According to a survey done by Coffee meets Bagel, 92% of Singaporean daters believe that good financial planning is a crucial trait they look for in their other half. Given the price of real estate, your first home is likely to be the biggest purchase when it comes to adulting. Like most adulting topics, it takes time to figure out finances too. Couples looking to purchasing their first home should take time to figure out key issues such as affordability, grants, and bank loans. If you are one of them, this article sets out key considerations to note of when purchasing your first home!

#1 Planning On The Same Page

While the topic of purchasing a house can be exciting, it is also important for both parties to be on the same page before delving into the specifics.

Firstly, it is crucial to understand you and your partner’s financial position. Aside from considering your combined savings, monthly income is also an important consideration to determine the loan quantum you could get which would in turn affect the price range of apartments you choose from. One restriction imposed is the Total Debt Serving Ratio (TDSR) which considers the total amount of monthly repayments. Based on the recent regulations, TDSR threshold is at 55%, which means that with your new mortgage, monthly instalments must remain below 55% of monthly income. Affordability calculator can aid you to better budget your finances to ensure some resiliency even during tough times.

Secondly, the manner of holdings should be considered. Most couples prefer holding their matrimonial property in Joint Tenancy, which means the whole property is jointly owned by both parties. Other couples, particularly those who wish to decouple, may wish to hold their property in Tenancy in Common, which prescribes a specific percentage of the property to each owner. Given the rise in ABSD rates, if you and your partner plan to own multiple properties, you may wish to co-own the property in tenancy in common to minimise legal fees in the future.

Thirdly, both you and your spouse should determine what matters the most to both of you. Is accessibility to MRT stations critical? Does proximity to your parents’ homes matter? Which area is more suited for your lifestyle? These are important questions that should be discussed as it would aid in forming the basis for choosing your first home.

#2 Note of Grants & Schemes For Couples

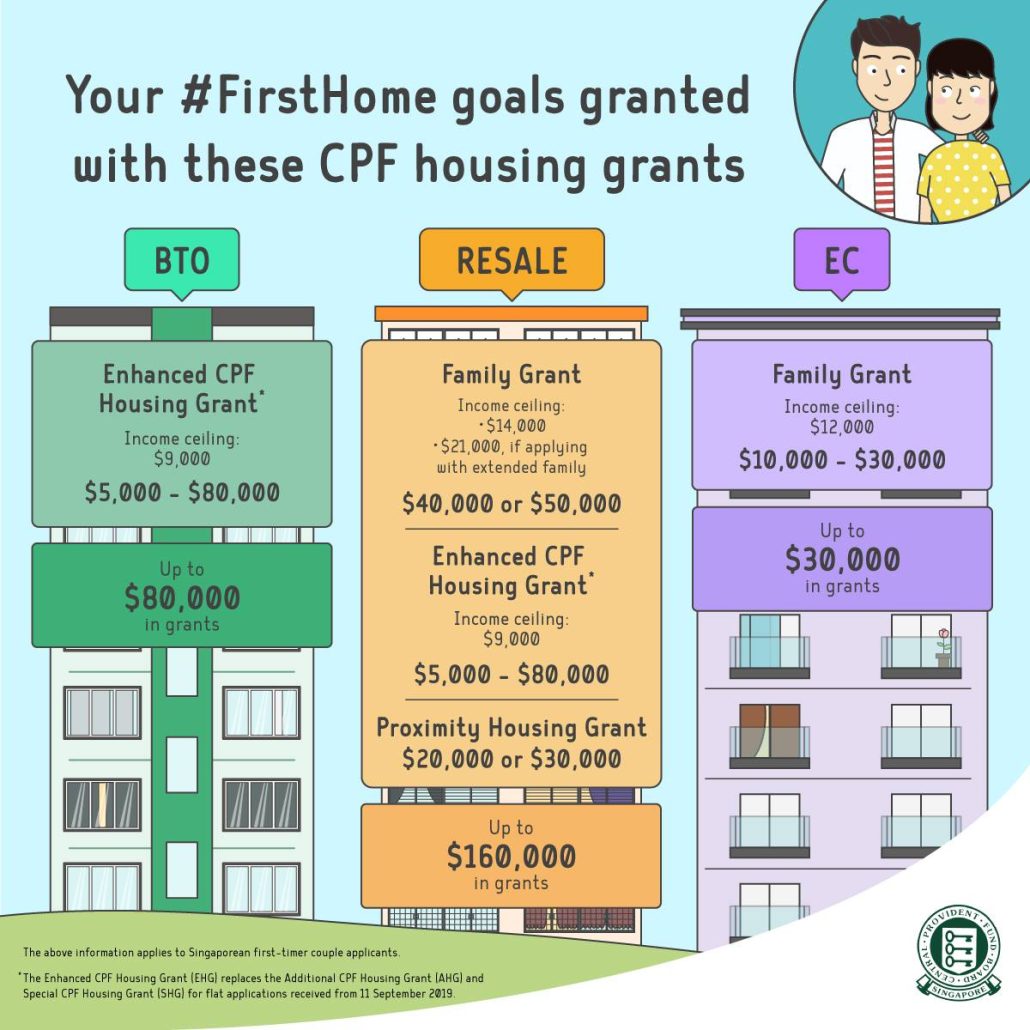

On top of your personal savings and CPF, you should also consider housing grants available. Depending on the type of housing ranging from new Built-To-Order (BTO) flats to Resale HDB flats to Executive Condominiums (EC) which become private properties after 10 years, various schemes are available that would offer your more choices on the type of HDB flats.

Since the grant quantum depends on the combined income of you and your spouse, couples who are still studying and wish to apply for a BTO which may take a few years to get ready can also apply for Deferred Income Assessment. If you and your spouse are ready to settle down, this scheme is perfect as it buys the couple some time by delaying the grant assessment on the couple’s income to be assessed nearer to their key collection.

#3 Choose A Suitable Home Loan

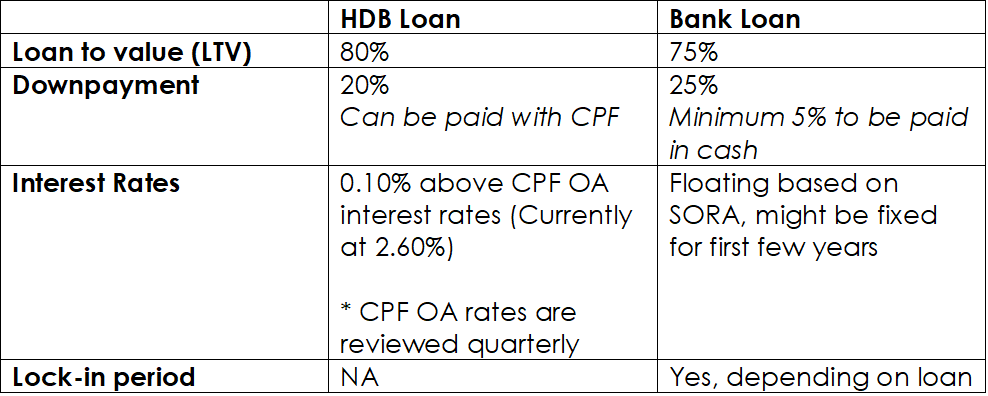

For first-time buyers, you can choose between HDB loans or getting a loan from a financial institution. Bank loans offer fixed rate and floating rate packages, which provide choice of stability and flexibility for property planning. On the other hand, HDB loans offer only fixed interest rates which provide greater predictability.

For young couples (particularly those on deferred income assessment) with limited cash on hand, downpayment may also be of concern. HDB loans offers higher loan amount and requires lower downpayment of 20%. In comparison, bank loans require downpayment of25% which includes paying the balance of 5% of the purchase price using CPF or cash when collecting keys to your HDB flat.

On the bright side, HDB housing loans offer flexibility to switch to private bank loans without incurring any penalty. It is also notable that the bank rates offered are depending on market conditions, hence its also good to compare and consider the pros and cons prior to refinancing.

Lastly, it is important to note that you will not be able to refinance private bank loans back to an HDB housing loan.

#4 Work With A Trusted Mortgage Advisor

If you are keen on refinancing your home loan or are curious on the exact loan quantum you are eligible for, you may wish to request for an In-Principle Approval (IPA) from financial institutions. While this may offer some guidance on the loan amount to take, you may wish to find a trusted mortgage advisor who can guide you on the purchasing process and help you find a property that fits most of your needs.

Undoubtedly, your friends and family might have some experience in purchasing their homes, but it’s still best to rely on the professionals who can analyse and advise more objectively. Our experienced mortgage advisors can also offer tailored advice on planning for the future to minimise unnecessary costs– be it for your family expansion, or investment plans to purchase more properties.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!