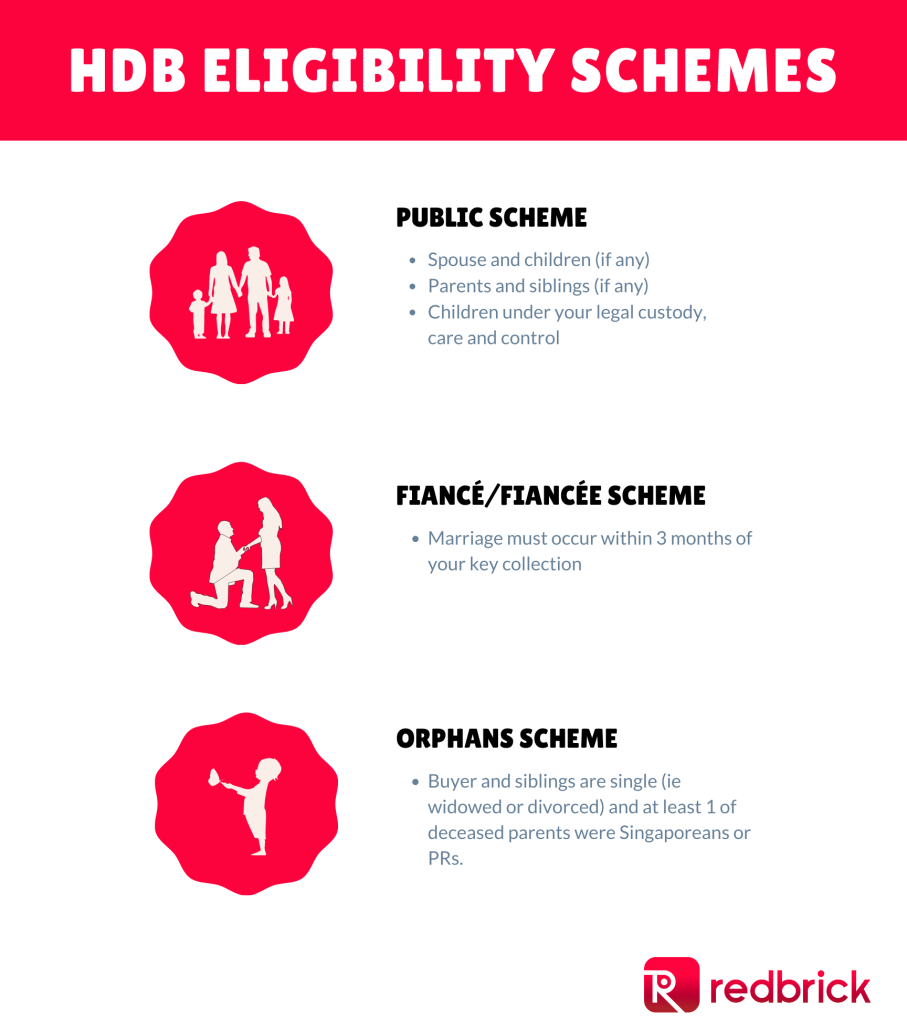

To be eligible to buy a brand new HDB, there has to be 2 Singaporean applicants, or 1 Singaporean Citizen and 1 Permanent Resident (PR). Additionally, applicants must be above 21 years of age, and should fall in one of the following eligibility schemes. There are also income ceiling set for each type of flats, which is available on the HDB’s website.

3. Work out your Finances

Since your house is likely to be the most expensive purchase in your life, it is important to choose a loan that is suitable for you. Particularly for young couples who have yet to build up a nice nest egg, it’s best to work out how much downpayment you can afford.

Many people also approach the banks for a preliminary loan assessment by requesting an In Principal Approval (IPA) before they ballot for their HDB BTO. IPA is a non-legally binding agreement in which a bank will share with you the maximum loan amount you can loan based on certain criteria. As further explained in the article, the option fee of $2000 to get the Option To Purchase (OTP) would be forfeited if you are unable to secure a mortgage loan (You’ll be surprised at how common this is!). Therefore, it would be better to get an IPA beforehand, and yes, it’s free anyway.

The Application Process

STEP 1: Balloting

If you are interested in the HDB BTO launch, you have to apply within a week of the sales launch and pay roughly $10 balloting fee. For years, balloting for flats have been known to be up to your luck – with some hitting the jackpot on their first try and others trying over 10 times to secure a flat. First-timers usually enjoy priority in the balloting process which is explained in detail here.

Ballot Results would be released about 3 weeks after the deadline for applications.

STEP 2: HDB Loan Eligibility (HLE) Letter or In-Principal Approval (IPA)

Upon successful balloting, you should request for a HDB Loan Eligibility (HLE) Letter which would allow you to request for a loan from HDB and declares the loan quantum for which you are eligible. For most who have met the requirements, the loan quantum for HDB Loan can go up to 90% of the price of the HDB.

Alternatively, if you have sufficient savings for a higher down payment and prefer a floating interest rate, you can obtain an IPA from a bank or approach a mortgage advisory firm for professional advice.

STEP 3: Choose your flat & pay for OTP

Based on your allocated queue number, you would be selecting your HDB BTO Flat. Since HDB issues more queue numbers than the number of units, there is a possibility of re-balloting if your queue number is too far back.

Simultaneously, you would need to pay the option fee to be issued the Option To Purchase.

| Flat Type | Option Fee |

| 4/5 Room Flat Executive Flat | $2000 |

| 3-Room Flat | $1000 |

| 2-Room Flexi Flat | $500 |

This is also the stage for you to apply for the CPF Housing Grants which issues grants up to $80,000 depending on your household average income level. For a newly-wed Singaporean couple with an average household income of $4500 and are both first-timer applicants, Enhanced CPF Housing Grant (EHG) would disperse a total of $45,000 to the two applicants’ CPF account. This grant can be used to offset the mortgage amount or the purchase price of a flat.

STEP 4: Sign Lease Agreement

Within 4 months of booking your flat, you would need to exercise the OTP and sign the lease agreement. Essentially, you are entering into a Sale & Purchase (S&P) Agreement with HDB. This is also the point when you pay your legal duties, stamp duty and downpayment.

Your downpayment would differ according to your loan structure, and part of it may be payable via your CPF Ordinary Account (OA). If you have applied for the HDB Concessionary Loan, the downpayment of 10% can be paid using CPF OA or cash. On the other hand, if you have secured a bank loan with a Loan-To-Value of 75%, you would need to pay a minimum of 5% cash and the remaining 20% can be paid via cash or your CPF OA.

STEP 5: Wait

Thanks to prefabrication, the time taken to build HDB BTOs have reduced significantly from the olden days as they are efficiently built off-site before being stacked up like Lego blocks.

But here’s the thing though, with the post covid situation, the construction sector is facing labor constraints. This means that instead of waiting for 3 to 4 years for HDB BTO to be built and fit for habitation, it might extend up to 7 years depending on your project’s location.

So, you’ll have to check the estimated TOP date to have a gauge on when it’ll be completed.

STEP 6: Collect your keys

The key collection process is relatively effortless.

Prior to your key collection appointment, ensure that you have purchased fire insurance from HDB’s appointed insurer, FWD Singapore. In addition, make sure you have the necessary documents including your Identification Cards (IC), proof of fire insurance and completed GIRO form if you are paying your monthly installments by cash.

Congratulations on being a homeowner!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!